Tax Refund Fraud Victims Getting Left Behind

MIAMI (CBSMiami) – Tax refund fraud has kept federal prosecutors in South Florida busy as the crime continues to grow in popularity. Just this year, two former NFL players pleaded guilty to taking part in tax refund fraud.

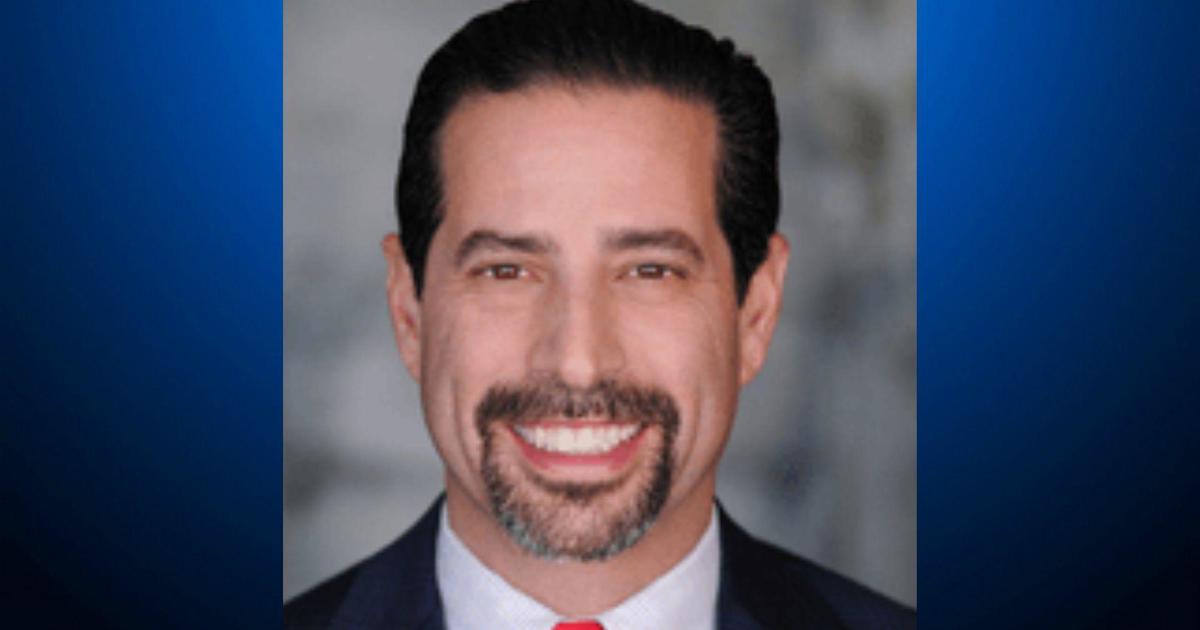

"Identity theft, tax refund scams are really no less than a tsunami that is barreling towards us," said U.S. attorney Wifredo Ferre.

