All eyes on Fed for rate hike clues

Financial markets will once again be captive to every word and detail coming out of the Federal Reserve on Wednesday as it releases its latest policy announcement. Investors will be searching for clues on the timing and pace of the Fed's first interest rate hikes since 2006 -- as the central bank prepares to start normalizing monetary policy.

Last month, June was highlighted as the most likely window for a rate liftoff. But several things have combined to make a rate hike now seem unlikely, including a disappointing March payroll report, evidence that the economy hit a snow-covered wall in the first quarter and ongoing signs that the strong dollar (which rose in part because of the Fed's hawkishness) is causing a drag on growth and corporate profitability.

The futures market has already shifted its expectations, effectively taking a June hike off the table and penciling in September as the soonest the Fed will kick off its rate hike campaign. But after years of demonstrating a hesitance to jostle a still-fragile recovery, one that's finally showing signs of wage gains for working Americans, investors and analysts are increasingly wondering if the Fed will hold off until early 2016.

For those keeping score at home, a dovish Fed statement would highlight any or all of the following:

- Concerns about the drag from the dollar's rise, something that Fed officials talked up ahead of their pre-meeting media blackout.

- Fears that job gains could slow given the March employment report.

- Worries that the slowdown in first-quarter GDP growth (with the Atlanta Fed's GDPNow real-time estimate tracking at just 0.1 percent) is more than just weather-related.

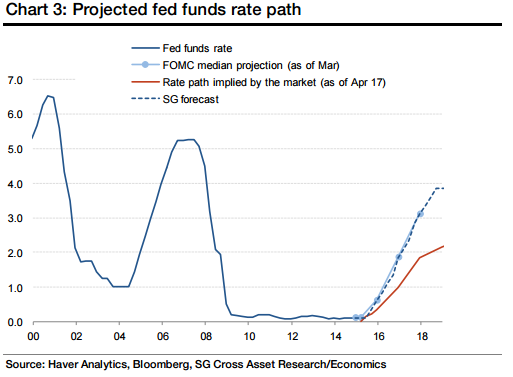

Societe Generale economist Aneta Markowska is looking for two rate hikes this year -- in September and December -- with five more increases next year. This is in line with the Fed's own estimates, which have actually shown a record of being too optimistic. Both Markowska and the Fed's rate path prediction are well ahead of where the market is, which she readily admits.

She's looking for three potential catalysts to keep a September rate hike on track.

The first is the April jobs report to be released on May 8. She expects payroll gains well in excess of 300,000 (vs. 126,000 in March) and a further decline in the unemployment rate from its current 5.5 percent.

The second is the reading on wage inflation from the Employment Cost Index for the first quarter, to be released on April 30. Assuming a 0.7 percent sequential increase in the first quarter, which would match the average of the past three quarters, the year-over-year growth rate in labor costs (a proxy for wages) would accelerate from 2.3 percent to 2.8 percent -- representing the best wage gains since 2008.

And finally, the April retail sales report in mid-May should confirm that the tightening job market and nascent wage gains are translating into increased consumer spending now that winter's chill has faded.

Until this data comes in, the Fed is likely to sound a cautious note. The result should be a deepening of the dollar's recent pullback, which is boosting stocks and risky assets by lifting dollar-sensitive commodities and assets like precious metals and materials stocks.