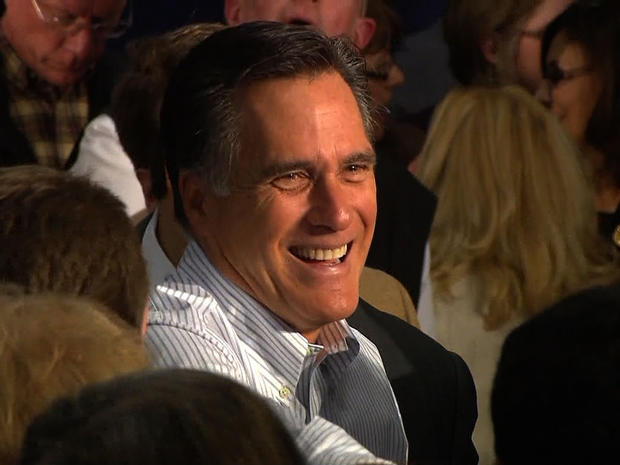

Analysis: Romney tax plan strongly favors the rich

Mitt Romney's new tax plan strongly favors the wealthiest Americans, offering earners in the top 20 percent an average tax cut of more than $16,000 while raising taxes on the bottom 20 percent of earners, according to an analysis from a non-partisan Washington think tank.

The analysis out Thursday from the Tax Policy Center, a joint venture of the Urban Institute and the Brookings Institution think tanks, finds that under Romney's plan the bottom 20 percent would see their average federal tax rate increase $149, or 1.3 percent.

The top 20 percent, meanwhile, would see an average tax cut of $16,134 -- a 5.4 percent reduction in their tax rate. The top one percent of earners would see their average tax rate fall by nearly $150,000 per year, and the top 0.1 percent would see a reduction of more than $725,000.

Romney's original plan called for making the Bush-era tax cuts permanent, getting rid of the estate tax (now paid only by those with estates worth $5 million or more), getting rid of taxes on investment income for those making less than $200,000, and lowering the corporate tax rate ten points to 25 percent. Last week he said he would also cut marginal, individual income tax rates by 20 percent for everyone who pays taxes.

According to the Tax Policy Center, Romney's plan would add $900 billion to the deficit in 2015, when the changes would go into full effect. The group has also found that the 20 percent tax cut, combined with Romney's proposal to repeal the Alternative Minimum Tax, would add $3 trillion to the deficit over ten years - even if the Bush-era tax cuts and more recent tax cuts are extended. (That part of the analysis looked only at the impact of those two proposals, not Romney's tax plan overall.)

A few important notes: Romney has said he would offset revenue lost by the tax cuts by eliminating deductions and loopholes in order to broaden the tax base, though he has not specified what he would do. Thus any offset is not included in the analysis.

In addition, Romney and his Republican allies have long argued that tax cuts will stimulate the economy and thus boost tax revenues in ways that are not measured in analyses like these. As the Tax Policy Center notes, "Gov. Romney says that the reductions in tax breaks, in combination with moderately faster economic growth brought about by lower tax rates, will make the individual income tax changes revenue neutral compared with simply extending the 2001 and 2003 tax cuts."

President Obama's tax plan, according to the Tax Policy Center, would increase taxes on the top 20 percent of earners by two percent while leaving taxes on other Americans essentially unchanged.