How homeowners can protect themselves from paying out of pocket for water damage

ST. LOUIS PARK, Minn. -- It happened again. There's been another water main break in a St. Louis Park neighborhood.

Homeowners are sharing their frustration with the city again Monday as they deal with two rounds of flooding in two weeks.

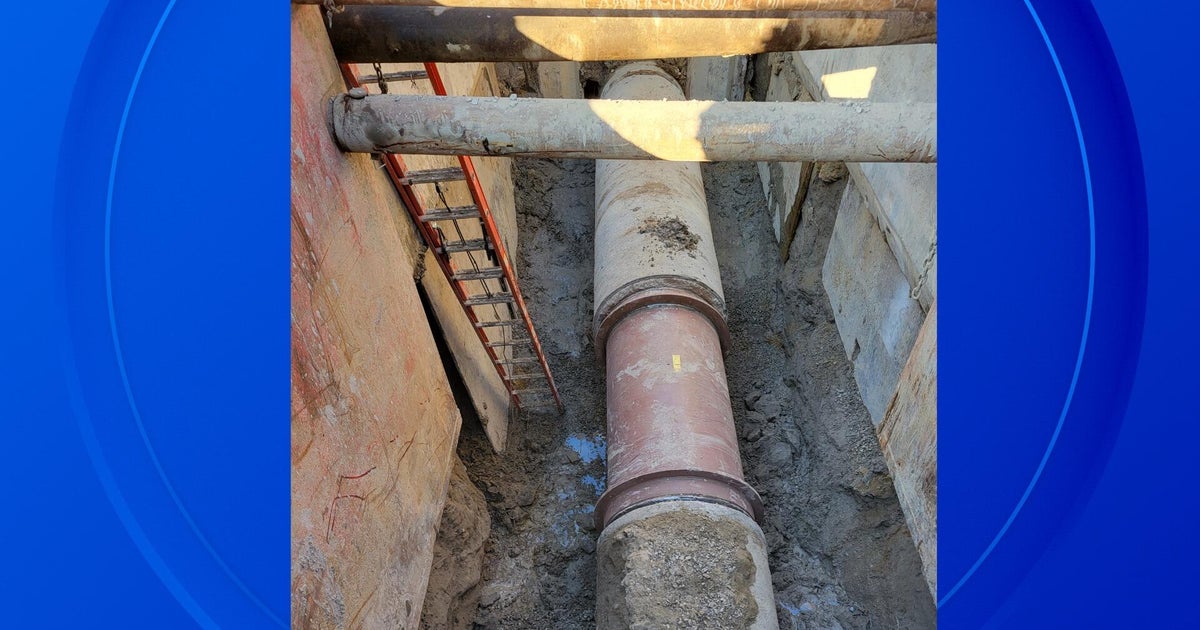

A 12-inch water main break flooded more than 50 basements on May 21. Last Friday, a second break near the first one caused more damage and sewage backup.

WCCO's Reg Chapman has more on the additional coverage you can carry to protect you from paying out of pocket for damages.

Disaster recovery specialist are making the rounds to homes off Minnetonka Boulevard, where water from a water main break flooded basements. With crews cleaning up, many homeowners are frustrating -- and looking to the city of St. Louis Park for answers as to how to pay for the cleanup.

WCCO spoke Monday with Mark Kulda, spokesperson for the Insurance Federation of Minnesota.

"Normally homeowner's insurance doesn't cover water damage, except if it comes through a sewer or drain. And if you have what's called a 'backup of sewer and drain endorsement,' then your homeowner's insurance policy would cover damage in your basement caused by water that comes from places like this," Kulda said, pointing to the damaged water main.

He says that additional coverage is worth the extra cost.

"It's about $35 a year for about $5,000 of coverage, and you can buy that coverage up," Kulda said.

The city of St. Louis Park said this in a statement: "Council and city staff are focused on fully ensuring we can provide meaningful information to residents who attend an important meeting Monday night, to discuss options to provide financial relief for both mitigation and restoration following these water main breaks."

Kulda believes while the city ponders on what, if any, relief to give to homeowners, insurance companies may force its hand in the end.

"The city might think, 'Well if insurance is gonna pay for it we won't have to pay those claims.' That may not be the case. Usually when an insurance company pays a claim, and then they find out somebody else was liable for the claim, they'll file what's called a subrogation against whoever was at fault," Kulda said. "So if the city is found to be responsible, even though insurance may have paid the claims initially, the city may still be on the hook."

Kulda says any homeowner who has a sub pump in their basement should consider the additional coverage.