Coral Gables woman out more than $3,000 after scammers trick her using Zelle

MIAMI – Transferring money on your smartphone is easier than ever, but so is losing the cash in just seconds. A Coral Gables woman says a fake call from Bank of America ended with her unknowingly sending more than $3,000 directly to scam artists.

Laura Hernandez says this all started when she received a text message from scammers. It was an alert asking her if she just spent $86 at Walmart. When she replied no, the scammers called her pretending to be Bank of America. They even went as far as spoofing the number from the bank.

"Immediately got a call from Bank of America's phone number – the same phone number on the back of my ATM card," says Hernandez.

It happened around 9 p.m. on June 9.

"They said, 'We need to take care of this because this is obviously fraudulent activity to your online banking. We need your login information.' They gave us IDs which weren't real but at the time we didn't know," says Hernandez.

Trusting the voice on the other end of the phone was a customer service rep, Laura gave them her login info.

"They said, we can see someone just tried to initiate a transfer to Zelle, $3,420, we're going to need you to reply to this text right away so we can reverse that Zelle transfer so I replied to the text," she says.

Feeling uneasy, but reassured someone was helping, Laura went to sleep. The next day she called Bank of America's Fraud Department.

"They said that the whole thing was a scam, the night before, that text you got, the phone number, everything – it was a scam."

"We live in a world where money is basically digital. The opportunities for criminals right now are as high as they've ever been," says Sebastian Schuetz, an assistant professor in the department of information systems and business analytics at FIU.

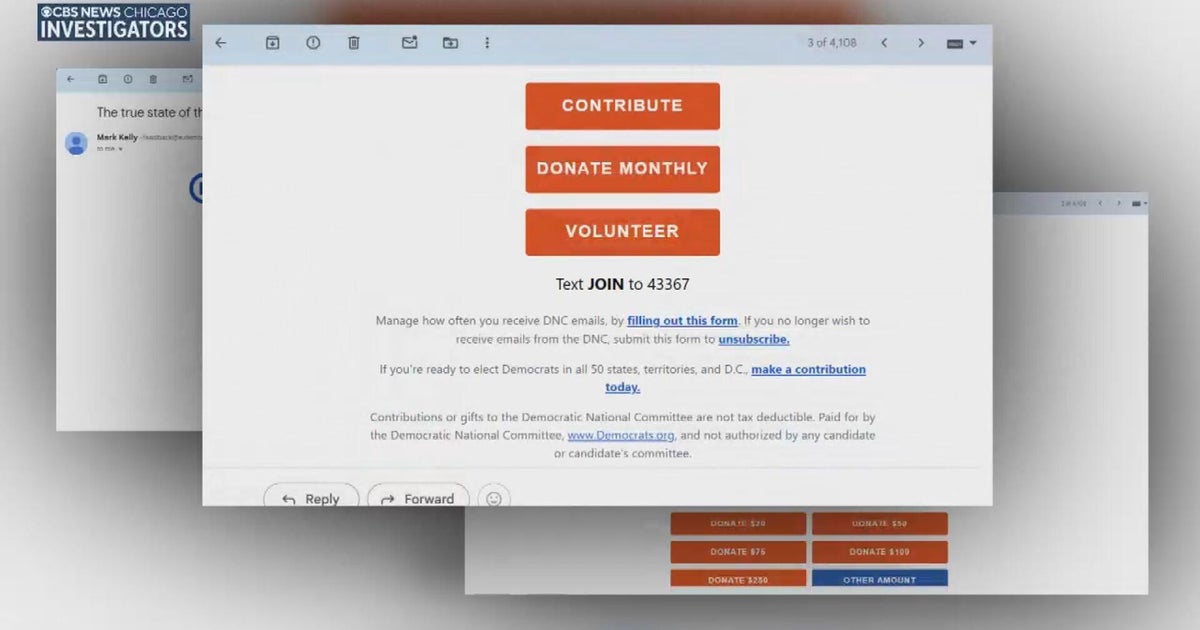

We did some digging to see what protections you have when using Zelle to transfer money. According to their website, if someone gains access to your account without your permission or knowledge, it's considered fraud and you're likely to get your money back.

But according to Zelle, a case like Laura's is classified as a scam and, if you authorize the payment, even if you're tricked in to doing so, your bank may not refund you.

"With Zelle they tell me no, no, that's like having cash on the table and someone picking it up we're not going to reimburse you for that," says Laura.

Schuetz says as the digital world progresses, cyber scams are a major problem.

"The damages to the US economy are probably in the billions every year. There are thousands of cases every day," he explains.

Bank of America says they will always send their customers notifications before they're able to go through with a Zelle transfer. They encourage their customers, only send money via Zelle to people you know.

Experts offer this advice for protecting yourself from this type of scam:

- Update your security settings

- Change your security settings to enable multifactor authentication — which is a second step to verify who you are, like a text with a code — for any accounts or services you use that support it

- Sign up for text or email alerts offered by your bank

- Most banks and credit unions warn of suspicious activity on your account. Sign up for account alerts and contact your bank immediately if you suspect unauthorized activity

- Steer clear of phishing calls and emails

- Beware of clicking links in emails and never provide any information over the phone if someone stating they're from your bank calls you

- Don't share personal details online

- Use long and well thought out passwords

- Beware of public Wi-Fi

- Don't log on to banking websites using public Wi-Fi