Hedging Drives Delta Air Lines To 2Q Loss

MINNEAPOLIS (AP) — For an airline, the whole idea of fuel hedging is to protect against big run-ups in oil prices. It didn't work out that way for Delta Air Lines Inc.

Its bets on oil prices went the wrong way, pushing it to a second-quarter loss of $168 million, or 20 cents per share. During the same period last year, Delta had net income of $198 million, or 23 cents per share.

The airline said Wednesday that it lost $561 million on wrong oil price bets that haven't settled yet. It also had $171 million in severance costs from voluntary staff reductions.

If not for special items, Delta would have earned $586 million for the quarter, or 69 cents per share. Analysts surveyed by FactSet expected 68 cents per share.

Revenue rose 6 percent to $9.73 billion, better than analysts had expected.

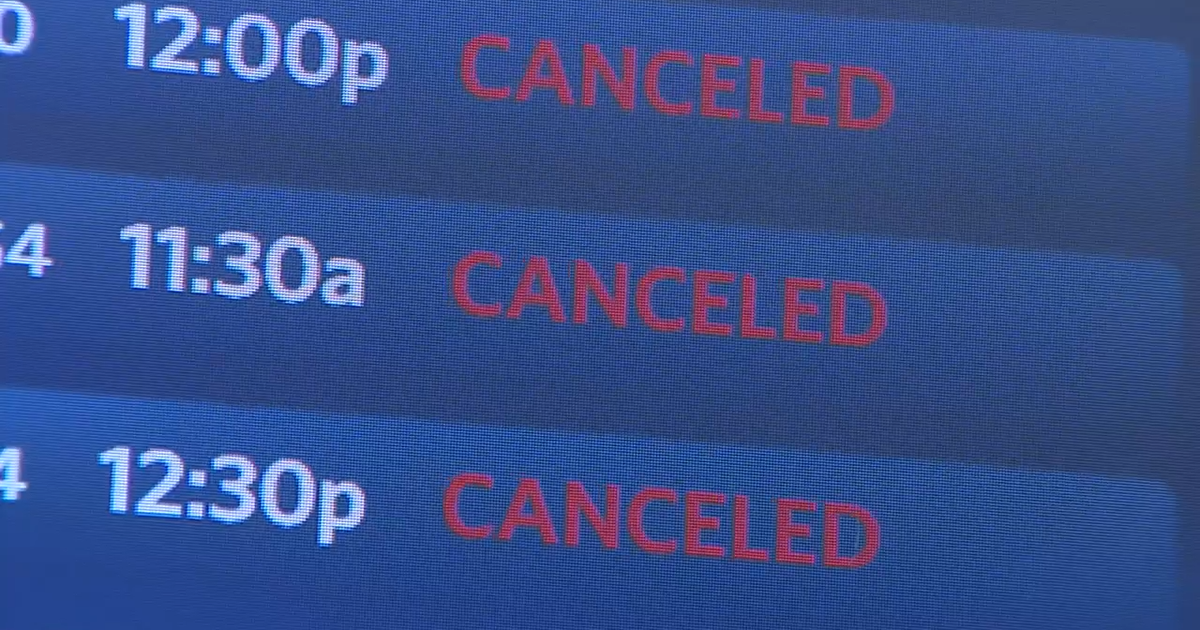

Delta plans to cut third-quarter flying by 1 to 3 percent compared to the same period last year. The airline expects "strong profitability" in the third quarter, CEO Richard Anderson said in a statement.

Delta said cargo revenue fell 1 percent as prices fell, even though it carried more goods.

Delta would have paid $3.21 per gallon for fuel during the quarter if not for the bad oil price bets. But because of those bets, it paid the equivalent of $3.95 per gallon.

Delta shares rose 37 cents, or 4 percent, to $9.70 in pre-market trading.

(© Copyright 2012 The Associated Press. All Rights Reserved. This material may not be published, broadcast, rewritten or redistributed.)