MN Surplus Expected To Top $1B, Possible Tax Cuts in '16

MINNEAPOLIS (WCCO) -- As a sign that Minnesota's economy continues to improve, lawmakers will find out this week about a state budget surplus that's expected to top $1 billion.

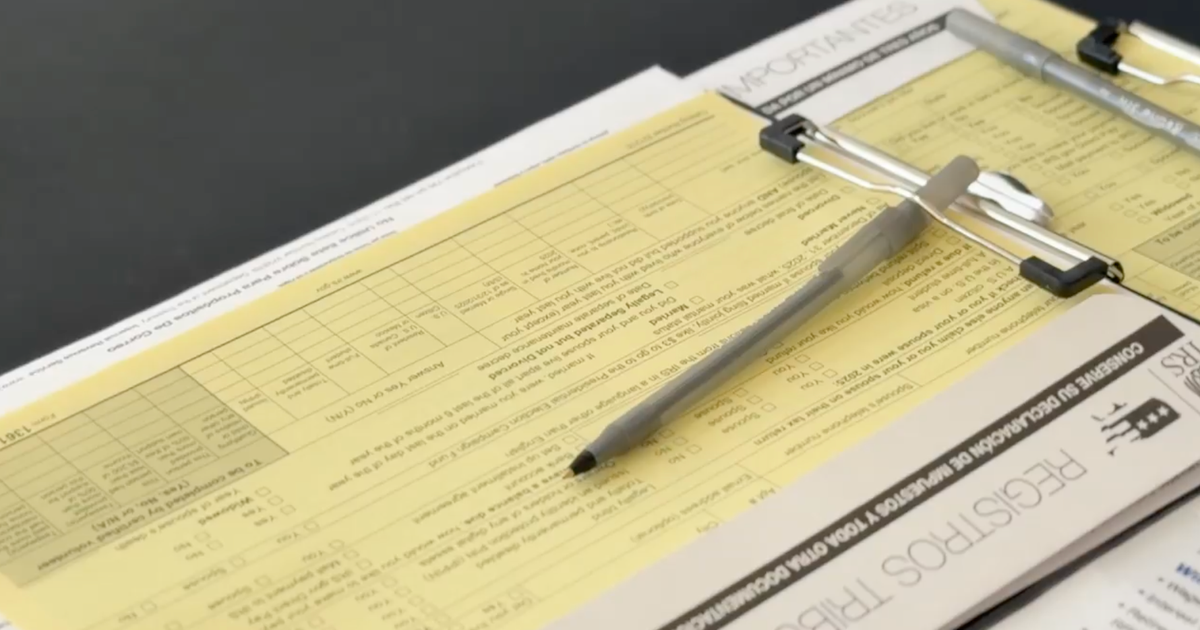

Gov. Mark Dayton is ready to resurrect a plan to expand child care tax credits, and working family tax credits. Those credits can also mean tax refunds for low income working Minnesotans.

House Republican leaders say they'll reprise a tax cut bill they christened with a Journey song title: "Don't Stop Believin'." It exempts from property taxes part of the value of certain businesses and cabins.

It phases out income taxes on social security and military pensions, and includes a personal dependent care credit.

"This is the 'Don't Stop Believin' tax bill, so we can't stop believin'," Rep. Greg Davids (R-Preston), chair of the Minnesota House Taxes Committee, said. "I had no idea when I named my tax bill that I wouldn't be able to stop believin' through the summer, fall, and into the winter."

It is unlikely Minnesotans will get a tax refund check in the mail.

Based on the proposals made public so far, Minnesotans are more likely to see a break on property and business taxes, coupled with specific tax credit programs.