Minnesota AG Keith Ellison cracking down on predatory payday loans

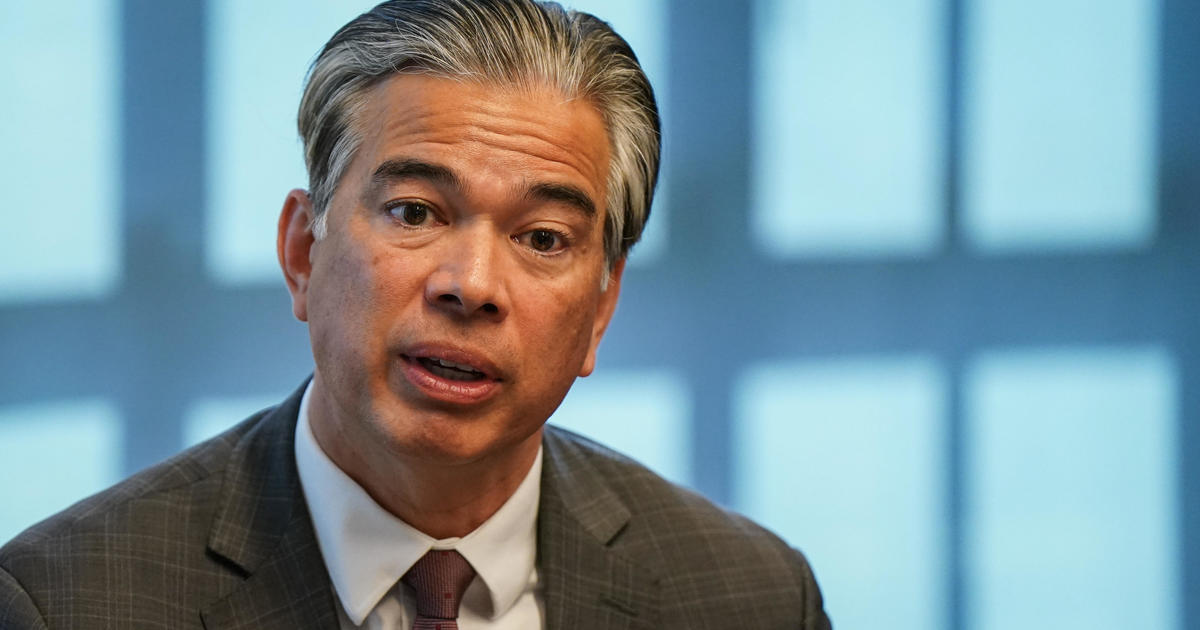

ST. PAUL, Minn. — Minnesota's Attorney General is going after payday loans that charge astronomical interest rates.

Cynthia, a single mother from Duluth, complained to Attorney General Keith Ellison's office after she was victimized, along with dozens of others.

"Got tricked into a loan I really didn't know much about," she said.

Cynthia says she was desperate when she borrowed $2,000 from an online lender.

Ellison is now suing that company, and two others like it.

"We're going to hold them accountable, and we're going to hold them according to the law of the state of Minnesota," he said.

Ellison calls these loans predatory. The way they work is a person borrows any small amount from a few hundred to a couple thousand dollars. The interest rate percentages can then be in the hundreds. Ellison says that's illegal.

WCCO obtained a real example from one of the companies being sued: A $550 loan came with a 700% interest rate. It ended up costing the customer $3,320.

"To see this deception and abuse, it does kind of boil the blood," Ellison said.

MORE NEWS: TSA finds loaded gun in bag of SkyWest Airlines employee at MSP Airport

Cynthia took on a second job to help pay off her loan.

"It was depressing, and I felt like I let my son down," she said. "It's embarrassing."

Anne Leland Clark is the executive director of Exodus Lending, a non-profit that's helped hundreds of Minnesotans get out from under predatory loans.

Leland Clark says these lenders use fine print and slick advertising to target low-income people with bad credit.

But she says there are alternatives.

"Ask first their credit union, their community bank, their family and friends... Before getting caught in traps like this," Leland Clark said.

WCCO reached out to the companies Ellison is suing and didn't hear back.

Starting next year, Minnesota will cap interest rates on payday loans at 36%.