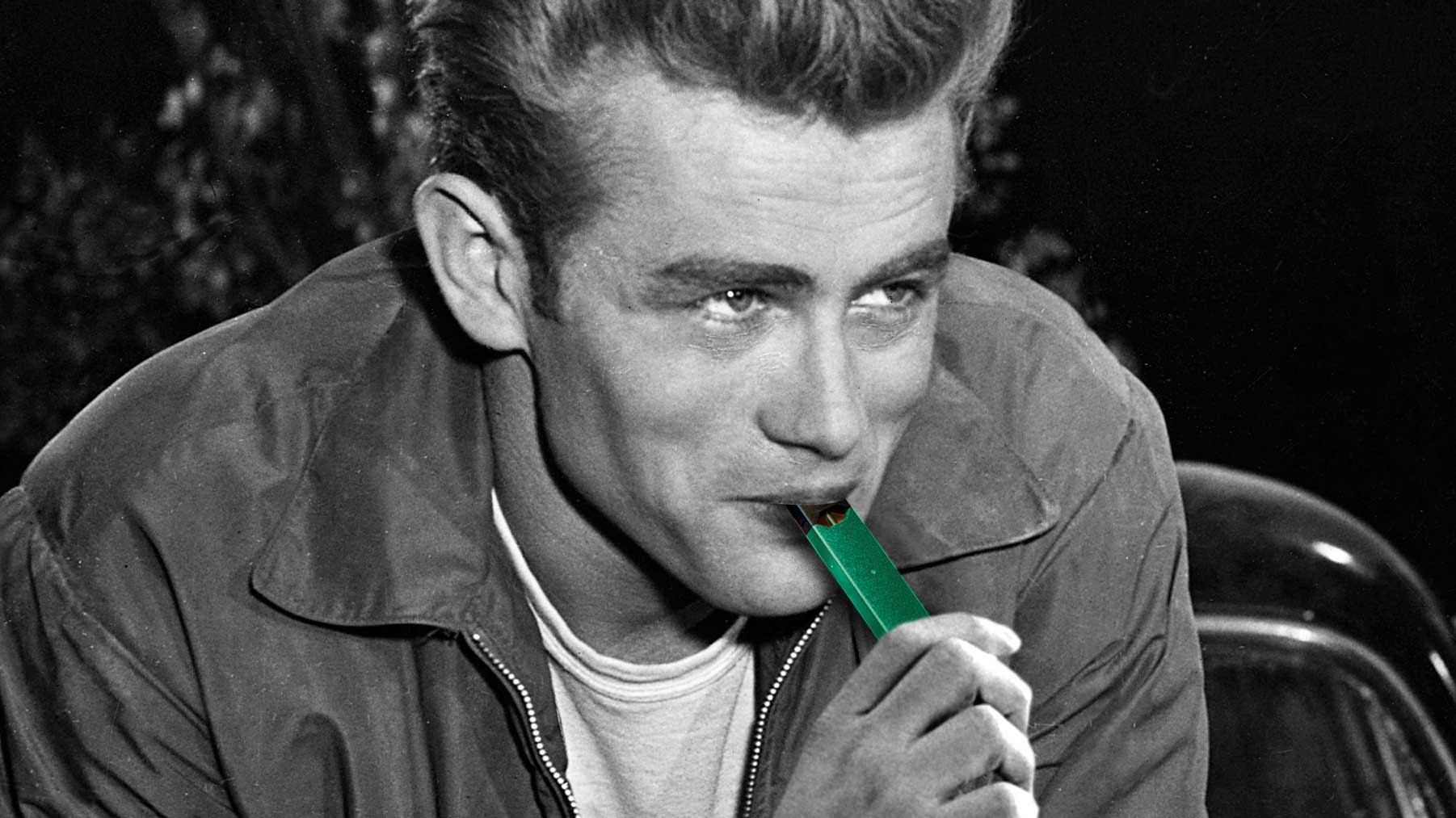

Is Altria's $13 billion investment in Juul going up in smoke?

- Philip Morris-owner Altria's nearly $13 billion purchase of a 35% stake in Juul Labs could turn out to be an expensive dud amid growing health and regulatory concerns around vaping.

- In the latest blow for Juul, Walmart said last week that it would stop selling e-cigarettes.

- The true value of Altria's stake in Juul may ultimately depend on whether the FDA determines vaping is safe.

Less than a year ago, tobacco giant Altria bet big on Juul Labs when it bought a major stake in the vaping company for nearly $13 billion. But that investment increasingly looks like an expensive dud amid growing concerns over the safety of e-cigarettes, which have been linked to hundreds of cases of respiratory illness and at least eight deaths, and as federal and state regulators move to crack down on vaping.

How much is Altria counting on Juul? At the time of the investment in December, Altria CEO Howard Willard described the $12.8 billion cash deal as nothing less than a move "to prepare for a future where adult smokers overwhelmingly choose non-combustible products over cigarettes."

