A look at Ally's failed Fed stress test and CDs

Updated at 3:44 p.m. ET

(MoneyWatch) The Federal Reserve just released the results of their stress test on 18 of the largest U.S. banks. All but Ally Financial survived a hypothetical sharp economic downturn. According to The Wall Street Journal, Ally's tier 1 common capital would shrink to 1.5 percent in such an adverse condition. Ally Financial is the parent of Ally Bank.

I contacted Ally's media relations but they were not readily available. They did release the following statement on their failing grade:

DETROIT, March 7, 2013 - Ally Financial believes that the Federal Reserve's analysis of Ally's capital adequacy for the Dodd-Frank Act Stress Test (DFAST) is fundamentally flawed and, while the Fed has not provided details, the analysis is inconsistent with historical experience in the most stressed periods in our business.

While Ally appreciates the Fed's role in ensuring that financial institutions have adequate capital during stressed situations, using flawed assumptions could have lasting adverse impacts on the economy, including ultimately causing banks to reduce certain key lending categories. For example, Ally believes the loss rates assumed for the automotive finance business are implausible, even in dire economic situations. The auto finance sector, in fact, has historically been one of the best performing asset classes during economic downturns.

Regardless of the DFAST results, Ally continues to have strong capital levels and ample liquidity to support its automotive finance operations. In addition, Ally Bank continues to be a well-capitalized bank with a leading position in the market.

Moreover, if the Fed has significant concerns about Ally's capital adequacy, it can immediately initiate a conversion of approximately $5.9 billion of existing capital that can be fully converted into Tier 1 common equity at their discretion. If the Fed had converted this capital, Ally's Tier 1 common ratio would have been 7.6%, which would have been materially in line with the industry average for the 18 banks in the DFAST analysis.

Later, I received a call from Gina Proia, Ally Finanical's chief communications officer, who went on to explain that the $5.9 billion referred to above is not an additional cash requirement from tax payers. This refers to the U.S. Treasury converting preferred stock to common stock. Ms. Proia made it clear that Ally was not requesting this conversion.

My take

Ally Bank's Certificates of Deposits are something I've been recommending for sometime and I have a couple dozen CDs of my own at the bank so I feel the need to comment.

I'm not privy to the methodology and assumptions used in the stress test. The failure is in contradiction to Bankrate's 4 star Safe and Sound safety rating. Many rating agencies gave banks like Wachovia the highest rating in 2007, however.

The conversion from preferred to common stock would result in the U.S. Treasury no longer receiving cash coupon payments which, as a taxpayer, is concerning.

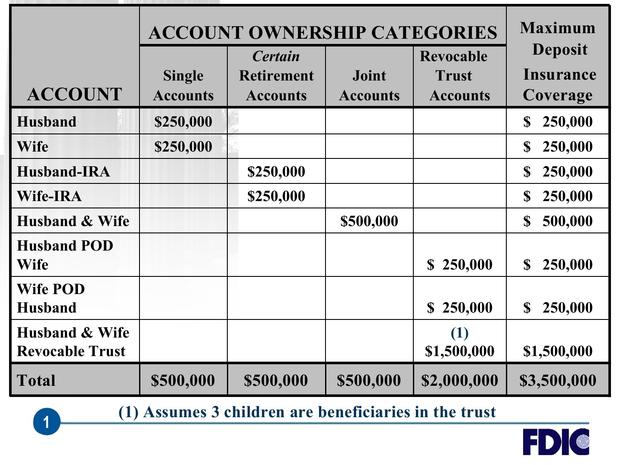

This failure absolutely concerns me but the implications of those of us that opened CDs at Ally Bank are minimal. That's because I always recommend staying below FDIC insurance limits. The worst case scenario is the nation does hit the economic downturn in the stress test and the Fed is correct, causing the takeover of Ally Bank. If Ally is taken over by another bank, they will either honor the CDs or the Fed will pay back depositors all insured funds, typically in a couple of weeks. That scenario results in not earning the rates on the CDs for the remaining term.

While not being able to earn the higher rate for the remaining term of the CD isn't great, it's a far cry from those that lost everything on the sub-prime bubble. I continue to offer my same advice of never going above FDIC or, for credit unions, NCUA insurance limits.

Author's note: After this piece was originally published, Ally Financial reached out to me. This story originally noted that Ally Bank had failed the stress test rather than the parent, Ally Financial. It also referred to the $5.9 billion in Ally's statement as additional cash from the Treasury rather than converting preferred to common. The latter, however, also has significant cash impacts as Ally would no longer pay a cash coupon to the Treasury.