Coronavirus and the economy: Best and worst-case scenarios from Minneapolis Fed president

The world economy has never shut down this fast. In the U.S., virus-related layoffs are expected to be measured in the millions and soon. For insight into what's coming, we found someone with responsibilities over the economy now and who helped pull the U.S. out of the Great Recession of 2008. That person is Neel Kashkari, president of the Federal Reserve Bank of Minneapolis. In 2008, he was the Treasury official in charge of the $700 billion rescue of the financial system. We met Kashkari this past Thursday for an eye-opening look at the stock market freefall, the near-freeze in the bond markets and a prediction for this economic emergency.

Neel Kashkari: Millions of people are gonna lose their jobs. And that's what's so scary about this.

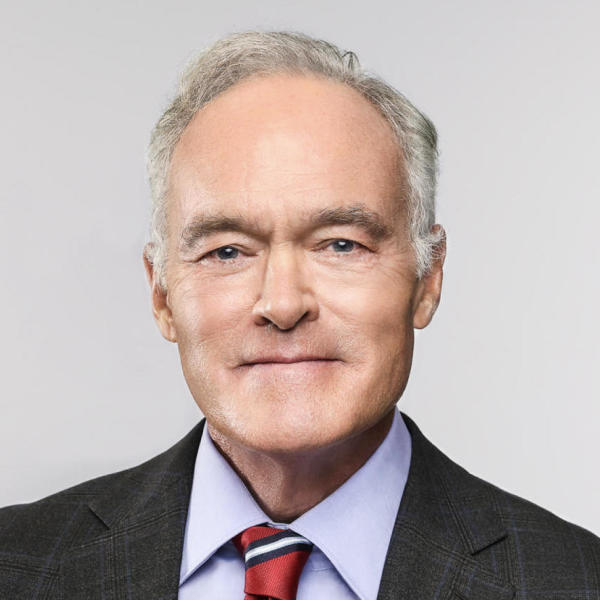

Scott Pelley: Are we in a recession?

Neel Kashkari: If we're not right now, we will be soon. My base case scenario is we'll at least have a mild recession like after 9/11. The worst case would be we'd have a deep recession like the 2008 financial crisis. We just don't know right now.

Scott Pelley: And what's keeping us from knowing with any certainty?

Neel Kashkari: Nobody knows how the virus is gonna progress, how many Americans are gonna get it, how effective is social distancing going to be, how long will it take the health care system to catch up?

Scott Pelley: Nationwide, last week there were almost 300,000 people filing first claims for unemployment benefits.

Neel Kashkari: It could be five times that amount next week. Maybe more.

Scott Pelley: Where is the bottom?

Neel Kashkari: If this is a three-month shutdown, we'll find the bottom pretty soon. If this is a year-long shutdown, this could be very damaging to the U.S. economy, and most importantly, to the American people.

46-year-old Neel Kashkari has been president of the Federal Reserve Bank of Minneapolis since 2016. He's the son of Indian immigrants and literally a rocket scientist. As an engineer, he worked on NASA spacecraft. After Wharton business school, he joined investment firm Goldman Sachs. In 2008, as assistant Treasury secretary, Kashkari ran the $700 billion troubled asset relief program, known as TARP, that helped end the Great Recession. Kashkari was the Republican nominee for governor of California in 2014. Today, he is one of 12 Federal Reserve regional bank presidents who oversee and support the nation's largest banks.

Neel Kashkari: I heard from a bank in our region, a well-to-do customer came in and said, "I wanna withdraw $600,000 of cash." Now, we can supply all the cash that the banks need to meet their customers' concerns. But it just speaks to the fear and the uncertainty that is rippling through the economy.

Scott Pelley: Will the Federal Reserve ensure that banks have all the cash they need to satisfy whatever withdrawals may be coming?

Neel Kashkari: Yes. This is the fundamental reason the Federal Reserve exists. We call it lender of last resort, this is literally why central banks exist. If everybody gets scared at the same time and they demand their money back, that's why the Federal Reserve is here, is to make sure that there's liquidity, that there's money to meet those demands. We will absolutely meet those demands.

Scott Pelley: Is the Fed just going to print money?

Neel Kashkari: That's literally what Congress has told us to do. That's the authority that they've given us, to print money and provide liquidity into the financial system. And that's how we do it. We create it electronically. And then we can also print it with the Treasury Department, print it so that you can get money outta your ATM.

