Can credit ratings on muni bonds be trusted?

(MoneyWatch) On Feb. 4, the U.S. Department of Justice filed civil fraud charges against Standard & Poor's for its role in granting positive ratings on nearly $3 trillion worth of mortgage backed securities that later collapsed in value. It was the first federal enforcement action against a credit rating agency over alleged illegal behavior tied to the recent financial crisis.

It's clear that the agencies' assessments of the credit quality of these deeply complicated instruments, were vastly overstated, allowing banks to sell them with AAA-ratings. The failure of the companies such as S&P to properly rate these securities raises an obvious question in the minds of investors: Why trust the quality of their ratings of municipal bonds?

We'll try to answer that question by examining it from two perspectives. The first is about conflicts of interest.

In the case of MBS, there was a clear conflict between the ratings agencies and the issuers. This stems from the business model of S&P and its brethren, Moody's Investors Service and Fitch: They get paid by the institution issuing the security, which naturally wants a strong rating. Without one, the banks wouldn't have been able to bundle diverse groups of mortgages, many of them bound to fail, into securities and sell them to investors in anywhere near the volume that they did. The more securities the banks created and sold, the more fees the rating agencies would earn -- a virtuous circle for the banks and the rating agencies, but a clear conflict of interest for the rating agencies whose role was to protect investors.

In general, municipal bonds don't have the same conflicts.

- Standard & Poor's decries government suit

- U.S. sues Standard & Poor's over mortgage ratings

- S&P lawsuit: Emails suggest concern about ratings

Unlike a bank creating and selling complicated derivatives based on mortgages it has written, a state or city is not likely to issue more debt if they get a higher rating. Their relatively straightforward borrowing is in response to cash flow needs and for capital expenditures, like building a school, a sewer system or a highway. It's not likely that a municipality's borrowing decisions will be heavily influenced, if at all, by their ability to borrow at a bit lower rate due to a higher credit rating. Thus, the rating agencies don't face the same conflict of interest. This is especially true for the type municipal bond holdings I recommend in "The Only Guide to a Winning Bond Strategy You'll Ever Need" -- AAA/AA rated bonds that are either general obligation or essential service revenue bonds.

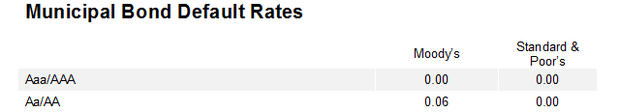

We'll now check the history of defaults and ratings on municipal bonds. The following table shows the municipal bond default rates for the period 1970-2006, just prior to the financial crisis.

Updating the data we see that while the number of municipal defaults increased since the recession, there were still only 11 defaults on long-term bonds rated by Moody's in 2010 and 2011, averaging just 5.5 defaults per year (compared with an average of 2.7 annual defaults over the period 1970-2009). Default rates for rated municipal bonds remain very low, with only 71 defaults over the period 1970-2011. And the majority of municipal defaults (73 percent) occurred in the healthcare and housing sectors. Only five general obligation (GO) bond issuers, including cities, counties and other districts, defaulted on GO bonds in the 41-year study period (7 percent of defaults); only one GO issuer, out of approximately 9,700 rated by Moody's at the end of 2011, defaulted on GO bonds in the last three years.

In addition, where there have been defaults on municipal bonds, recovery rates have been much higher than for corporate bonds. For example, the largest municipal default in U.S. history was Orange County, Calif., in 1994, and all bond holders were eventually paid in full. According to a Fitch Ratings study on default risk, defaults of tax-backed debt and essential-service debt have typically been followed by recoveries of 100 percent. Also, Moody's noted that the anticipated recovery rate on defaulted general obligations bonds is nearly 100 percent. This was true even during the Great Depression.

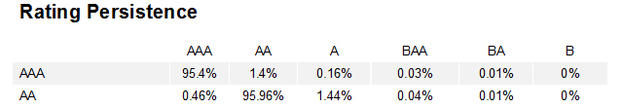

Here are some other facts to consider. First, states cannot enter Chapter 9 bankruptcy, and 26 states prohibit municipalities from filing for bankruptcy. Second, unlike corporate bonds, municipal bond ratings don't typically experience drops of several credit rating levels at a time, such as when Lehman Brothers corporate debt went from a rating of A2 by Moody's and A by S&P prior to default in the same day. In addition, as the table below (covering the period 1970-2011) demonstrates, highly rated municipal bonds have a high one-year persistence of ratings, much higher than on corporate bonds.

It's important to monitor the credit quality of the bonds in your portfolio so that appropriate action can be taken if there are adverse changes to credit quality. My recommendation is to sell bonds with a rating of A or lower if the maturity is three years or longer and BBB (the lowest investment grade) for shorter maturities.

The bottom line is that the data clearly shows that, freed of the conflict of interest inherent in mortgage backed securities, the ratings agencies have done an excellent job of rating municipal bonds. Thus, you can feel confident relying on them.

There is one more point we need to cover. The big benefit of stock mutual funds is that they provide broad diversification, diversification which is needed to minimize the idiosyncratic risks of individual companies. With U.S. Treasury bonds and similar instruments (such as government agency debt) that benefit is not needed because there is no credit risk.

With corporate bonds that benefit is also important. However, if you limit your municipal bond holdings to the type recommended here, the data makes clear that the need to diversify credit risk is much less, though not zero. That is why we build individual municipal bond portfolios for investors with at least $1 million to allocate to this asset class. This size portfolio allows us to achieve sufficient diversification, with no more than 10 percent allocated to a single issuer. This not only saves the expense of the mutual fund, but it also allows the tailoring of the portfolio to the client's unique tax and state situation, and to harvest losses at the individual security level.