CEO offers advice for minority business owners struggling with PPP loans

African American and Latino small business owners have faced an uphill battle trying to get relief amid the coronavirus pandemic. The U.S. government's PPP loan program, meant to help business owners across the country, has been fraught with challenges and complaints that it is not working the way it is supposed to, hitting minority businesses particularly hard.

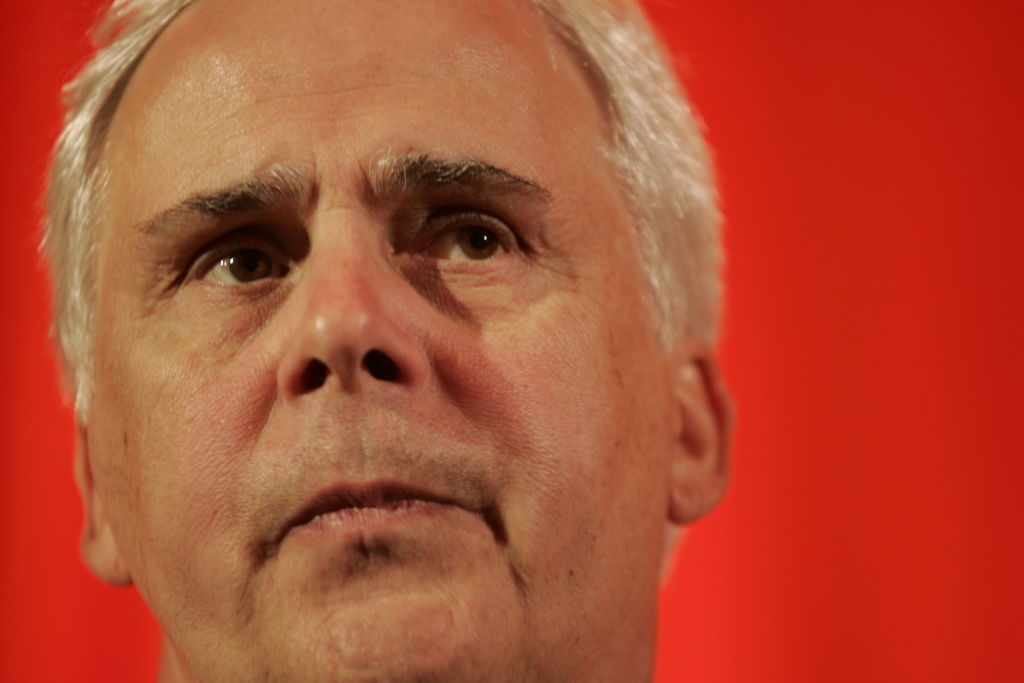

A fundamental challenge is that a number of large banks do not have branches in majority-black or Latino neighborhoods, said Robert Smith, CEO and founder of Vista Equity Partners, a private equity and venture capital firm.

"There's a statistic, around 70% of African-American neighborhoods actually don't have a branch bank," he said on "CBS This Morning" Friday. "These businesses, 94% of them or so, are small — so, proprietorships. They don't have those banking relationships."

He recommended looking into what he calls "capillary banks," which he described as "the community development, financial institutions, minority depository institutions."

Smith and his team have been working with Treasury Secretary Steve Mnuchin to expand the infrastructure under these institutions to better process PPP loan applications. "We've been actually pretty effective in that action over the last few weeks," he said.

Asked about why minority-owned businesses are getting the brunt of the PPP loan fallout, Smith explained that the "vast majority" of them are "sole proprietors" who usually have under five employees, and so apply for smaller loans that do not provide much of an economic incentive for large banks.

"Unfortunately, it's basic economics," he said. "The larger loans, even though they get a smaller fee, it's a quantum of dollars to the banks that incentivizes them to prioritize the bigger companies, the bigger loans, as opposed to the smaller ones."

To offset the imbalance, one of Smith's focuses has been "driving the capacity" for smaller and capillary banks to process the loans more effectively. In the current situation, he said, it costs more to process the small loans than what the total sum would be, when fees are included

"Some of the work that we found — without CDFIs and MBIs, it takes about 7.5 hours without technology to really process these loans effectively. And that costs them about $1,500 to process the loans, and they get 5% — I'll call it a $25,000 loan, to receive $1,250. They're losing money on every loan," he said.

He called on the country's leaders to work with him in thinking about how to change the dollar amount or the system itself to make the loan program more efficient, and incentivize banks to prioritize smaller loans.

Smith said going to the Community Development Financial Institutions program, or CDFI Fund, could be beneficial to small and rural businesses that are getting rejected or haven't heard about their PPP loans.

"Going to the CDFIs is an effective way, and the MBI is an effective way to actually get the loans processed. We've been very effective actually in getting folks who were either turned down or didn't hear anything, processed," he said.

He also recommended sites like nationalbankers.org, nationalactionnetwork.net and ourfairshare.com for the application process.

"I think it's important to think about these capillary banking systems, these fintech-enabled banking systems as an effective way for small to medium businesses, specifically minority businesses and rural businesses, to get access to the PPP capital," he said.