Minnesotans weigh in on student loan forgiveness plan cancelling up to $20,000 for millions

MINNEAPOLIS -- President Joe Biden on Wednesday announced his administration will cancel up to $20,000 in federal student loan debt for millions of Americans.

To qualify, borrowers need to earn less than $125,000 as an individual or less than $250,000 per year for married couples. The plan cancels $10,000 in federal student loans per borrower and an additional $10,000 for recipients of Pell Grants, which is financial aid for low-income families.

The Biden administration is also extending its loan repayment pause, which started when the pandemic began. Payments will resume in January and won't exceed 5% of a borrower's discretionary income for undergraduate loans.

"An entire generation is now saddled with unsustainable debt in exchange for an attempt at least at a college degree," Biden said during his remarks at the White House. "The burden is so heavy that even if you graduate, you may not have access to the middle-class life that the college degree once provided."

For Zach Lyons, the move will wipe away the remainder of his federal student debt.

"I'm sure there are a lot of other impacts economists are talking about in terms of inflation and how that might impact, but for my personal pocket, it gives some money back so it's something I'm excited about," Lyons, who lives in Minneapolis, said.

More than 780,000 Minnesotans have some sort of outstanding federal student loan debt totaling more than $26 billion, according to data from the U.S. Department of Education. The White House expects 43 million Americans will benefit from the plan and 20 million will see their remaining balance canceled.

Current students are eligible too, but future students will not be, senior administration officials told CBS News and other reporters Wednesday.

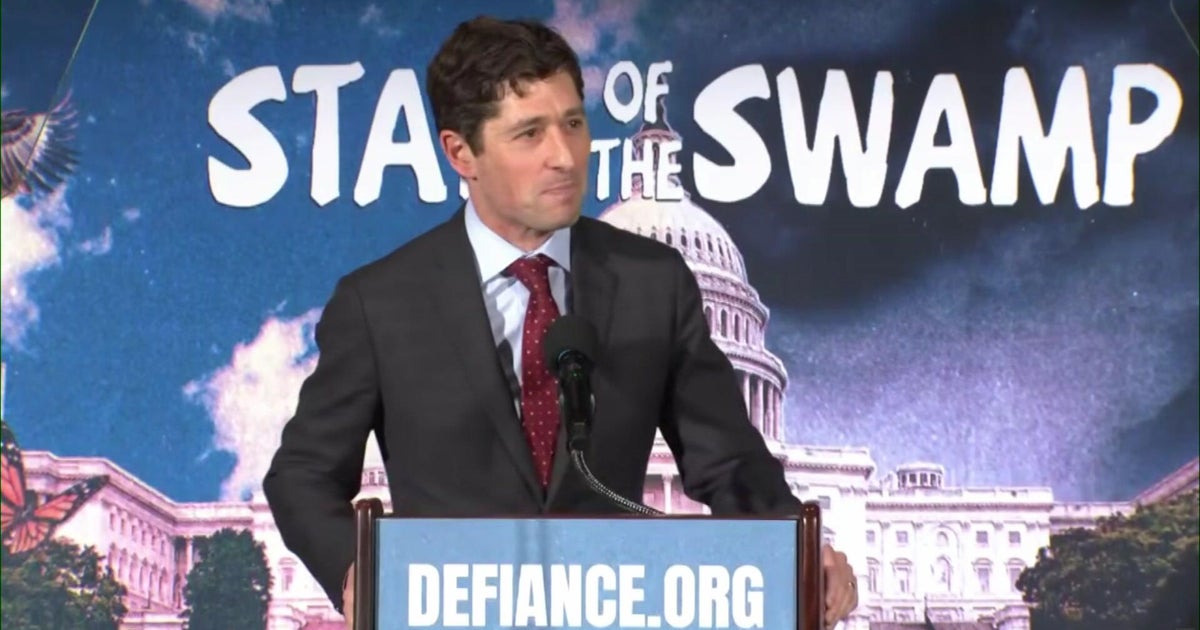

Republicans have criticized the effort, saying Biden does not have the authority to cancel the debt. U.S. Rep. Tom Emmer, who represents Minnesota's Sixth District, who called it a "socialist policy."

"Debt cannot be canceled; it can only be transferred," Emmer wrote on Twitter. "President Biden's socialist proposal to 'cancel' student loan debt will fuel inflation and do nothing to fix our broken higher education system."

Sharon Bauman of Excelsior said she is excited by the announcement, which will impact many of her grandchildren. One of them, she said, has $80,000 in student loan debt and this relief will go a long way.

"I'm happy they're finally helping these kids out," she said. "This is a house payment or car payment for them. It's a lot of money for them especially just starting out."

Minneapolis resident Conor Mullan said that the pause on loan payments allowed him to save more money over the last two years and purchase a home. His remaining balance will be cut in half under the new plan.

"It is a relief for sure. It helps me and my family out substantially," he said. "I know my fiancé is also impacted so it is going to give us some extra income to think about things

But he expressed some concern, too: "Looking at the economy as a whole, there's obviously some drawbacks there with inflation where it is so 50/50 good and bad."

An analysis from the Penn Wharton Budget Model estimated it would cost $300 billion in the first year to forgive the debt.

Relief is capped at the amount of the outstanding debt, according to a FAQ by the Federal Student Aid office. That means if you're eligible for $10,000, but only have $8,000 remaining, you will only get $8,000 in relief.

There's also a proposed rule change that would forgive loan balances of $12,000 or less after 10 years, instead of after 20 years.