Advance payments of Minnesota's child tax credit are coming in 2025. Here's what you need to know

ST. PAUL, Minn. — More than 220,000 families in Minnesota this past year received the state's child tax credit, billed as a nation-leading benefit aimed at cutting child poverty by one-third — and when taxpayers file their returns next year, they can choose to get half of that credit early in advance payments.

The full credit is $1,750 per child and it reduces for households with higher incomes until it's fully phased out.

When taxpayers file their 2024 returns this spring, they can opt in to receive half of their 2025 credit at the end of the year instead of a lump sum during tax season. The other half will still be paid out when they file.

The payments will come in August, October and December. A family who qualifies for the full credit of $3,500 for two children and chooses advance payments will receive $583 in each of those months, and the remaining $1,750 the following year.

The credit is refundable, which means Minnesotans who don't owe tax can still qualify. The average total credit for tax year 2023 was $1,242, according to data from the Minnesota Department of Revenue.

"We know that if you can do the advanced payment on the child tax credit, it enhances the ability of the child tax credit to reduce child poverty," said Paul Marquart, the department's commissioner.

The program mirrors what the federal government did during the pandemic, when millions of families received six monthly payments of $250 to $300 per kid from July to December 2021. The money amounted to half of the child tax credit authorized by the American Rescue Plan, a COVID relief package.

Studies suggest those payments kept families afloat during difficult financial times and reduced food insecurity.

Marquart said Minnesota is the first to try advance payments of a state child tax credit and could expand to more monthly installments in the future.

"We want to make sure, being the first in the nation to do this, that we do it right," he said. "We want to hear back from those families that are using the advanced child tax credit and get input from them on what's working, what's not working, and we can then adjust from there."

But advance payments of the credit aren't for everyone: choosing this option could count against a family's SNAP benefits, Marquart added. Taking the lump sum at tax time does not have the same effect.

The state is launching an online calculator next month for SNAP recipients to assess the impact.

LeAndra Estis, a mother of three who received the child tax credit, said she is choosing the advanced payment option and is grateful that it will soon be available. She believes the credit puts her on a path out of poverty.

"It's good to have that back end of government assistance, but the reality of the programs are really to graduate you and help you to become self-sufficient, and the Minnesota tax credit — It's just another way of helping people to be self-sufficient," she said.

Who qualifies for the Minnesota child tax credit?

There are income limits in order to qualify for some of or the full $1,750 child tax credit in Minnesota. To get the maximum refund, income cannot exceed $29,500 for a single filer or $35,000 for married couples filing jointly.

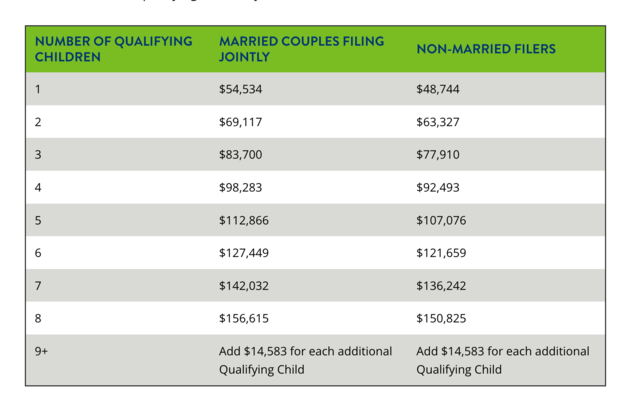

The credit phases out completely for families with one child if their annual income is $54,534. But the threshold for the full phase-out increases with more children. For example,a couple with four children would still receive part of that credit if they make $90,000 a year.

How do I choose advance payments?

Qualifying Minnesota families and individual filers must file a tax return by April 15 electronically or by mail. Then they can choose to opt-in to advance payments.

Marquart said there will eventually be an online portal that would allow people to change their selection and update banking information.

Protections in place for Minnesotans whose financial situation improves

A key change to the child tax credit approved by lawmakers this past session includes what Marquart called "safe harbor" protections.

It's essentially a grace period if a person's financial situation improves and they no longer qualify for the same amount of the child tax credit that they once did.

As long as someone's increased income does not exceed the thresholds for the full phase-out, he explained, they would not owe anything back.

Marquart said fear of making too much money and owing the department the difference is a deterrent to enrolling in advance payments. The goal of the "safe harbor" provision is to incentivize people to opt-in since he believes the child tax credit program will be more effective this way.

"To alleviate this fear and overcome this participation hurdle, [we're] basically saying that as long as you qualify for the program, even if you still qualify for just $1, you are assured of at least 50% of your credit from that year before," Marquart said. "So even if you increased your [salary] or a spouse gets a new job, as long as you still qualify, you get at least that 50% credit and you would not owe any money back."