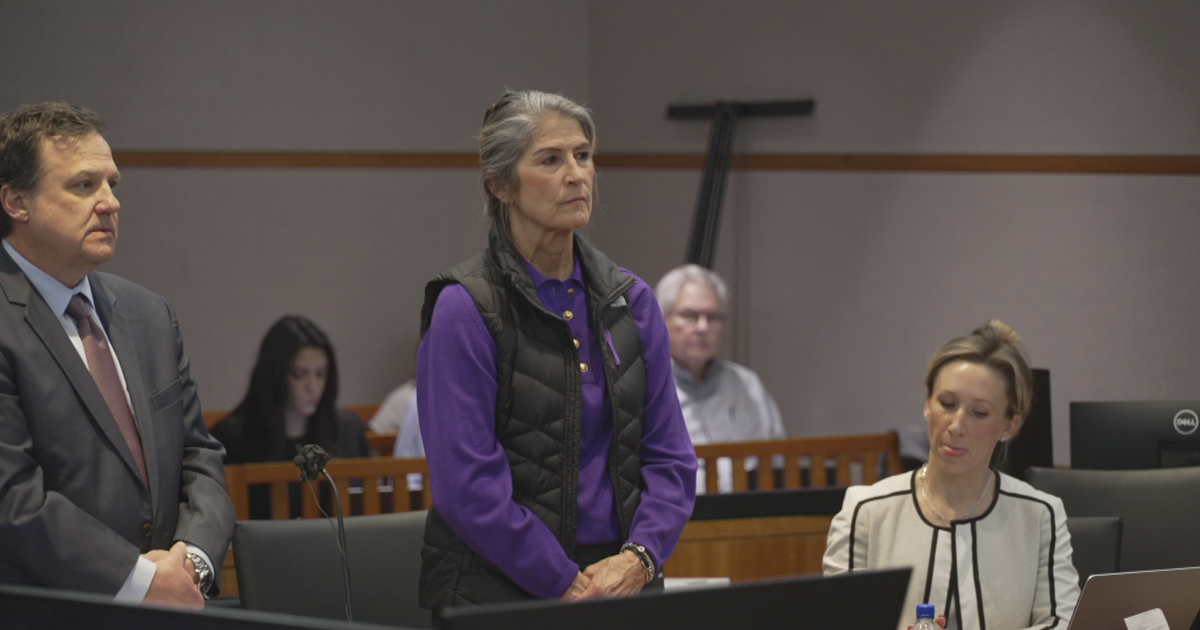

For victims like South Dade's Lauri King, waiting for help from the Internal Revenue Service is getting harder. She still doesn't know when the agency may get around to mailing out her refund.

"I think they are overwhelmed," King said of the IRS. "I think this is something they never planned for, never expected to happen."

King filed her tax refund seven months ago. She expected to get her refund a few months later, but continues to wait for the IRS to finally act.

"Just two weeks ago, I mentioned to my husband, did we ever get our IRS refund and he said, 'No,'" King said. "So we called and actually got to talk with a person and she informed us that we had an issue with identity theft."

Miami has the highest fraudulent tax return rate in the nation according to Ferre.

"Over 74,000 potentially fraudulent returns filed in Miami resulting in $280 million in bogus returns in 2010," Ferre said. "The city of Miami per capita numbers of fraudulent returns based on id theft was 46 times the national average...this is absolutely outrageous."

While the IRS investigates an estimated $5.2 billion dollars worth of phony tax refunds nationwide, tax payers like Lauri King are running out of patience while she waits for her tax refund.

"I feel like I'm nobody; I feel like whatever happens, happens," King said. "It's a very defeating feeling, you work all year long, you're one little bit of change you get can back to have a little freedom with. Nope, just a name, just a number that's all."

Several weeks ago CBS4 News asked the IRS how many identity theft victims were still waiting to get their tax refunds? The agency said it's not releasing that information publicly and wouldn't even let CBS Miami go inside its Plantation Customer Service Center with a camera to talk with taxpayers who are critical of the way the agency's treating them.

The agencies local customer service offices are so crowded, warning signs are often posted before noon that they don't have any more time to meet with taxpayers.

"I don't see anything to assist them with getting a refund or getting the credit processed and going foward in any kind of expedited basis," Miami tax lawyer Kevin Packman said.

Packman said federal prosecutors are making progress arresting the scammers, but he believes more needs to be done to help the victims and warns victims like Lauri, "Could still be dealing with this somewhere for 12-18 months."

CBS4's Al Sunshine asked if he's heard of people dealing with this for more than a year? Packman answered "Yes, definitely."

The IRS insists it's changing procedures, tightening up its electronic processing systems to avoid more scams next season. But what about getting tax fraud victims' legitimate refunds back this year?

In a prepared statement, the I-R-S said:

"Refund times can vary depending on the complexity of the case, and we understand the frustration that taxpayer may have that have been identity theft victims. Along with taking steps toward faster resolution of identity theft cases, we are continuously improving the way we track and report on the status of all identity theft cases. We believe these improvements will reduce the time to work identity theft cases in coming filing seasons so that honest taxpayers will receive their refunds sooner. Additionally, better tracking and reporting means that we can spot - and correct - any flaws in the system more quickly." - Michael Dobzinski, IRS Media Relations Specialist

Still, with bills mounting and the holiday shopping season right around the corner, victims like Lauri think seven months is way too long for the IRS to get her refund back to her.

"The working public needs help to resolve issues like this," King said. "It's hard enough going to work every day and now you're having your money stolen on top of it and then you have to prove your identity to make sure you're the correct person. I don't know how far it's gone, is it just the IRS check, is it other things? Where does it stop, how does the IRS stop it from happening again? Where does it end, does it happen next year, does it happen a year after that?"

A recent Inspector Generals' report warned these scams could cost Uncle Sam $21 billion dollars in fraudulent tax refunds over the next 5 years. The IRS continues to ask victims to be patient while they wait for their legitimate refund checks to be mailed out.

But it still declines comment on what it's doing to make sure next year taxpayer refunds end up with the people who earned them, and not the criminals who've been so successful stealing them.

For more Information:

http://www.irs.gov/uac/Identity-Protection

http://www.ftc.gov/bcp/edu/microsites/idtheft/

Identity Theft Affidavit - Internal Revenue Service

www.irs.gov/pub/irs-pdf/f14039.pdf

http://www.treasury.gov/tigta/auditreports/2012reports/201240050fr.pdf