3 Black Friday trends for retail investors

It's almost here. No, not the warmth of family and friends gathered around table. I'm talking the start of the holiday shopping season on Black Friday. That's the decidedly American pastime -- which has been coming earlier each year -- of fighting hordes of similarly minded bargain shoppers in parking lots and aisles for cut-rate electronics, toys and clothing.

If you ever wondered what the zombie apocalypse would look like, just visit your local Walmart (WMT) at around 6 a.m. the day after Thanksgiving.

Wall Street has been preoccupied with the retail sector recently as quarterly earnings flowed out and management teams give guidance on what to expect for the fourth quarter. Given the importance of the next few months for both retail stocks and the broader economy, here are three things for investors to keep in mind.

Black Friday is big

Research from LPL Financial sets the stage: Holiday sales figures have had roughly a 92 percent correlation with fourth-quarter GDP growth over the last 10 years. Consumer spending is still responsible for more than two-thirds of the U.S. economy. And seasonal employment is set to add upward of 750,000 jobs to the economy in the months to come.

The holiday quarter is the biggest of the year for retailers. And it's also the quarter carrying the highest profitability, according to LPL's research, with average earnings per share of more than $6 vs. around $4 for the other three quarters.

The holiday season months and those immediately following it also tend to be the best-performing periods for retail stocks. Over the last five years, the S&P Retail Select Index has gained 7.7 percent and 9.9 percent in the fourth and first quarters, respectively, but zero percent and 3.2 percent for the second and third quarter, respectively.

But is it losing its edge?

Online retail sales growth has actually been stronger than the pace for traditional bricks-and-mortar in recent years. Perhaps the crowds and the chaos are getting to consumers. Bloomberg recently reported how traditional retailers investing in their e-commerce presence aren't seeing much success.

Sales during the four-day period from Black Friday to Cyber Monday are actually declining as more stores open on the Thanksgiving holiday and deeper discounts are seen closer to Christmas (Super Saturday, the last Saturday before Christmas, for example). Despite the drop in Black Friday weekend sales, overall holiday sales have been rising.

Early indications are mixed

So far, the retail sector is sending different messages on what to expect from this holiday season.

Stocks of large retailers Macy's (M) and Nordstrom (JWN) have been hit hard on outlook cuts and bloated inventories. Target (TGT) shares weakened after the company reported inline third-quarter results on margin pressure. Staples (SPLS) fell after comparable-store sales (those at stores open a year or more) dropped 2 percent. Dick's Sporting Good (DKS) saw shares drop on a third-quarter earnings per share miss on weaker-than-expected comp-store sales (0.4 percent vs. 1.9 percent expected) and lower guidance.

Best Buy (BBY) was hit despite a third-quarter earnings per share beat as investors were disappointed by domestic comp-store sales growth of 0.8 percent (below the 1.2 percent expected). There just isn't the "gotta have it now" product or category in the electronics category this year.

Yet other retailers have been looking better.

Shares of Abercrombie & Fitch (ANF) gained 25 percent on Friday after better-than-expected earnings and revenue on strong comp-store sales growth. Gap (GPS) rose 7.5 percent on third-quarter results in line with its preannouncement. Foot Locker (FL) climbed 5.7 percent on an earnings per share beat. Ross Stores (ROST) gained 10 percent on solid earnings, profit margins and comp-store sales growth.

Home Depot (HD) rose on a third-quarter earnings beat, led by a 5.1 percent increase in comp-store sales. TJX (TJX) was helped by a third-quarter beat and customer traffic momentum. And Walmart gained after reporting slightly better-than-expected earnings on a 1.5 percent increase in comp-store sales, in line with estimates. Store traffic increased 1.7 percent.

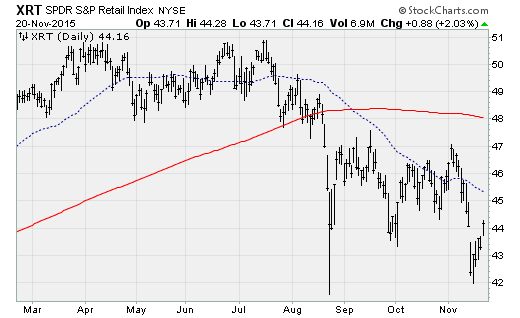

However, for now the S&P Retail Index SPDR (XRT) remains in a confirmed downtrend -- with the 50-day moving average (blue line in chart above) below the 200-day moving average (red line) and sloping lower. That means investors are skeptical overall despite apparent tailwinds for consumers, including a strong jobs market, low energy costs and cheap credit.