A decade since the housing crash, a new story emerges

As many as 10 million Americans are believed to have lost their homes because of the financial crisis that erupted a decade ago, according to the St. Louis Federal Reserve.

The crisis wiped out almost $8 trillion in household stock-related wealth and $6 trillion in home value after banks, mortgage lenders and financial companies provided loans to speculators, house flippers and people who couldn't afford to pay, spinning the economy into the worst financial disaster since the Great Depression.

A decade later, how does the U.S. housing market look?

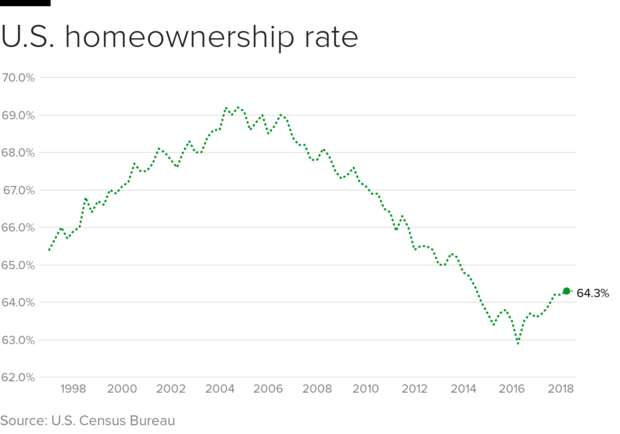

Homeownership is below pre-crisis levels

At the end of June, roughly 64 percent of homes were owner-occupied, according to statistics from the St. Louis Fed. That's below the historic highs of 2004, four years before the bankruptcy of Lehman Brothers, widely used to mark the acceleration of the crisis.

The current homeownership rate represents a slight increase from the 2016 low of 63 percent. The gain may signal that Wall Street is trading more mortgages as the Federal Reserve raises interest rates and lawmakers ease some of the post-crisis regulations on banks.

Fewer young adults and minorities own homes

Between 2004 and 2016, overall homeownership rates plummeted 8 percent, according to a study from the Pew Research Center. Demographics also changed.

Younger Americans felt the impact more than older homeowners. For adults between 25 to 44, the homeownership rate dropped 16 percent. And for adults younger than 35, the rate plunged 18 percent.

A decade later, it's clear the crisis delayed a traditional marker for adulthood -- homeownership -- for a greater number of young people.

"The typical household head is older now – age 51 today vs. 45 in 1994," the researchers wrote. "Older households tend to be more likely to own their homes than younger households, and thus today's homeownership rate is being propped up, in part, by an aging America."

The crash is still being felt more keenly by non-white groups as well. Black households, for instance, also now own homes at a rate that's 16 percent lower, at 41 percent. That compared with ownership of white households at 72 percent, just a 5 percent slip in the same time period, according to the Pew study.

Prices are up, but are rising even faster in cities

If you live in a city, chances are real estate is now more expensive than in rural areas. Migration to cities is helping to drive the increase, according to a recent study from real estate website Trulia.

In the five years ending mid-2018, home values in the 100 biggest metropolitan areas rose 53 percent, according to Trulia. That's double the gain in rural areas, where property values rose 28 percent, the study found.

The difference "between some of the largest metro areas and rural America is especially stark—many metros have seen robust growth in jobs and home prices, while many rural areas have stagnated," wrote Felipe Chacón, a housing economist for Trulia, in the report. "This divergence has boosted demand for housing in the nation's cities, fueling rapid rises in home prices."

A population shift to those urban areas is contributing

From 2012 to 2017, the U.S. population grew 3.7 percent. But in the 100 biggest metro areas, it expanded 4.8 percent. In rural areas, the population dipped 1 percent, the Trulia study found.

Even among the urban areas, some cities are far more expensive than others. In Silicon Valley, the area around San Jose, California, the current median home is worth $1.29 million, statistics released this week by real estate search company Zillow showed. That's 74 percent higher than the top of the real estate bubble and more than double from its post-crisis low.

Denver was next on the list of increases, with a value of $397,800. That represents a 66 percent rise.

Contrast that with Las Vegas, where values are still 16 percent below their pre-financial crisis level. Orlando and Chicago homes remain almost 14 percent below their pre-crisis values, according to Zillow.

Rising interest rates are also helping tap the brakes

The Federal Reserve has already raised interest rates twice this year, and is expected to hike them twice more to keep the economy -- and the housing market -- from overheating.

"While housing affordability is still running above longer-term historical levels, rising prices and interest rates have taken some steam out of demand," Deutsche Bank economists wrote in an August note looking at the housing market.