Almanac: The dot-com bubble

On March 10, 2000, newly-formed online companies reached unprecedented heights on the stock market, setting the stage for an Icarus-like fall. It would come to be known as the day the dot-com bubble burst.

Online entrepreneurs had been on a roll up to then, launching dot-coms galore. Investors were eagerly snapping up those dot-coms' initial stock offerings, even though few of the ventures had any REAL assets, or revenue, to speak of.

No profits? No problem!

- Broadcast.com IPO Soars 249% (CBS News, 7/16/99)

- Online grocer Webvan stock price closes 65% above initial offering (NY Times, 11/06/99)

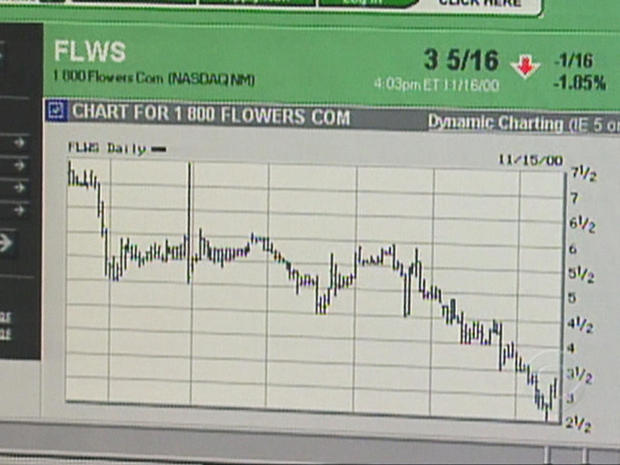

Powered by dot-coms, the NASDAQ soared Icarus-like into the stratosphere, closing that fateful March 10 at just over 5,000. But unbeknownst to anyone that day, the peak had passed.

Icarus-like indeed – those dot-com stocks began to plunge, and plunge, and plunge!

By October 2002, the NASDAQ hit bottom, at roughly 1,100, down nearly 80% from its peak.

Dozens of highly-touted dot-coms (remember pets.com?) were reduced to little more than road kill.

Today, new dot-coms have replaced the old ones, and the NASDAQ has well surpassed that previous peak.

Still, as the lesson of that earlier bubble reminds us, what goes up … can go down.

Story produced by Trey Sherman.