Apple's "darkest day" raises doubts about iPhone's future

Although Apple's iPhone has long wowed consumers and investors alike, the device that has served as a benchmark for mobile devices for more than a decade may be losing its luster. Citing weak demand in China, the technology giant shocked Wall Street on Wednesday by warning that its revenue for the critical holiday period would fall short.

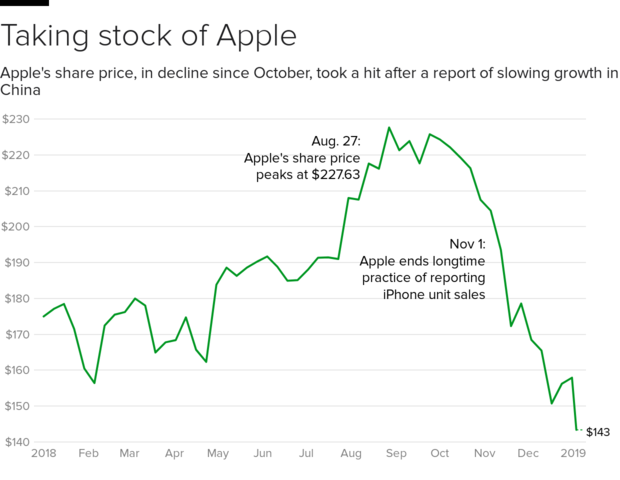

Apple shares promptly tumbled, falling 8 percent on Thursday to their lowest level in 19 months. The surprise announcement amounts to Apple's "darkest day" since it first released the iPhone in January 2007, said Daniel Ives, an analyst at Wedbush who has generally sung the company's praises. More broadly, the sales miss raises a fundamental question for Apple: Is the iPhone -- for years the preeminent symbol of high-tech innovation and design -- getting old?

Red flags

Investors fear that demand for the iPhone -- demand that turned Apple into the world's most successful tech company -- is waning in key markets around the world. While tepid sales in China was singled out as the chief reason for the revenue shortfall, CEO Tim Cook also acknowledged that iPhone sales "were not as strong as we thought they would be" in other developed markets, which he didn't name.

Apple faces a "challenging growth period ahead for the company (and its investors)" Ives said.

IPhone sales were crimped not only by slowing economic growth in China, but also by competitive issues such as the device's hefty cost and the availability of cheaper battery replacements. The result: Consumers can hold on to their aging iPhones longer, making them less likely to upgrade to pricey new models.

Wednesday's warning wasn't the first recent hint of trouble at Apple. In November, the company raised analyst concerns when it said it would no longer disclose exactly how many iPhones it sells, prompting some investors to question whether the company is seeking to hide unfavorable numbers.

That contributed to a stock slump shortly after Apple hit an all-time high in August. Even before this week's guidance alert, the company had shed one-third of its value amid worries over iPhone sales and overall growth.

Analysts have questioned whether consumers are reaching their limit in upgrading to the latest iPhones, noting that the device's price tags have continued to rise. A survey last year found that more customers were buying the cheaper iPhone 8 rather than the pricier iPhone X, perhaps signaling that people weren't willing to pay up for the latest bells and whistles.

"We believe higher prices and lack of new features with real utility is lengthening replacement cycles," Oppenheimer analyst Andrew Uerkwitz told CBS MoneyWatch. "We've finally hit the limit on Apple's ability to be a price taker."

China syndrome

Apple isn't the only phone vendor seeing soft demand. Shipments for Samsung, the top seller of smartphones, fell 8 percent during the 12 months ending in September. In 2018, global smartphone sales declined 3 percent to 1.4 billion -- the first annual drop -- according to International Data Corp., which tracks such movements.

Apple's headache in China is twofold: Slowing economic growth is leaving Chinese consumers with less spending power, and homegrown rivals are giving Apple a run for its money. Once the top-selling smartphone in China, the iPhone now trails several domestic smartphone manufacturers that are producing cheaper products, such as Huawei and Xiaomi.

Apple customers now upgrade their iPhone every 33 months on average, compared with roughly 24 months just three years ago, according to Ives.

That presents a dilemma for Apple. CEO Cook must decide whether to "steer ahead with no pricing changes and hope future iPhone designs will catalyze upgrades OR take the medicine now and significantly cut prices" to lure more consumers in China and elsewhere back to Apple, Ives said.

Despite its recent travails, Apple remains a global powerhouse and is not to be underestimated. Ives estimates that almost half of the world's current 750 million iPhone users could upgrade to a new device within the next 18 months. The company's software services business and other units are also growing, with Apple noting that outside of its iPhone business sales grew 19 percent.

But those businesses are small compared with the iPhone. Analysts question whether other Apple products can ever match the device in popularity and global impact.

"Apple is always working on new products and innovations," Oppenheimer's Uerkwitz said. "However, if you look at the previous slates -- iPad, Apple Watch, AirPods, HomePod -- the sales potential has been less and less."

-- The Associated Press contributed to this report