Are 1-ounce gold bars a good investment?

These days, investors have any number of assets to choose from — and all have varying degrees of risk. Investing in stocks, for example, offers an opportunity for high returns, but it also comes with big risks. All it takes is a market downturn to go from hefty rewards to massive losses, and it can happen in a matter of minutes.

Conversely, there are more stable investment options, like gold. While you won't get rich overnight simply by investing in gold, it can be a smart option for investors who are seeking stability in their portfolios. That can be especially attractive right now, considering the uncertain economic climate and rampant inflation issues.

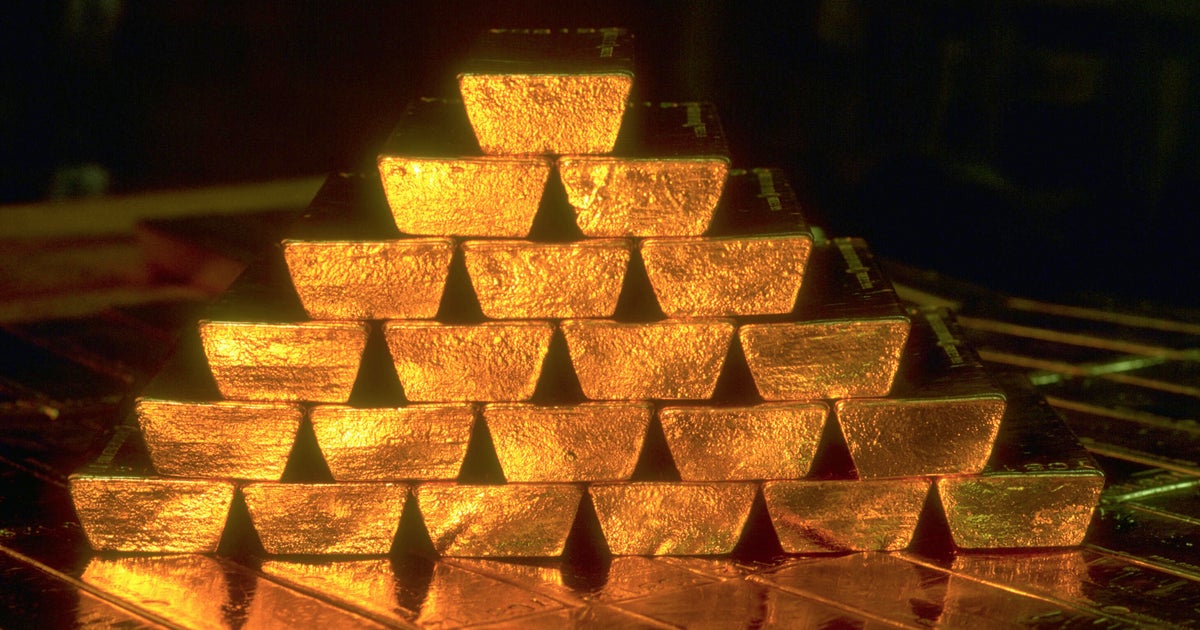

And, there is a range of gold investments to choose from, from gold stocks, gold IRAs and ETFs to gold bars and coins. Gold bars, in particular, are in high demand right now, and even Costco is now selling them. In fact, the demand is so high that Costco can't keep the 1-ounce gold bars on the shelves. But while 1-ounce gold bars are popular among investors, are they a good investment overall?

Explore the many benefits that gold investing offers with a free information kit here.

Are 1-ounce gold bars a good investment?

The short answer is yes, in many cases, it can pay to buy gold bars. These gold assets tend to hold their value well and have historically increased in value over time. And, they offer lots of other unique benefits to investors, too.

Still, investing in 1-ounce gold bars won't be the right move for everyone. The right investment opportunities can differ from one person to the next, and there are some potential downsides to consider as well.

Get started and learn more about gold investing here.

Why 1-ounce gold bars could be a good investment

In general, 1-ounce gold bars are often a good investment because they offer the following benefits to investors:

Tangible ownership

Unlike many other types of gold investments, 1-ounce gold bars offer investors the advantage of being tangible assets. You can physically possess and secure your gold bars, which can instill a sense of ownership and security. It also gives you direct control of your assets, which is a big plus for some investors.

Liquidity

Physical gold is highly liquid, and 1-ounce gold bars are no exception. These gold bars are recognized globally and can be swiftly converted into cash, especially during times of economic uncertainty when demand for gold tends to rise.

Diversification

Including gold in your investment portfolio can provide diversification benefits. That's because gold often exhibits different behavior compared to traditional assets like stocks and bonds, which can help reduce overall portfolio risk.

Inflation hedge

Historically, gold has served as a hedge against inflation. When the value of traditional currencies erodes due to inflation, gold's purchasing power tends to rise. And considering that we're still dealing with issues from stubborn inflation, 1-ounce gold bars are an attractive option for preserving wealth for many investors right now.

Portability

These types of gold bars are relatively small and easy to store or transport, making them a practical choice for individuals looking for a portable store of value.

Why 1-ounce gold bars may not be a good investment

And, just like any other type of investment, there are a few reasons why 1-ounce gold bars may not be the right move for some investors:

Storage and security

While 1-ounce gold bars are compact, they require secure storage. Keeping them at home exposes you to the risk of theft, and storing them in a bank's safe deposit box may incur additional costs, so it's crucial that you weigh those factors before investing.

Lack of income

Gold does not generate income like stocks or bonds. Investing in 1-ounce gold bars means relying solely on the potential for the price of gold to appreciate, without the benefit of dividends or interest payments. In some cases, it could make more sense to put the money into income-generating assets instead.

Short-term price volatility

While this type of physical gold can be a safe haven for your money during economic crises, gold can also experience significant price swings in the short term. And, if you aren't in it for the long haul, putting your money into 1-ounce gold bars could potentially lead to investment losses, especially if you have to sell shortly after purchasing.

Transaction costs

Buying or selling 1-ounce gold bars can also involve transaction costs, including dealer premiums and insurance expenses. These additional costs can eat into your potential gains if you aren't careful.

The bottom line

If you're seeking a low-risk asset that offers benefits like diversification and wealth preservation, 1-ounce gold bars can be a promising option. This type of investment offers tangible ownership, portability, liquidity and the potential to hedge against inflation.

However, it's essential to weigh the potential drawbacks, such as storage costs, the absence of income generation, price volatility and transaction expenses before making a decision. It's also important to carefully assess your financial goals, risk tolerance and the role gold plays in your overall investment strategy to ensure it's a good investment for you.