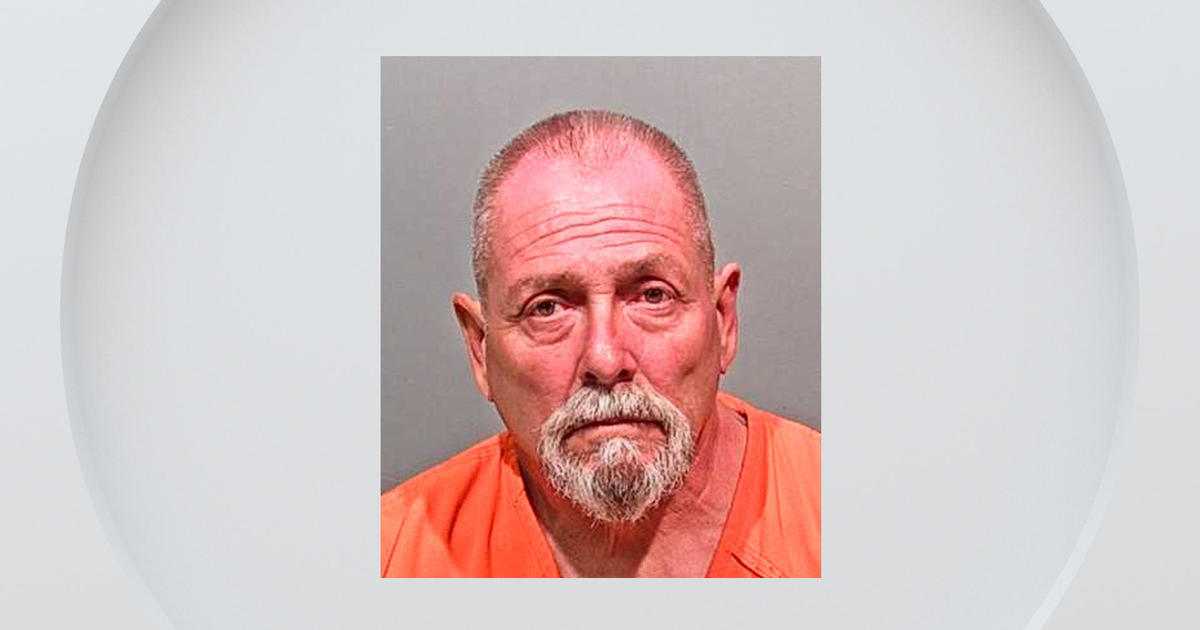

Feds Arrest Claudio Osorio, Allege Millions Stolen From Investors

MIAMI (CBSMiami/Herald) – Slick entrepeneur Claudio Osorio made millions by defrauding investors and stealing millions to support his esoteric lifestyle, according to the U.S. Securities and Exchange Commission (SEC).

On Friday, the jet-setting, Venezuelan-born entrepreneur was arrested by the Miami U.S. Attorney's Office on federal fraud charges, CBS4 news partner The Miami Herald reports.

The sweeping indictment, charging Osorio and his business partner, Craig Toll, with 23 counts of fraud and money laundering, probably has left many wondering whether the big-spending millionaire ever climbed anything other than the luxurious cherry staircase in his Star Island mansion.

In a parallel action, the SEC also charged Osorio with defrauding investors by grossly exaggerating the financial success of his company, and stealing nearly half of the money to pay the mortgage on his $12 million dollar home, his Maserati, a Colorado mountain retreat home and country club dues.

Osorio, 54, built his company, InnoVida, in 2005, selling it to investors as a cutting-edge producer of fiber-composite panels, which interlocked similar to Legos, and could produce affordable housing and post-disaster shelter in places like New Orleans, Haiti and developing countries overseas. His business model involved forming joint ventures in Latin America, Europe, Asia and Africa.

Authorities said Osorio managed to use his connections to lure very prominent people into investing in his company. Among his investors: current and former NBA players Alonzo Mourning, Carlos Boozer, Dwight Howard and Howard Eisley; one of his Star Island neighbors, a Tanzanian businessman and a group of United Arab Emirate investors.

Like other South Florida high rollers before him, Osorio and his wife, Amarilis, threw dazzling parties, contributed large sums to charities, hosted lavish political fundraisers and flashed fat financial portfolios to give the appearance that they were as rich and sophisticated as the celebrities, financial moguls and business people with whom they rubbed elbows.

To lend legitimacy to his effort, Osorio assembled a high-profile board of directors that included former Florida Gov. Jeb Bush, Miami condo king Jorge Perez and others.

Osorio, a former Ernst & Young Entrepreneur of the Year, raised at least $40 million from investors by portraying InnoVida Holdings LLC as having millions of dollars more in cash and equity than it actually did, according to the indictment.

He allegedly used Boozer's connection with a college roommate to get a meeting at the White House to obtain a $10 million government loan, according to a civil suit filed by Boozer, who invested $1 million.

In a 2011 interview, Osorio told The Miami Herald that he never induced anyone to invest in his company.

"No shareholder was invited into InnoVida on the prospect of making a quick buck,'' he said, adding that he was more than two years away from going public. At the time, however, his empire was already crumbling. A judge had stripped him of the authority to run the company, whose headquarters were on Lincoln Road in Miami Beach.

Chris Korge, a shrewd Miami developer and lawyer, said Osorio assured him that his company had about $40 million in cash and a lucrative deal with Middle Eastern investors to purchase $500 million in company stock. Korge invested $4 million before he began to suspect that something didn't add up.

"Jeb Bush was on the board, there were a lot of successful people convincing me. We went out and we met and I just began to realize that the cost-effectiveness of building with the materials would never work,'' Korge said. By that time, however, it was too late.

Creditors were already knocking on Osorio's door, including the Swiss government, which claimed he owed $220 million in loans from Swiss banks that he obtained by lying about the soundness of his previous business venture, Miami-based CHS Electronics. That company went bankrupt in 2000.

Korge's attorney, Kendall Coffey, said Osorio had a knack for exploiting South Floridians' quest for wealth and success.

"Miami is a city of newcomers and opportunity. And the combination creates a perfect landscape for fraud,'' said Coffey, a former Miami U.S. attorney.

"Osorio had the opportunity to arrive in town and make high connections that wrapped him with respect and effectively positioned him to entice some very bright people.''

Osorio and Toll, the CFO, are also charged with defrauding Korge and other investors out of $40 million, and scamming the federal government out of the $10 million they were given to help finance construction of a Haitian factory to build homes for hurricane victims.

Toll, 64, is a graduate of the University of Pennsylvania's Wharton School of Business. A certified public accountant, Toll formerly was an auditor for Deloitte & Touche, rising to audit partner and director of a 50 person audit department. He lives in Pembroke Pines.

The Miami Herald was unsuccessful in reaching Orlando DoCampo, Osorio's attorney, and Toll's lawyer, Richard Klugh.

Korge's civil lawsuit and those of others forced Osorio into bankruptcy last year and his $12 million Star Island mansion was auctioned off. As part of his Chapter 11 filing, the embattled entrepreneur promised to repay creditors and investors $50 million. The company, however, was shut down last year, and its formula for building the resin-structured housing was sold to a Brazilian firm.

Korge, who spent another $500,000 to sue Osorio, said he felt some vindication now that Osorio has been arrested.

"Even though at the end of the day I may not see a penny back, at least I have a clear conscience that I stopped someone from hurting other people's lives,'' he said.

(©2012 CBS Local Media, a division of CBS Radio Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed. CBS4 news partner The Miami Herald contributed to this report.)