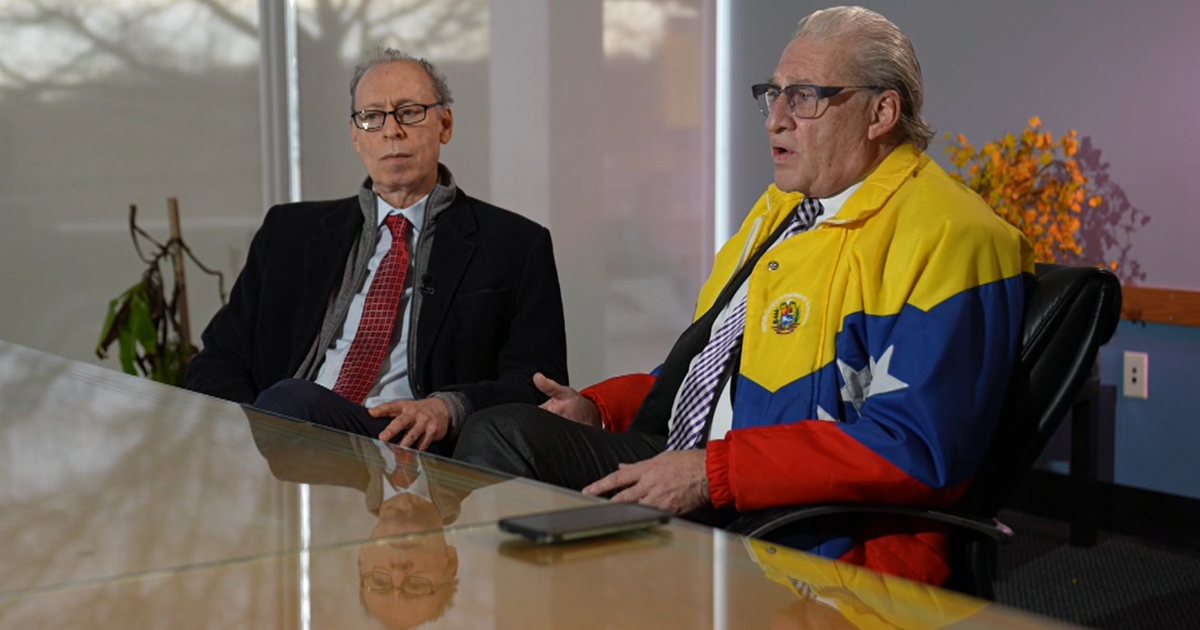

Miami Executive Claudio Osorio Pleads Guilty In $50M Fraud Scheme

MIAMI (CBSMiami) – The head of a Miami Beach-based Fortune 500 company pleaded guilty Friday to stealing millions from investors.

Claudio Osorio faces up to 30 years for wire fraud, money laundering and other conspiracy offenses after fleecing investors and the U.S. government to fund the building of low-cost housing in Haiti and other developing countries, CBS4 news partner The Miami Herald reports.

Osorio, a Venezuelan native who once held fund-raisers for Hillary Clinton, Barack Obama and other political heavyweights at his Star Island home, pleaded guilty Thursday to three conspiracy offenses involving wire fraud and money laundering.

The two fraud convictions carry up to 20 years and the laundering conviction up to 10 years. But Osorio, 54, is expected to be imprisoned for 12 or more years under federal sentencing guidelines at a hearing set for May 9.

He has agreed to cooperate with the U.S. attorney's office in the continuing case against his defunct company's former chief financial officer — and possibly others — and will be required to pay restitution of between $20 million and $50 million to victims. But very little of that money has been recovered so far.

FBI agents arrested Osorio in December after some of his investors accused the high-flying entrepreneur of using his Miami Beach-based company, Innovida Holdings, to fleece $50 million from them and the U.S. government. Among the investors: former Miami Heat star Alonzo Mourning. Osorio stole the money to prop up his Star Island lifestyle, and maintain resort homes in Switzerland and Telluride, Colo., according to authorities.

"I feel relieved, honestly, that a fraudster like Claudio Osorio has finally been brought to justice, and that he won't be able to ruin any more people's lives," said Miami businessman Chris Korge, who invested $4 million in Innovida, including $3 million borrowed from his close friend, Miami-Dade lobbyist and businessman Rodney Barreto. "He has ruined a lot of people's lives."

