Best debt relief companies, plus expert insights on how their services work

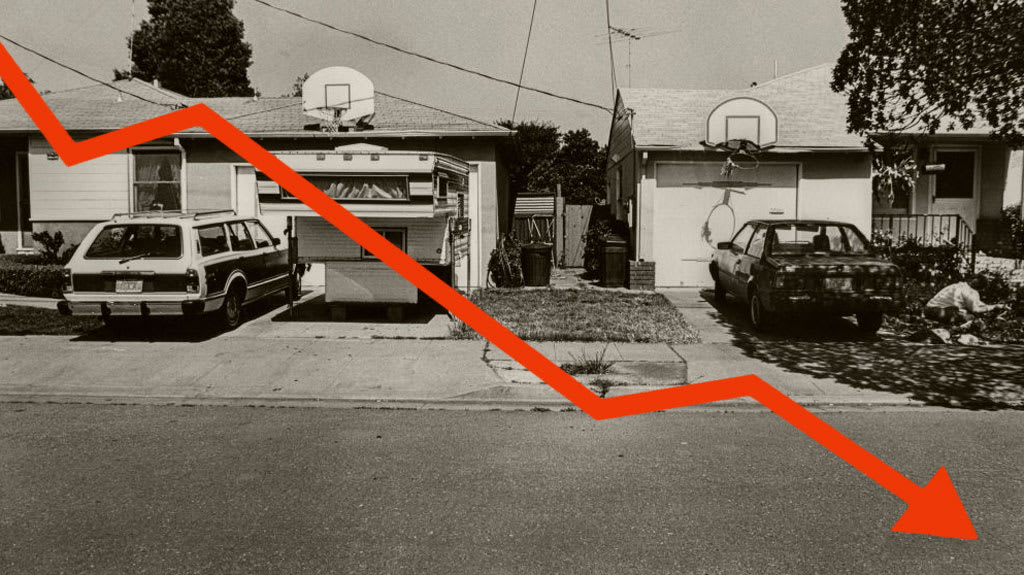

The sustained impact of recent price increases continues to affect Americans' daily lives, despite today's inflation rate being much lower than recent peaks. Although the rapid price growth has cooled, consumers still face persistently higher costs for fundamental necessities such as groceries, gas and housing, putting a squeeze on family budgets nationwide.

These economic challenges have fundamentally altered spending patterns across the country. More Americans are turning to credit cards to cover everyday expenses, leading to concerning levels of household debt. Credit card balances have climbed to a record-breaking $1.17 trillion nationally, reflecting the widespread financial pressures many citizens are experiencing.

For those struggling with mounting credit card bills, several paths to debt relief exist, including debt consolidation programs and settlement options with creditors. The best debt relief companies offer comprehensive services tailored to different financial situations. Credit experts at these firms can evaluate your unique circumstances and recommend appropriate options for reducing your burden. Selecting a reputable debt relief service is crucial for those considering this approach.

To help you find the right option, we've analyzed and compiled a carefully vetted list of recommended providers based on comprehensive research and evaluation criteria — and gathered expert insight into how these services work.

Compare leading debt relief companies now.

Here are some of the best debt relief companies broken down into four categories.

- Best overall: Accredited Debt Relief

- Best for customer satisfaction: Freedom Debt Relief

- Best for large debts: National Debt Relief

- Best for credit card debt: Accredited Debt Relief

Best overall: Accredited Debt Relief

Accredited Debt Relief is our pick for the best overall debt relief company for its stellar reputation and ratings, experience and its focus on providing personalized options for its clients. The company, founded in 2011, has enrolled over 300,000 clients and resolved over $3 billion in debt. It has an outstanding 4.8 rating with Trustpilot (as of January 17, 2025) and an A+ grade with the Better Business Bureau (BBB).

Working with Accredited Debt Relief starts with a free phone or online consultation. A representative will work with you to determine the best option to address your unique financial situation. The firm provides multiple debt relief programs to tackle your unsecured credit card debt, typically lowering or eliminating it in 12 to 48 months —12 months quicker than many of its competitors.

The standard fee for Accredited Debt relief ranges from 15% to 25% of the debt you enroll in the service, but you're not charged until your debts are reduced.

Find out how Accredited Debt Relief can help today.

Best for customer satisfaction: Freedom Debt Relief

Freedom Debt Relief is our selection for the best debt relief service when it comes to customer satisfaction. The firm has been in business for decades, has resolved over $15 billion in debt for over 850,000 clients over the last 20 years and has an A+ BBB rating. It also has an excellent (4.6) rating on Trustpilot with over 43,000 reviews (as of January 17, 2025) — indicating that its customers are highly satisfied overall in terms of the outcomes of using this service.

Freedom Debt Relief aims to help with unsecured debts like credit cards, personal loans and medical bills. The company negotiates with your creditors to reduce the amount you owe and help you get out of debt. According to the firm, clients with at least $7,500 in debt resolve it within two to five years. Freedom Debt Relief charges 15% to 25% of the enrolled debt with no upfront fees, and you won't pay anything until you've agreed to a settlement.

Best for large debts: National Debt Relief

If you're buried under significant debt, National Debt Relief is a reputable debt relief company that can help you find financial relief. Since 2009, they've helped over 600,000 clients get out of debt for debt amounts of up to $100,000 and more. They earned an impressive 4.7-star Trustpilot rating (as of January 17, 2025) and an A+ with the BBB.

