4 borrowers who should open a HELOC (and 3 who shouldn't)

A home equity line of credit (HELOC) is a powerful borrowing tool in some situations, but it's not right for everyone.

Watch CBS News

We may receive commissions from some links to products on this page. Promotions are subject to availability and retailer terms.

A home equity line of credit (HELOC) is a powerful borrowing tool in some situations, but it's not right for everyone.

If you're expecting a tax refund, there are a few places you may want to deposit that money to earn big returns.

A HELOC could offer a cost-effective way to purchase a second home now. Here's what homeowners should consider.

Homeowners may be surprised to learn these three things about the home equity borrowing landscape now.

Debt relief companies can provide timely help with your debt this spring. Here are signs for when to ask for help.

Most lenders will limit your loan to a percentage of your home equity, but that's not always a set rule.

If you're a homeowner considering borrowing with a HELOC, waiting for Fed rate cuts may not make sense. Here's why.

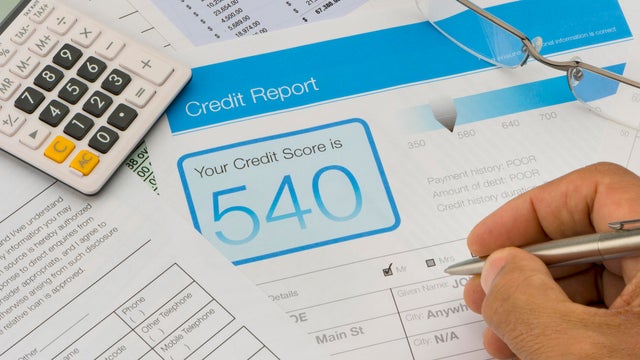

Most types of debt relief have an impact on your credit report, and it's important to know how long that lasts.

Credit card debt management isn't a magic solution, but it can be a powerful debt relief tool for the right person.

Both types have benefits worth exploring now. Here's how experts say you can determine which is better for your needs.

If you're buying gold for the first time, consider these key factors before choosing a gold firm.

Before you tap into $200K (or more) of your home's equity, make sure you consider these important factors.

Filing an extension doesn't necessarily change the date your tax payment is due. Here's why.

The price of gold just hit a new record. Here's how to get started without having to pay top dollar.

With the rising cost of living, managing credit card debt can be tough, especially for retirees on fixed incomes.