CPA From One Of The Largest South Florida Accounting Firms Breaks Down Details Of $1.9 Trillion COVID Relief Bill

MIAMI (CBSMiami) – The long-awaited stimulus checks will soon be on the way now that Congress passed a massive COVID relief bill.

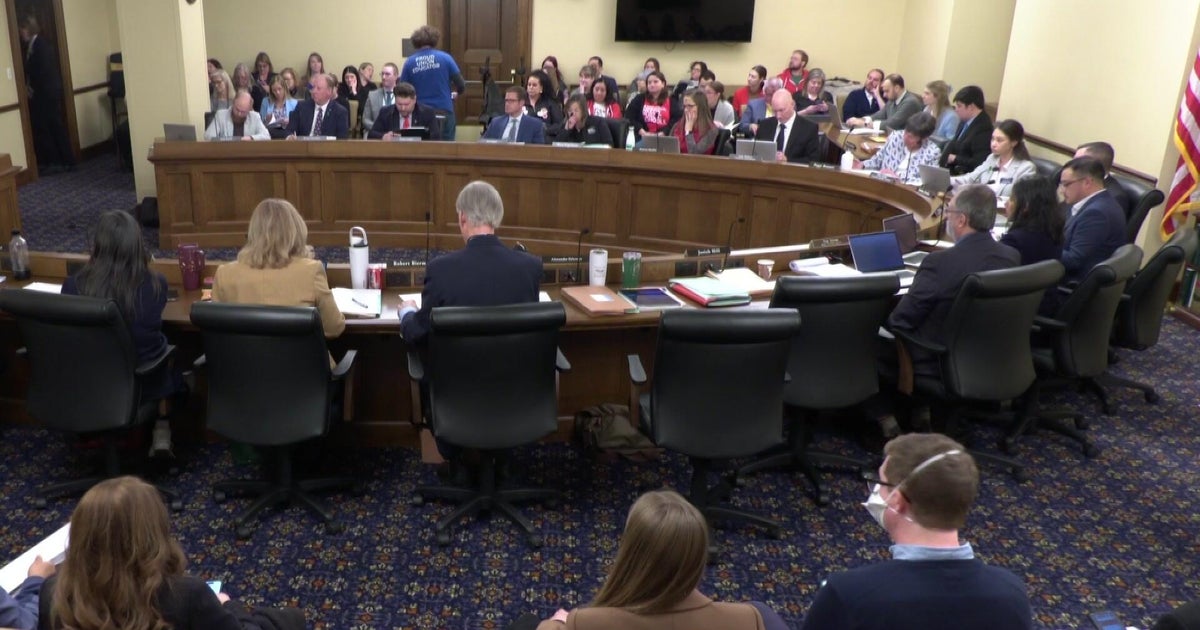

"On this vote, the yays are 220, the nays are 211, the motion is adopted," said Democratic house speaker Rep. Nancy Pelosi as she banged her gabble sealing the approval of the $1.9 trillion American Rescue Plan.

"We, of course, are moving full speed ahead on the implementation of the bill, because we know that the American people need help and need it as soon as possible," said White House Press Secretary Jen Psaki.

The relief package includes direct payments up to $1,400 per person for individuals making less than $75,000 a year and $2,800 for couples making less than $150,000.

But CPA Meredith Tucker with the Kaufman Rossin accounting firm said there are lots of other benefits in the COVID relief bill.

"The $1,400, that's just a recovery stimulus. On top of that, there are new credits for people who are incurring child care expenses while they work. There's also an increase in the child tax credit, and that is one of the biggest changes," she said.

Unlike previous years, the child tax credit will increase from $2,000 to at least $3,000. And Tucker said people won't have to wait to file their taxes to get that money.

"It's more money, but the really big thing their doing is there going to start to pay you out the credit early," she explained. "So rather than just claim it on your tax return, their plan is to mail people checks on a monthly basis."

And whether it's the $3,000 tax credit or the $1,400 direct payment, many in the community are celebrating

"It's all about helping out the rest of the community and there's so many families out there that have no work and $600 covers nothing," said Marvis Cevira. "So an extra $3,000 for families with kids will definitely help."

"Many families need it. Truly there's a lot of needs to be paid, a lot of evictions. When you think about it it's not really much," echoed resident Carl Young.

Still other residents like Yanely don't agree with the efforts, saying, "$3000, I can go to the market I spend it and then that's it. Then next month it's going be the same, the same problem for us."

The $300 federal unemployment benefit is also being extended, and a portion of those funds will no longer be taxed.

The relief plan also includes paying COBRA premiums for those who lost their jobs.

And the plan doesn't stop there.

"We know that there's almost $10 million that's going to homeowners who are struggling to make mortgage payments and utility bills. They've said that $100 million is going to be carved out for folks who need housing counseling to try and stay in their homes. They've allocated, I think, about $5 billion for folks who are dealing with homelessness. $5 billion for housing vouchers. I believe the help is going into the hands of people who need it the most," said Tucker.

In addition, billions will be spent to increase COVID testing and vaccine distribution. Schools will also get millions to help them reopen.