5 tips to keep your financial resolutions on track

'Tis the season for … stories about New Year's resolutions. Articles that recount the importance of making resolutions to improve your finances or your health are everywhere this time of year, all quoting studies that show why you need to make these changes.

For example, Fidelity Investments recently released its ninth annual New Year Financial Resolutions study, showing that the top three financial vows Americans make are: save more, pay down debt and spend less. Financial Engines also suggests three steps you should take to improve your finances: max out your 401(k) contribution, reduce your mortgage debt and optimize your taxes.

These are indeed all valuable goals. The trouble is, many people know what steps they should take to improve their health and finances, but they have trouble ever actually taking these steps. According to a recent paper by the Stanford Center on Longevity, small percentages of Americans report they're "already doing well" with key financial and health actions. Yet high percentages report being "very concerned" or "fairly concerned" about staying healthy, avoiding serious illness and running out of money when they're older.

If you'd like some help making your New Year resolutions stick, here are five tips from research in psychological science and behavioral economics that can help:

Create vivid visualizations

Take a few minutes, and imagine your future life in the next few decades. Think about past experiences that have given you joy and satisfaction and that you want to repeat in the future. For some people, these experiences might be travel, hobbies or working on your favorite causes. For others, it might be participating in important family events, such as attending reunions, weddings or grandchildren's activities.

Place pictures of these past happy events in strategic spots to remind you of the possibilities for enjoying your future life. Studies show that using vivid visualizations can boost your chances of meeting goals that you set for yourself.

See the future you

Psychologists contend that most people don't think much about their future selves. As a result, they aren't motivated to take steps now to improve the life of their future selves. But studies show that people who can envision themselves in the future have more desire to care for that future self.

To ramp up your motivation, create a picture of what you might look like in 10, 20 or 30 years. AgingBooth is one smartphone app you can help you do that. If you take this step, here's a hint: Smile for the camera. You want that future you to be happy!

If you're really brave, gather a group of your friends who share your goals and take this step together. Discuss your reactions and the steps you might take to improve your situation. Your family and friends can significantly influence your decisions and actions. The next tip provides even more evidence.

Reflect on stories that influence you

People are more often influenced by stories than by facts and figures, according to Jennifer Aaker, a marketing professor at the Stanford Graduate School of Business. So try thinking about both the positive and negative stories you know that might influence your thinking about your health and finances. For example, do you have older friends and relatives who suffered in their later years, making you fearful about growing old?

