Better returns: More stocks or riskier bonds?

(MoneyWatch) As we have discussed frequently, there are now many investors for whom safe bond investments no longer generate the interest income they need to meet expenses. This is causing some to take on incremental risk, often in the form of high-yield bonds. The problem is that many investors forget the main role bonds are supposed to play in a well-diversified portfolio.

My colleague and co-author Jared Kizer recently took a look at the same issue. The following summarizes the main points Jared raised.

Tax Efficiency

Stocks receive more favorable tax treatment than bonds, since interest on bonds is typically taxed at ordinary income tax rates, while the return on stocks is taxed at preferential capital gains rates. Thus, for investors who hold assets in taxable accounts, stocks provide a more efficient way to take risk than bonds.

Risk-Adjusted Returns

Over the period August 1998-June 2012, the annualized Sharpe ratios (a measure of risk-adjusted return) of the equity premium, investment grade credit premium and high-yield credit premium have been 0.43, 0.07 and 0.21, respectively. Translation: You would have been better served by increasing your allocation to stocks and keeping credit quality high.

Risk Management

There are times when lower-quality bonds (such as investment-grade corporate bonds) are riskier than normal. At times, corporate bonds behave roughly similar to Treasury bonds, and at other times a 100 percent allocation to corporate bonds is basically equivalent to having 30 percent or so of your portfolio in stocks.

Unfortunately, while the correlation of corporate bonds to stocks is on average low, they behave more like stocks at exactly the wrong time, when stock market risk is high. This means that during a bear market a 60/40 allocation where the 40 percent is in Treasury bonds, for example, is a lot different than a 60/40 allocation where the 40 percent is in corporate bonds (or lower-quality bonds in general). Because most investors don't account for the stock-like risk in corporate bonds, they get surprised by how much risk they have in their portfolio when stock market risk shows up.

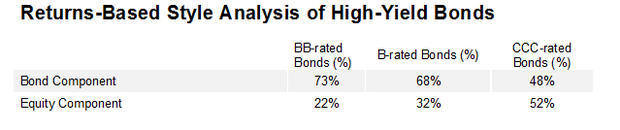

While I don't recommend including riskier bonds in your portfolio, if you decide to do so your investment policy statement should account for their equity-like risks. The following table, from the 2008 study "Returns-Based Style Analysis of High-Yield Bonds," provides you with guidance on how to account for the risk in these bonds.

As an example, if your 60 percent stock/40 percent bonds portfolio includes a 10 percent allocation to CCC-rated bonds, your portfolio has the same risk profile as a portfolio that is 65 percent stocks/35 percent bonds, assuming the remaining bond allocations are from the safest categories -- U.S. government, federal agency debt, FDIC-insured CDs and AAA/AA municipal bonds.

Finally, the historical evidence demonstrates that if you want/need to take more risk you would be better served to either increase your stock allocation or increase your allocation to small and value stocks, which have a higher expected return over the long term. The bottom line is that the main role of fixed income assets in your portfolio should be to reduce risk to the level appropriate for your unique circumstances. Thus, bond holdings should generally be limited to the safest bonds.