Minnesota Senate passes tax bill featuring $4B in cuts

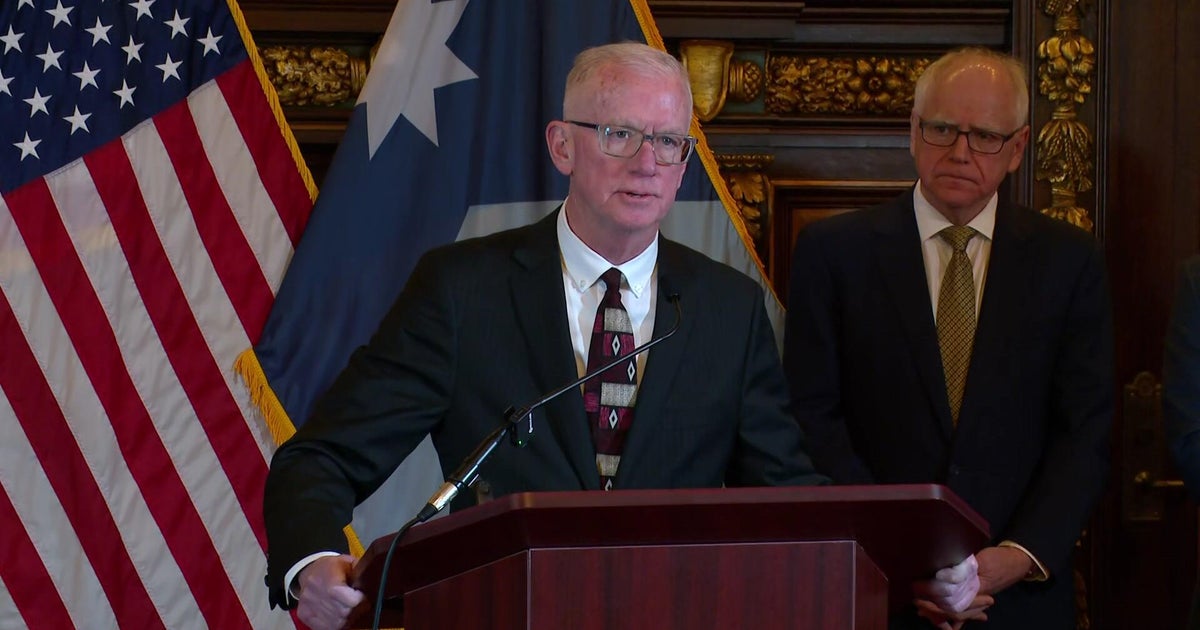

Note: The video above aired April 26, 2023, before the bill's passage.

ST. PAUL, Minn. – The Minnesota Senate passed its tax bill on Tuesday and will now seek to iron out differences between its plan and those of the Minnesota House and Gov. Tim Walz.

DFL lawmakers called the Senate bill "the largest tax-cut package in state history."

The bill includes one-time rebate checks in the amount of $558 for couples making up to $150,000, and $279 for single filers making up to $75,000. Taxpayers with children would receive an additional $56 per child (up to three).

READ MORE: Minnesota House passes bill establishing state paid family and medical leave program

The tax plan also includes a $1.24 billion social security tax cut. Lawmakers say under this plan, 76% of state social security recipients won't pay taxes on their benefits. Republicans have called for full elimination of the social security income tax.

Other highlights include a $620-per-child tax credit for families making up to $80,000, $325 million in funding for public safety and more than $900 million to aid with child care costs.

When Senate Democrats unveiled the tax plan, Republicans said they were disappointed in the bill, and advocated for more tax relief for Minnesotans.

The state House has passed its own version of the tax bill. The bills will now go to conference committee to reconcile the differences.