Are Commercial Property Values Rising or Falling?

Richard Green of USC notes two widely followed, but contradictory indications on whether commercial real estate values are rising or falling. More importantly, he gives guidance on how to interpret the contradictory signals:

Are commercial property values rising or falling?, by Richard Green: This might seem like a simple question. But it is not.

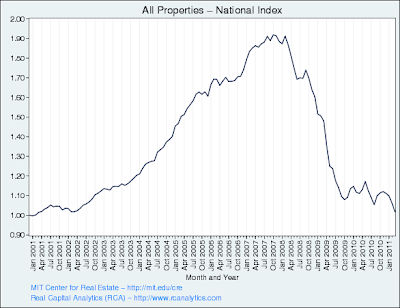

The Moodys/REAL Commercial Property Price Index (CPPI), produced at MIT, says they are still falling:

Green Street's Commerical Property Price Index says they are rising:

Which one is correct matters. If Green Street is right, and prices are only 12.6 percent off peak, then commercial properties by-and-large have equity (loan-to-value ratios rarely exceeded 80 percent on commercial properties). If MIT is right, we are still in deep trouble.Both sources do a good job explaining their methods. ...

[T]he big differences are: (1) MIT looks only at transactions, whereas Green Street looks at current negotiations; (2) MIT's valuation model gives equal weight to all properties, while Green Street's valuation gives greater weight to expensive properties than to cheaper properties; and (3) MIT has a much broader sample, because REITs would rarely buy properties as inexpensive as $2.5 million.So which index is correct? It all depends on context. While I would be a little leery of using "negotiated price" as an indicator of value (as opposed to closed transactions), the timeliness of Green Street's data does give it an advantage. For REIT's trying to determine strategy, the Green Street index is probably better. For banks making loans to smaller properties--or for individual investors thinking of buying small office buildings--the MIT index is more relevant.