Scott Pelley: Are the banks sound?

Neel Kashkari: They are right now. Now, we're hearing from big businesses across the country, including in Minnesota, that big businesses are drawing down their credit lines. They're borrowing money from the banks just because they're nervous. And if they're all drawing down these credit lines at the same time, it puts stress on the banking system. And that's where the Federal Reserve steps in to provide that liquidity to make sure that the banks have enough money to get out to their customers.

The Dow has tumbled about 35%. But something else is wrong. Some investors lost confidence in bonds which normally do well in troubled times. The bond markets finance government, corporations, and by extension, homebuyers.

Scott Pelley: And the stresses you're seeing in the bond market are what?

Neel Kashkari: Well, we were seeing stresses this week in the Treasury market and in the mortgage backed security market. And that's why the Fed stepped in with this very aggressive action to provide liquidity to those markets. We saw stresses in the commercial paper market, which is another type of bond market. And we're still seeing stresses in the municipal market, where state governments and cities fund themselves, and in the corporate bond market. So, we're not outta the woods yet.

Scott Pelley: And by stresses, you mean what?

Neel Kashkari: There's just a freezing up of new financings for corporations. That's something I'm very focused on. We need to get that market open again. Because we don't want blue-chip American companies, who have customers, who are operating, we don't want this virus to creep into their businesses because they're not able to raise money to meet their basic operational needs. We need them to keep running.

Scott Pelley: Solid blue-chip American companies are having trouble borrowing money?

Neel Kashkari: It's more expensive for them to borrow money. Say someone's saying, "I'm gonna go issue $1 billion of debt to go fund my new factory," those aren't taking place right now.

Scott Pelley: People are shunning U.S. Treasury Bonds, which are always thought to be the safest possible investment?

Neel Kashkari: It is. Now, keep in mind, Treasury Bond prices are still very high relative to history. They've just been just not quite as high as they were a few weeks ago. So they still are viewed as a very safe investment, very attractive for a lotta people. But this fear of where the virus is going to go is leading people to say, "I just want cash. And if that's cash under my mattress or in my safe, I'll sleep better at night."

Scott Pelley: What's it gonna take to get the bond markets working again?

Neel Kashkari: I think a combination of factors. I think Congress taking bold action to say they're standing behind the U.S. economy, the $1 trillion stimulus they're talking about. I think that'll help. I think continued actions from the Federal Reserve will help. And I think more confidence that the health care system is catching up to the crisis.

This past Sunday, the Fed dropped interest rates nearly to zero. Then every day last week it announced emergency lending programs. It pledged to spend at least $700 billion supporting mortgages, banks, money market mutual funds, corporate bonds and lending to central banks of other countries because the dollar is the currency of world trade.

Neel Kashkari: We're being very aggressive. And I think our chairman, Jay Powell, has learned from the experience of 2008. We're moving much faster than we moved in 2008. We're being more aggressive. Is there more we can do? Yes. Is there more we may end up doing? Yes. But I think we're being very aggressive. I think that's the right thing.

Scott Pelley: Can you characterize everything that the Fed has done this past week as essentially flooding the system with money?

Neel Kashkari: Yes. Exactly.

Scott Pelley: And there's no end to your ability to do that?

Neel Kashkari: There is no end to our ability to do that.

Scott Pelley: What did we learn from 2008 when you were in the Treasury Department? And how is that being applied today?

Neel Kashkari: There are two big mistakes when I look back at 2008 that we made that I think are relevant today. Number one, we were always too slow and too timid in responding to the crisis. The reason is we didn't know how bad it was gonna get. And we didn't wanna overreact. And it turned out it got really, really bad. And the right answer should've been overreacting to try to avoid the devastating recession that we ended up happening. So today, whether it's health care policy makers, fiscal policy makers, which means Congress or the Federal Reserve, we should all be erring on the side of overreacting to try to avoid the worst economic outcomes. And number two, in 2008, we tried to be very targeted in helping homeowners. Only helping homeowners who needed a little bit of help because a lot of Americans were angry at the thought of their neighbor getting a bailout for being irresponsible or so they thought. So we tried to target our program. It ended up we didn't help very many people.We would've been much better off if we had been much more generous in our support for homeowners, deserving and not deserving. We would've had a less crisis. So my advice to Congress as they're designing their programs to help workers and to help small businesses, err on being generous.