Altria's future, in short, is hitched squarely to vaping. Traditional cigarette usage in the U.S. fell to 14% of American adults in 2017 (the latest year for which figures were available), down from nearly 21% in 2005, according to the Centers for Disease Control and Prevention.

Altria is counting on Juul's dominance in the burgeoning e-cig business to help drive future growth in North America and other global markets where cigarette smoking is on the wane. Juul had revenue of about $2 billion last year and a commanding 72% share of the vaping market. At the time of its investment, Altria's 35% stake in Juul valued the San Francisco-based startup at more than $35 billion, making it one of the most valuable private companies in the world.

"Altria probably thought traditional cigarettes would get regulated away and e-cigarettes would end up being the winner in the regulatory contest," said Dan Caplinger, director of investment planning for the Motley Fool. "But that doesn't seem to be panning out."

While Juul's products haven't been directly linked to the eight vaping-related deaths, the company's struggles have multiplied in recent months, and Altria shares have fallen nearly 20% so far this year.

The stock sank more than 10% on September 11, the same day the Trump administration said it planned to ban the sale of flavored vaping products. Other dips in Altria's stock have coincided with announcements by the U.S. Food and Drug Administration and state watchdogs that they are investigating the safety of e-cigarettes.

Altria stock has lost more than $30 billion in stock market value — almost the entire estimated value of Juul — since the FDA launched an investigation into the safety of vaping in April.

Federal prosecutors in California are in the early stages of a criminal probe into the company, the Wall Street Journal reported Monday, citing people familiar with the matter. The focus of the probe is not clear. A Juul spokesman had no immediate comment, the Journal reported, and Juul did not immediately respond to a request for comment from CBS MoneyWatch.

Juul has repeatedly said it has never marketed to youth and does not want non-nicotine users, especially kids, to ever try its product. Juul CEO Kevin Burns in August said the company "has taken the most aggressive actions of anyone in the industry to proactively curb underage use."

Juul and its competitors face other obstacles, too. Walmart — the country's largest retailer — said last Friday that it would stop selling e-cigarettes, noting the uncertain regulatory outlook.

In June, meanwhile, Juul's hometown of San Francisco became the first U.S. city to ban the sale and distribution of e-cigarettes, citing concerns that they were being marketed to youth.

Overseas, India last week announced it would ban e-cigarette production and sales. That effectively nuked Juul's expansion prospects in the country, which has the second-largest population of smokers after China.

China, for its part, also suspended sales of Juul on two e-commerce sites days after they were made available for purchase.

Despite such setbacks, whether Altria's investment in Juul pans out depends largely on whether the FDA determines that vaping products are safe, which will shape the regulatory battles to come. The agency has not disclosed a timetable for that ruling.

Financial experts say Altria likely accounted for potential questions surrounding e-cigarettes' health benefits when it shelled out billions for its Juul stake in 2018. At the time, Juul's products had only been on the market for three years.

"I would think the $12.8 billion figure Altria negotiated included at least some possibility this sequence of events would play out," Caplinger said. "And if the value ended up closer to zero, then they made some kind of valuation or assumption and basically said. 'There's a 50% chance this will be worth $30 billion and a 50% chance it's worth zero, and for $12.8 billion the potential upside is enough to justify the risk of the potential downside.'"

For it's part, Altria told CBS MoneyWatch it continues "to believe in the harm reduction potential of e-vapor products for adults" when asked about the diminished value of its stake in Juul on Friday.

Altria also stressed the need to curb e-cigs' use among youth: "Regulation of e-vapor is rapidly developing — as an investor, we believe urgent action is needed and addressing the youth issue is a top priority," a company spokesperson said.

Juul's value is likely to shrink until the FDA rules on its safety, said Tim Sullivan, CEO of venture capital firm Oceanic Partners. "If the FDA says that while teens shouldn't be Juuling, adults who want to transition away from combustibles should use Juul, then they will be 100% back on track," Sullivan said.

"It's just that no (FDA) announcements or information and maybe turmoil within Juul itself on how to respond is all stacking up against them right now," he added.

Caplinger emphasizes that Altria, whose cigarette brands include Marlboro, Parliament and Virginia Slims, will survive regardless of what happens to Juul. The reason: Smoking remains popular in many countries around the world, despite the potentially lethal health risks.

Altria still has a market capitalization of $77 billion, even after its stock slide this wear. It reported profits last year of $7 billion on revenue of more than $25 billion. It's also seen as one of Wall Street's most reliable dividend engines for investors, increasing its per share payout every year the past 10 years to $3.20 in 2018 from $1.28 a decade ago.

"The traditional cigarette still makes up a huge portion of Altria's revenue and will continue to make up a huge portion of it for the foreseeable future," Caplinger said. "A lot of value in Altria's stock is in cigarette smokers continuing to buy the product, and I don't see the pace in deterioration of its financials accelerating unless there is more draconian regulation on the traditional cigarette side."