3 worries for a quiet stock market

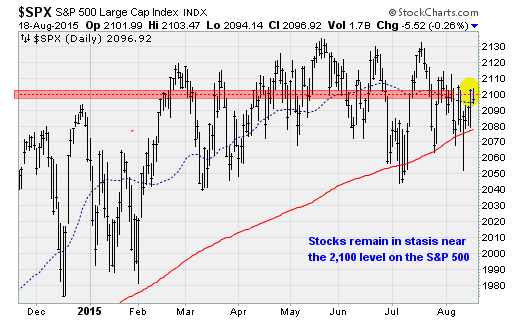

Stocks simply aren't going anywhere. But that could soon change.

According to Bespoke Investment Group, the S&P 500's closing high/low range over the last six months is a mere 4.4 percent. That's narrower than any other six-month period in history. Market data shows that once market volatility returns, returns have been mixed over the three months that followed.

And yet this tranquility on the surface belies turmoil in individual stocks.

Right now, a total of 13 components of the Dow Jones industrial average are in outright corrections, down 10 percent or more from their highs. These are major players, including American Express (AXP), Caterpillar (CAT), Chevron (CVX), Dupont (DD), Intel (INTC), 3M (MMM), Procter & Gamble (PG), United Technologies (UTX), Walmart (WMT) and Exxon Mobil (XOM).

Three potential negative catalysts could cause the major averages to succumb to the selling many individual stocks are already suffering.

The Fed. The first is the risk of a negative reaction to a possible interest rate hike from the Federal Reserve at its next policy announcement on Sept. 17. According to Bank of America Merrill Lynch, the odds of a September hike stand at around 60 percent. With interest rates at zero since 2008, the simple truth is no one knows what the markets' response will be. The flow of capital from bonds to stocks via debt-funded corporate buybacks is at risk, which would remove a major source of fuel for equities.

China. The situation in China has been the center of attention in recent weeks as evidence of an economic slowdown has led to panicked selling, aggressive intervention by Beijing and last week, the largest one-day devaluation of the yuan in what looks like a bid to restore export competitiveness.

Heading into this week, investors were hopeful some stability was forming as the yuan held firm and the Shanghai Composite Index climbed out of its July lows.

That changed overnight Tuesday as that index dropped 6.2 percent, forcing the People's Bank of China to reengage with another large liquidity injection. The upshot: China's markets are growing increasingly dependent on the force feeding of direct support from its central bank.

Wall Street professionals are worried. The latest Bank of America Merrill Lynch Global Fund Manager Survey highlighted a China recession as the largest "tail risk" according to professionals.

Earnings. And finally, Wall Street analysts may be overzealous in their forward earnings estimates, penciling in a bounceback in profitability that may not be forthcoming.

According to data compiled by Ed Yardeni of Yardeni Research, S&P 500 revenues and business sales have both slumped to levels associated with the start of the last two recessions. Removing the drag from energy by looking at nonpetroleum business sales results in a similarly dour picture.

Yet analysts assume that despite tepid top-line growth, companies can keep juicing earnings by expanding profit margins -- something Yardeni believes is "overly optimistic" right now. If the analysts are wrong, it means stocks are even more overvalued than commonly assumed. The cyclically adjusted price-earnings ratio on the S&P 500 is already at heights exceeded only during the bubbles of 1929, 2000 and 2007.