Korge, a major Democratic fundraiser who came to know Osorio and his wife during the Clinton and Obama presidential campaigns, was not the only investor dazzled by the charismatic entrepreneur.

Others saw potential profits in Osorio's company, including NBA star Carlos Boozer, a Tanzanian businessman, a group of United Arab Emirates investors, and a former Star Island neighbor.

Previously, Osorio had headed a computer distribution business in Miami that was listed on the Fortune 500 before it filed for bankruptcy in 2000. Despite the failure of CHS Electronics, several investors said they trusted Osorio with their money in his Innovida start-up because he sold them on the likelihood of its success.

Although Innovida had a manufacturing facility in North Miami-Dade, and prominent board members including former Gov. Jeb Bush and Miami condo king Jorge Perez, the company never gained traction.

Osorio was convicted of using Innovida, which claimed to produce high-tech building panels for low-cost housing, to deceive investors and line his pockets.

Osorio, represented by attorney Humberto Dominguez, pleaded guilty before U.S. District Judge William Dimitrouleas in Fort Lauderdale federal court. As part of his plea, the U.S. attorney's office agreed to drop 19 other charges.

In court, Osorio admitted he "solicited and recruited investors by making materially false representations and concealing and omitting material facts regarding ... the profitability of the company, the rates of return on investment funds, the use of investors' funds and the existence of a pending lucrative contract with a third-party entity," according to a statement issued by the U.S. attorney's office.

Dimitrouleas took over the case this week from U.S. District Judge Cecilia Altonaga, who was supposed to hear Osorio's change of plea in Miami on Friday. Altonaga recused herself from the case.

As Osorio awaits sentencing, he will be held without bond and remain at the Miami Federal Detention Center.

In 2011, a bankruptcy judge ordered Osorio to sell the one major asset that belonged to him and his wife, Amarilis. The couple auctioned their one-acre, two-story Star Island home with infinity pool for $12.7 million.

The sale of the heavily mortgaged property generated millions for banks and other lenders, and some money for his burned investors.

Osorio was allowed to keep at least $500,000 of the sales proceeds. Last July, he and his wife paid nearly $924,000 for a four-bedroom, five-bathroom condominium in Aventura, but now federal prosecutors have moved to seize the property as part of the criminal case.

According to an indictment, Osorio conspired to swindle $40 million from 10 investors and an additional $10 million from a federal government program between 2006 and 2011. The government grant was for building 500 homes in Haiti after its devastating earthquake in January 2010 — a project that Osorio touted to promote his company, but which never broke ground.

Osorio's co-defendant, Craig S. Toll, 64, of Pembroke Pines, has pleaded not guilty. He was the CFO for Innovida.

Toll's attorney, Richard Sharpstein, said his client should not have been named in the indictment with Osorio because he committed no wrongdoing. Sharpstein said Toll was unaware of Osorio's fraudulent financial and banking activities.

Osorio moved investors' money to off-shore bank accounts in the Cayman Islands, which the bankruptcy trustee of his failed company said he could not recover because the money was either spent on Osorio's extravagant lifestyle or moved to other secret accounts overseas.

Osorio's indictment referred to an "unindicted co-conspirator" who personally benefited from his business scam. Although not identified by name, the co-conspirator is his wife, according to sources familiar with the case. She is not expected to be charged.

Signs of her husband's downfall emerged in January 2011, when the Swiss government obtained the Justice Department's assistance to investigate possible criminal charges against Osorio in Switzerland.

Authorities there alleged Osorio and others fraudulently obtained $220 million in loans from Swiss banks in the late 1990s by lying about the soundness of his previous venture, CHS.

It was a former Fortune 500 distributor of computers worldwide that filed for bankruptcy in 2000, and settled a securities fraud case with a class of shareholders the following year.

The status of the Swiss investigation is unclear.

(TM and © Copyright 2013 CBS Local Media, a division of CBS Radio Inc. CBS RADIO and EYE Logo TM and Copyright 2013 CBS Broadcasting Inc. Used under license. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed. CBS4 news partner The Miami Herald contributed to this report.)