National Debt Relief offers different plans tailored to your situation and the firm claims you can regain your financial footing within 24 to 48 months. The company specializes in helping clients with high-interest debt reduce their balances by negotiating with their creditors. The fee for their services is 15% to 25% of enrolled debt and comes with a money-back guarantee.

Check your National Debt Relief options here now.

Best for credit card debt: Accredited Debt Relief

Accredited Debt Relief, our top pick overall, also earns our recommendation as the best choice for cutting or zeroing out credit card debt. The company offers several solutions to tackle unsecured credit card debt, which can be completed in as few as 12 months.

Accredited Debt Relief can negotiate for a lower credit card balance and reduced fees, so you can pay off your debt for less than you owe. But if you're not keen on lowering your debt through debt settlement, the company can help you consolidate your credit card debt if your total credit card debt exceeds $10,000. Accredited Debt Relief offers a free online or phone consultation where a debt specialist can help you create a personalized plan to cut down your debt.

How do debt relief services work?

Debt relief services typically begin with a free consultation where credit experts assess your financial situation and debt load. After this evaluation, they recommend a personalized plan that may include debt consolidation, negotiation with creditors for reduced payment amounts or structured repayment programs tailored to your budget.

"Debt relief is the process of restructuring and eliminating outstanding debts," Leslie Tayne, a debt relief attorney at Tayne Law Group, says. "Typically, it involves working to modify the conditions of debt to create a more feasible situation for the individual owing money. This could encompass decreasing the principal balance, securing lower interest rates, lengthening repayment schedules or incorporating several of these approaches together."

The best debt relief companies act as intermediaries between you and your creditors, leveraging their relationships and expertise to secure better terms than you might achieve independently. Many services require you to make monthly deposits into a dedicated account, which they then use to pay creditors according to negotiated agreements.

Most reputable providers offer educational resources and ongoing support to help you rebuild financial stability. Their comprehensive services often include regular progress updates, credit counseling and budgeting assistance to prevent future debt accumulation.

Do debt relief programs hurt your credit?

Certain types of debt relief programs can initially have a negative impact on your credit score, particularly if the process involves settling debts for less than the original amount owed or temporarily stopping payments. Credit experts warn that these short-term consequences are a necessary trade-off for long-term financial recovery in many cases.

"Debt relief can leave a significant mark on credit reports, but research shows that credit profiles rebound — often much better than ever — once the consumer has settled their debt and can go on to moving their financial lives forward," Sean Fox, Achieve's president of debt resolution, says.

However, some services work within parameters designed to minimize credit damage, such as debt management plans that ensure consistent, on-time payments to creditors.

Over time, successfully completing a debt relief program often leads to improved credit scores. As your debt-to-income ratio decreases and you establish a positive payment history, many clients see their credit recover and strengthen within 12 to 24 months after program completion.

Debt relief vs. debt settlement

Debt relief encompasses a broad range of services designed to make debt more manageable, including consolidation loans, credit counseling and structured repayment plans. These comprehensive options focus on helping you repay what you owe under more favorable terms, often without significant damage to your credit profile.

Debt settlement, on the other hand, is a specific strategy within the debt relief spectrum where companies negotiate with creditors to accept less than the full amount owed. While this approach can reduce your total debt burden, it typically has more severe credit consequences and may trigger tax liabilities for forgiven debt amounts.

The best debt relief companies offer both services and help clients determine which option aligns with their financial goals. Credit experts at these firms evaluate factors such as debt amount, credit score objectives and timeline to recommend either debt relief programs focused on full repayment or settlement options for those facing more severe financial hardship.

Debt relief vs. credit repair

Debt relief services address existing debt by creating strategies to reduce, consolidate or negotiate better terms for your outstanding balances. These programs focus on resolving the fundamental debt problem through structured payment plans and reduced interest rates negotiated by experienced debt professionals.

Credit repair, meanwhile, focuses primarily on improving your credit report by identifying and disputing inaccurate or outdated negative items. While credit repair can help clean up reporting errors, it doesn't directly address the underlying debt or provide options for making payments more affordable. Many debt relief companies also incorporate elements of credit repair within their comprehensive services, recognizing that resolving debt issues and rebuilding credit often go hand-in-hand.

Alternative options for debt relief

While debt relief companies can help you settle your debt for less than you owe and give your finances some breathing room, they're not your only choice. Here are some alternative options to help manage your debt.

- Apply for a 0% balance transfer card. With good credit, you may qualify to transfer your existing balances to a new card with an interest-free period of up to 21 months, which may give you enough time to put a significant dent in your debt.

- Take out a debt consolidation loan. This type of personal loan can combine up to $100,000 in high-interest credit card debt into one loan, ideally with a lower interest rate.

- Tap into home equity. If you own a home with equity, home equity loans and HELOCs offer you access to cash to pay off debt — or use it for any other purpose — by using the equity in your home as collateral.

- Consider credit counseling. An accredited, non-profit credit counselor can help you create a budget, manage debts and possibly lower your interest rates with a structured payment plan. When looking for a qualified counselor, consider those associated with the National Foundation for Credit Counseling (NFCC) or the Financial Consulting Association of America (FCAA).

The bottom line

Do your due diligence before working with any financial company, including debt relief firms. The Consumer Financial Protection Bureau (CFPB) suggests reaching out to your state attorney's office and local consumer protection agency to check for complaints against any company you're considering. If a debt relief company has a good record, and you feel comfortable working with them, they may help you overcome your financial challenges, negotiate for lower debt balances and relieve your debt burden.

Tim Maxwell contributed to this report.