Scott Pelley: When America gets back to work, how long does it take to recover from this?

Neel Kashkari: You know, the economy can bounce back fairly quickly. It's the workers that take time. I mean, that's the-- one of the other lessons from 2008. It took more than ten years to put America fully back to work, relative to where they were before the crisis. Ten years. And so that's what we have to try to avoid, having these mass layoffs. We can't have another ten-year recovery.

The deadline for filing taxes, both personal and business, has been postponed until July. This past week, the House and the Senate proposed trillion dollar emergency spending plans. The bills envision sending government checks directly to households, expansion of unemployment insurance, corporate tax cuts and relief for small business. Republicans and Democrats are haggling over the details.

Scott Pelley: Well, what do the small businesses need?

Neel Kashkari: I think that they need forgivable loans. Like, it's much better if we can keep small businesses to retain their workers than to lay them off.

Scott Pelley: What do you mean by forgivable loans?

Neel Kashkari: I've heard a proposal that if the government made a loan to a small business, if they retain their workers, the government would forgive the loan after a couple years. Just to avoid the mass layoffs that we're starting to see right now.

Scott Pelley: Sort of a bridge loan to get the local restaurant or the local mechanic through this period of time?

Neel Kashkari: That's right. And importantly, keeping their workers employed. That's much better because once people are lost into the sidelines, it just takes a long time to get them back.

The Federal Reserve System as we know it was set up in the Great Depression to regulate big banks, set interest rates and be the source of all cash. That's why every bill in your pocket is inscribed, "Federal Reserve Note." The Fed's mandate is to provide the highest rate of employment with the lowest rate of inflation. But in 2008, it invoked its authority for the first time to take the role of emergency first responder.

Scott Pelley: If the current measures are not enough, what else can the Fed do?

Neel Kashkari: Well, we have very broad authorities with our emergency lending authorities that have to be done in concert with the Treasury secretary. We've announced a couple of those measures this week on money markets and commercial paper as an example. Some people have suggested that we should be providing more support directly to the corporate bond market. And I'm sympathetic with those views and also the municipal market. Making sure that states and cities are able to access the capital markets as well. So, there's a range of things the Federal Reserve could do. We're far from out of ammunition.

Scott Pelley: Far from out of ammunition. Sunday, the Federal Reserve lowered its benchmark interest rate to zero. Can you go below zero?

Neel Kashkari: In theory, we could. Some countries have. I don't think many of us-- I don't think any of us on the committee think that's a particularly good idea. It creates other challenges for financial markets. But in the last crisis, we've used something called quantitative easing, buying long-term bonds. We've got a lot more experience in how to do that. It didn't trigger inflation. So, there're other tools that we've used before that I think we could also use again in using it aggressively.

States face an enormous surge in unemployment claims. Connecticut alone, which normally has a little over 2,000 claims a week, saw 72,000 last week. When the national number of new claims for unemployment is released Thursday, it's expected to be in the millions. The Fed is watching China and South Korea, where the outbreak appears to be subsiding.

Scott Pelley: What are you seeing in China?

Neel Kashkari: Well-- China appears to be turning back on. And they are telling a very good story that they've got their arms around this, they don't have new cases. But if, at the same time, they're saying lots of people had the disease with no symptoms. So, unless you've tested everybody, how do you know that you've really got this under control? And as you relax the economic control, does the virus simply flare back up again? We just don't know yet.

Scott Pelley: To the person who is about to grab their car keys and go to the ATM and take out $3,000, you say what?

Neel Kashkari: You don't need to. Your ATM is safe. Your banks are safe. There's enough cash in the financial system. And there's an infinite amount of cash at the Federal Reserve. We will do whatever we need to do to make sure that there's enough cash in the banking system.

Scott Pelley: Are you optimistic or pessimistic?

Neel Kashkari: Overall, I'm optimistic. having been at the frontline of the 2008 financial crisis and I saw how devastating that was, we did get through it. It was very painful for millions of Americans. We did get through it. We will get through this crisis.

Produced by Henry Schuster. Associate producer, Sarah Turcotte. Edited by Sean Kelly. Broadcast associate, Ian Flickinger.