Home Prices Continue To Plunge In Twin Cities

MINNEAPOLIS (WCCO) -- The latest numbers have the Twin Cities leading the nation in a category nobody wants to win.

Minneapolis posted a 10 percent drop in home prices from this same time last year. That's the biggest drop in the country.

Experts said we haven't reached bottom yet and the continued fall of housing values is prompting a surge in rentals.

This latest drop means that average home values are down a staggering 38 percent from what they were at their high point in 2006. And what we are seeing is more people are opting to rent. Just more than half of people living in Minneapolis now rent. The trend isn't just in the city, it's also spreading to the suburbs.

Charlie Gholl, his wife and two elementary school-aged kids have been renting just a few blocks from where they used to own a home in south Minneapolis. He said he was worried about the market then, and he is still worried about the market.

He said he has no plans to buy a home anytime soon.

"In hindsight it has been a great decision for us," Gholl said. "We are in the same schools, we have the same friends and most importantly we are in the same hockey district."

The Gholl family isn't alone. The number of people renting and not buying is up in many Twin Cities communities over the past 10 years. Maple Grove has had a 5.6 percent increase, Woodbury is up 4.3 percent and Lakeville, Plymouth and Eden Prarie are all up four percent. Minneapolis is up two percent.

Experts said the bottom of the housing market isn't here yet.

"We are five to 10 percent more perhaps to get to the bottom. The bottom is always a moving target," said Professor Tom Musil at the University of St. Thomas.

Musil said the Twin Cities figures on home values appear worse than they are because the glut of foreclosures are driving down the price of the average sale. But the high percentage of foreclosures in every price range is driving prices down further and faster here.

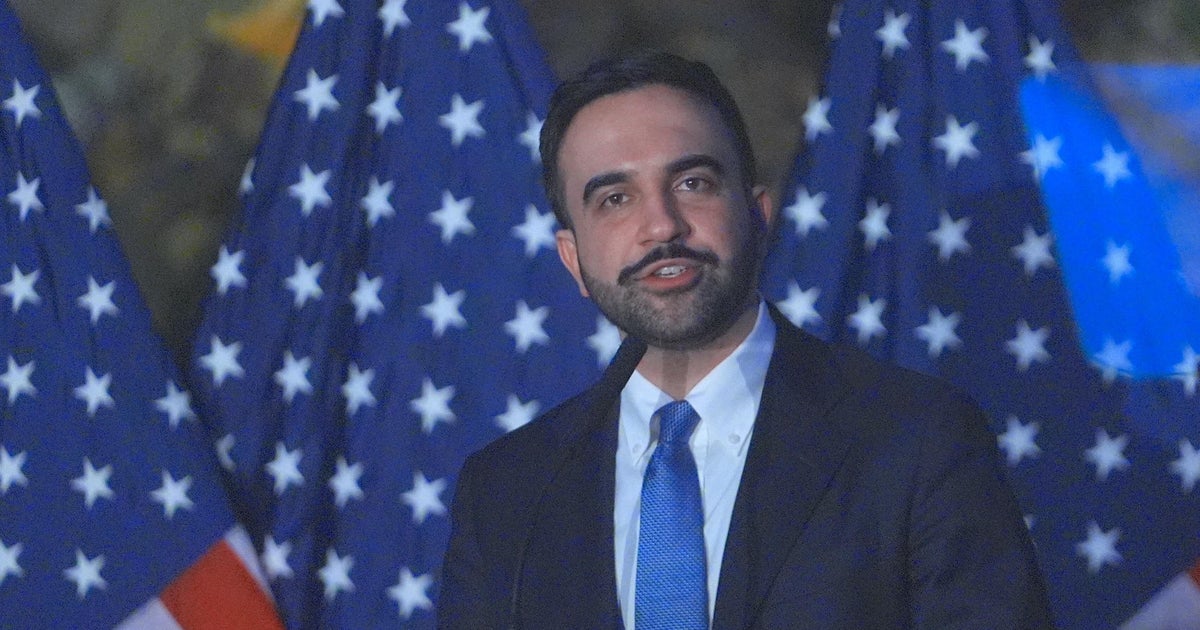

"That is very bad news for the Twin Cities," said Senator Al Franken.

Franken is proposing federal legislation to help struggling homeowners facing foreclosure.

"I think that will help stem the tide of foreclosures, which will then put a bottom on the market," Franken said.

Also fueling the drive to renting are tighter standings by banks for getting loans. Some federal regulators are even pushing for a requirement of a 20 percent down payment for a home, higher down payments for loans are already here another factor leading to more renters.