Comprehensive vs. collision auto insurance: What's the difference?

Auto insurance coverage comes in many forms, and what you'll pay — both for your premium and if you need to file a claim — will rely heavily on the coverages you choose. Two of the primary types include comprehensive coverage and collision coverage. And while both can offer much-needed protection for your car and pocketbook, they aren't one and the same — nor are they both necessary in every situation.

Are you unsure which type of coverage you should choose for your car insurance policy? Below, we'll detail what you need to know.

Start by getting a free price quote for both insurance types here.

Comprehensive vs. collision auto insurance

There are many types of car insurance coverages you can choose from. Generally speaking, though, the only one that is legally required is liability coverage, which covers the bills if someone else is hurt or another person's property or vehicle is damaged in a collision you cause.

But many drivers opt for collision and comprehensive coverage, too. These are coverages designed to protect your own property and vehicle in the event of an incident (not those of others, as liability coverage does).

"Both are considered optional coverages — with specific expectations, and are part of what is commonly known as a full-coverage policy," says Mark Friedlander, director of communications for the Insurance Information Institute. "About 75% of U.S. drivers carry these coverages."

Collision imsurance covers repair costs if your car is in a physical collision. This can be with another vehicle or other property.

"If you hit another car or a stationary object like a guardrail, collision coverage would pay for the repairs to your vehicle," says Kevin Boggs, an insurance agent with Goosehead Insurance.

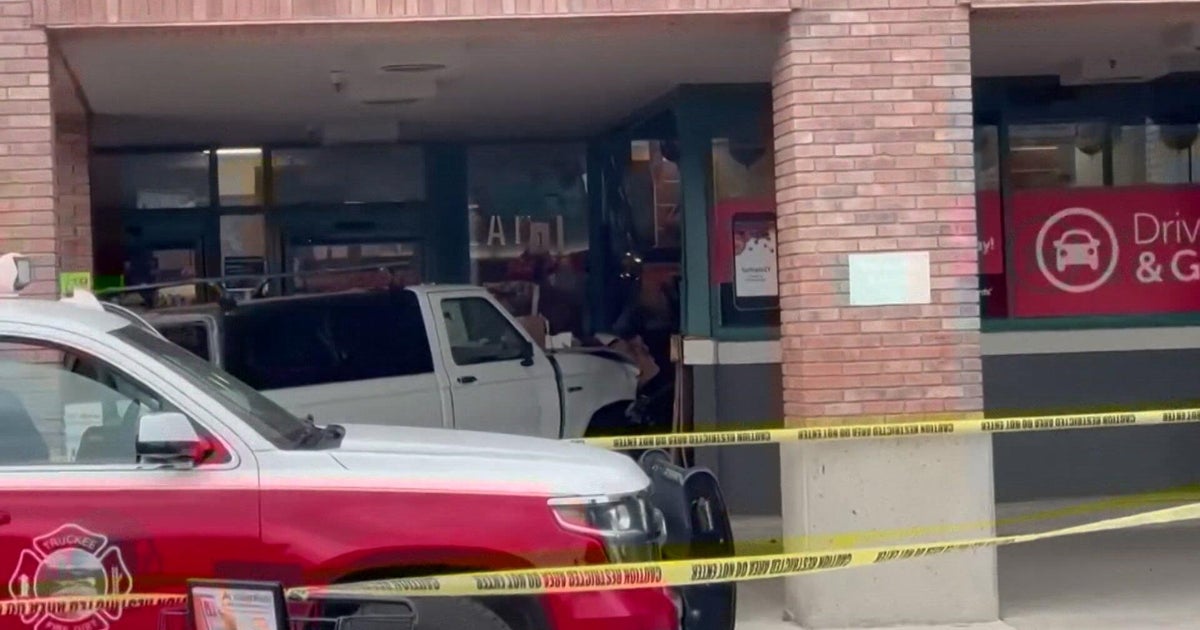

Comprehensive coverage, on the other hand, is for situations outside of collisions — natural disasters, vandalism, theft, hail, flooding, a tree falling over, etc. If your car is damaged by one of these events, comprehensive coverage would help pay for the repair costs.

Learn more about your auto insurance options here.

Which auto coverage type is better?

Neither collision nor comprehensive coverage is better because they both function differently. Comprehensive typically costs less than collision, according to Progressive, though the exact costs will depend on your vehicle, car insurance company, deductible, and other factors. Many drivers choose both comprehensive and collision, or you can opt to do just one or the other. You also may have the option to waive both coverages, depending on whether you own your car or not.

Do you need both comprehensive and collision insurance?

This answer depends on your car and ownership situation. As Boggs puts it, "While neither comprehensive nor collision coverage is mandated by state law, lenders or leasing companies often require them."

If you're not in a scenario where collision or comprehensive coverage is required, then you'll need to think about a few factors. First: How much have you saved up for potential repairs? Without either, you may get stuck paying for the repairs independently, without the help of an insurance company. In severe cases, you'd need to replace your car entirely entirely out of pocket. For this reason, you should also think about your car's age and value — and how much repairs or replacement would cost if it came to that.

"Oftentimes, people remove them on older vehicles that are not worth very much," says Ben Guttman, an agent with North Central Insurance Agency.

Finally, you should also think about the risks. What risks are the biggest for your vehicle? If you're commuting far and often, then your risk of a collision is fairly high, and you'd probably want coverage. If you're in a high-theft area or somewhere with lots of natural disasters, you may want to choose comprehensive coverage to ensure you're protected.

"If you waive them, you will have no coverage for your vehicle," Guttman says. "This comes up often on the comprehensive side if there is storm damage like a flood or fallen tree."

If you're not sure whether you need one, both, or neither coverage, talk to an independent insurance agent. They'll help you weigh your risks and budget and ensure you build the best policy possible.