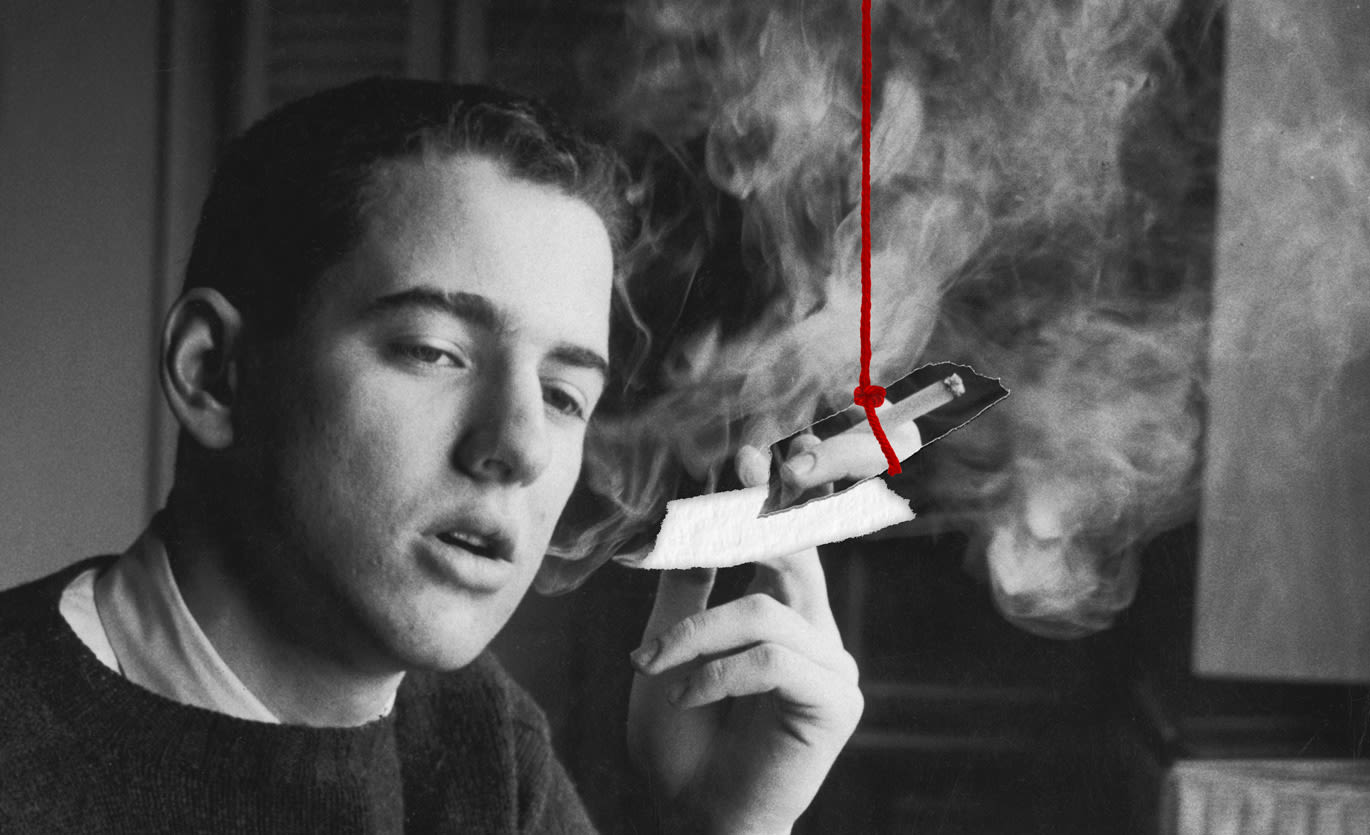

Don't just worry -- take some actions steps. While some people suffer at younger ages due to diseases beyond their control, others may contract diseases due to lifestyle factors such as smoking or obesity. Use any negative stories to motivate you to correct unhealthy behaviors. For example, "I don't want to end up like my poor Uncle Bob, so I'll stop smoking now and never take it up again."

Also seek out the positive stories of older friends and relatives who are living long and well, and are financially secure. Ask them about the steps they took to improve their lives. Most likely, they'll be a positive influence on you and will be glad to share their experiences with you.

Use affirmations to help you succeed

These are statements you make about your values that can help you cope with difficult or stressful situations. Geoff Cohen, a professor at Stanford University, has conducted fascinating research on the power of values affirmations in a few difficult situations, such as helping disadvantaged youth succeed in school and helping women lose weight.

Affirmations work best when they're a statement about your values. For example, take a minute or two to think about and write down why personal responsibility, your family or other values are important to you.

Then you can use these affirmations to remind yourself that being responsible for your life and the impact on your family are core values for you. That can help boost your motivation when you'll inevitably face some tough choices with your finances and health.

Write down your hopes and dreams, fears and concerns

Sally Hass ran one of America's most comprehensive retirement readiness programs at Weyerhaeuser (WY) for many years. Hass recommends that you "Write down your hopes and dreams for your retirement life, and think big! List the things that can really get you excited about life."

This can serve as a bucket list that motivates you to take steps to realize your dreams.

Hass also suggests that you "Write down your fears and concerns about your future. Identify events that can get in the way of realizing your hopes and dreams." Your list will identify risks that you want to avoid, such as running out of money and poor health.

Hass recommends prominently displaying these two lists in a place you'll see them often as a constant reminder to stay on track.