Amex CEO: "If the U.S. defaults, the system literally unwinds"

(CBS News) NEW YORK -- The prospect that the U.S. might default on its debt led Fidelity Investments to sell many of its short-term U.S. bonds, out of fear they won't be repaid. The interest rate on the one-year Treasury bill that matures Oct. 17 -- the day the country could default -- has doubled in the past 24 hours, reflecting the higher risk to investors.

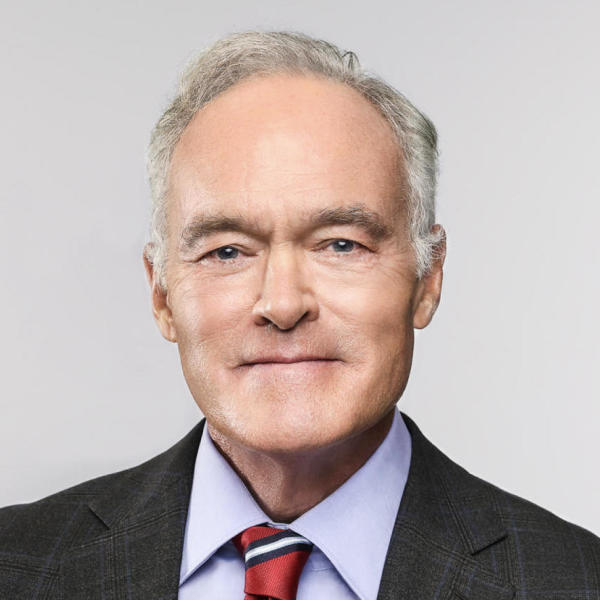

We talked about all this with one of America's most successful financial executives: Ken Chenault, who has been chairman of American Express since 2001. His cards account for 26 percent of the total dollar value of credit card transactions in the U.S. The company's market value is $77.9 billion.

KEN CHENAULT: I think what's important to understand is if the United States hits the debt ceiling and is unable to pay its debts, the consequences will be immediate and dramatic. The reality is that U.S. Treasury debt is viewed as a risk-free asset, because the United States has been the wealthiest nation on the planet for the last 100 years, and no one ever believed that the United States would not pay its debts. As a result, the world financing infrastructure is built on U.S. Treasury debt. If the U.S. defaults, the system literally unwinds.

PELLEY: There's a little bit of a "chicken little" effect here. Back when the sequester was happening, the mandatory budget cuts, there were predictions of grave consequences for the economy that really haven't happened. When the government shutdown began about eight days ago, there were suggestions of grave impacts on the economy. We haven't quite seen those yet. What's different about this?

Debt ceiling deadline is biggest threat to U.S. economy

Investor calm could prolong debt ceiling duel

Debt ceiling: Understanding what's at stake

CHENAULT: Scott, what we're talking about is a default -- is the first time in 237 years, the history of this country, that the United States would not pay its bills. What that means is a government does not stand behind its word. And the confidence in our financial system would be severely eroded. This would be catastrophic.

PELLEY: Your message to Washington then is what?

CHENAULT: My message to Washington is the United States has gone through incredible crises, and our leaders have been able to find common ground. And that's what our leaders have to do. Failure is not an option, because what our government should be focused on is doing what's right for our people, doing what's right for the economy, and in fact ensuring that the promise of this great country can be realized.

Chenault told us U.S. banks are much stronger than they were in 2008 -- better able to withstand a shock.