10 things you should know about reverse mortgages

You've probably seen the commercials: Actors tell older adults that they can use a reverse mortgage to access the equity in their homes and live a more financially carefree lifestyle. They say the reverse mortgage will eliminate seniors' monthly mortgage payments, freeing up that money for other expenses.

Sounds simple, right?

Reverse mortgages are loans available to homeowners age 62 and older that allow them to borrow money based on the value of their homes. Unlike other kinds of loans, borrowers don't have to pay back the debt immediately, instead deferring payment until they move out of the home or pass away -- in which case the payment will be taken from their estate or sale of the home.

While the government doesn't provide the loans, the Federal Housing Authority (FHA) oversees the Home Equity Conversion Mortgage (HECM) program. The FHA insures reverse mortgages so that lenders can recoup their entire investment, even if the home's sale value is less than the balance of the loan.

A 2015 study by the Consumer Financial Protection Bureau found that consumers who saw TV ads for reverse mortgages had a number of misconceptions about what the loans are and how they work, and news stories about people who got in over their heads and lost their homes are all too common.

However, reverse mortgages can be a helpful tool when used in a well thought out financial plan for seniors, said Sandy Jolley, a reverse mortgage suitability and abuse consultant from Oxnard Shores, California.

"It should be part -- but not all -- of your financial strategy," Jolley said. "I tell people to look at four things: Your financial strategy, your health requirements, your financial security through retirement and your estate wishes. If people look at the consequences of a reverse mortgage on those things and those consequences are acceptable, then a reverse mortgage might be right for them."

Could a reverse mortgage be a way for you to improve your financial situation in retirement? Click ahead to learn how these loans work.

How does a reverse mortgage work?

A reverse mortgage is a type of home equity loan for adults 62 and older, designed to help them be more financially stable in retirement, when many have a fixed income. The amount of money available to a borrower is determined by the home's value, how much the borrower still owes on the mortgage and other home loans and the borrower's age, said Peter Bell, president of the National Reverse Mortgage Lenders Association.

The older a borrower is, the more money he or she will be able to draw through the loan. The loan amount is calculated based on the age of the youngest spouse living in the home.

Borrowers can choose to receive their payment as a lump sum, a monthly payment or a line of credit.

The borrower won't have to make any payments as long as he or she -- or his or her spouse -- still lives in the home. However, if the borrower and spouse move out of the home or pass away, that payment becomes due.

If the borrower or heirs sell the home, the proceeds of the sale first go toward paying off the loan. If the home is worth less than is owed on the loan, all money from the sale goes to the loan, and it's considered paid.

While there have been numerous news reports over the last few years of one spouse being evicted after the other one -- who was the only one listed on the reverse mortgage -- passed away, Bell said new rules for reverse mortgages that took effect in 2014 better protect nonborrowing spouses and allow them to stay in the home.

Will I still own my home?

Some people think taking out a reverse mortgage means the bank owns your home, but that's not true, Bell said.

The bank has a lien on the home as it would with a traditional mortgage or any other home loan, and it has first claim on the proceeds from its sale. But borrowers still own the home, he said.

However, a few restrictions do apply to that ownership, Jolley said.

"This is an owner-occupied loan, so you must occupy the home as your primary residence," she said. You cannot lease the home to another resident.

Why do people take out reverse mortgages?

Many borrowers take out a reverse mortgage to pay down and eliminate their monthly payments on their existing mortgages, home equity loans and other debts, Bell said.

"In a lot of cases, just paying off loans is enough of a motivation," he said.

Others use the loan as a way to open a line of credit to help with unexpected expenses, he said.

By having the funds from a reverse mortgage line of credit available, seniors may not have to sell off stocks or other assets to cover unexpected costs.

"We find retirees have peaks and troughs in their cash needs," Bell said. "With a reverse mortgage, they're able to hold onto their other investments (when they need extra cash) and continue to collect dividends on those."

Reverse mortgage popularity

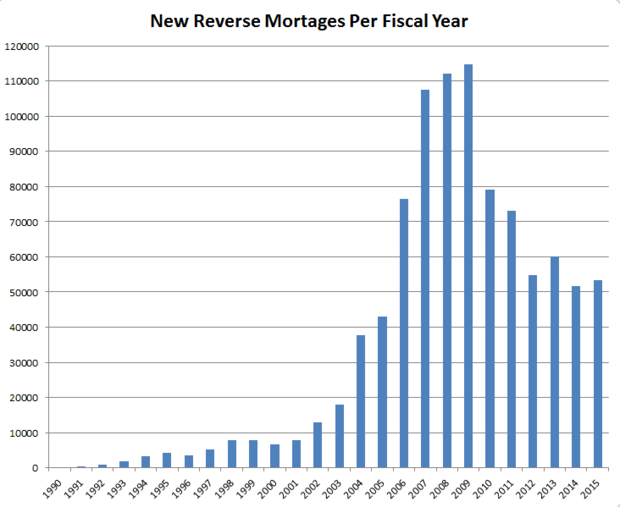

Only 157 reverse mortgages were made in the 1990 fiscal year -- the program's first year -- according to the NRMLA. The annual number of reverse mortgages spiked in the 2000s and reached a peak of 114,692 new loans in the 2009 fiscal year.

That number dropped sharply in the Great Recession, down to 79,106 the next year. In the 2015 fiscal year (Oct. 1, 2014, through Sept. 30, 2015), there were 53,372 new loans, up slightly from 51,642 in 2014.

Since the program began, consumers have taken out a total of 911,314 reverse mortgages, according to the NRMLA. Bell said he expects that number will hit 1 million in the first half of 2016.

Take interest and fees into account

With a traditional forward mortgage, interest is included in your monthly payments and is paid a little at a time. Because borrowers don't make payments on a reverse mortgage during the life of the loan, that interest (which is usually charged at rates similar to other mortgages) builds up, Jolley said.

This means the amount of debt increases over the life of the loan and can "eat up" the remaining equity in the home.

It's also important to remember that while they no longer have to pay mortgage payments, homeowners are still responsible for paying homeowners insurance, taxes, homeowners association fees and other costs of homeownership, Bell said. Failure to pay these expenses can result in default and immediate repayment on a reverse mortgage.

Do your research

A number of resources are available online to help potential borrowers better understand how reverse mortgages work and the impact this step can have on their finances.

Bell recommends checking out the NRMLA website, where his organization has laid out a roadmap to reverse mortgages, frequently asked questions and a glossary of terms.

AARP and the National Council on Aging also have online resources to help borrowers understand reverse mortgages, he said.

Government agencies like the Federal Housing Authority and the Consumer Financial Protection Bureau also offer online guides and information on reverse mortgages.

Talk to a professional

To get a reverse mortgage, all potential borrowers must have a counseling session with a certified reverse mortgage counselor before completing an application, Bell said.

"Lenders are required to provide a list with a number of (reverse mortgage counseling) agencies, and it's up to the client to schedule a session with one," Bell said. "If a lender tells you not to go or tries to steer you to a specific agency, that should be a red flag."

A full roster of certified HECM counselors is available on the HUD website.

Jolley also recommends that potential borrowers discuss a reverse mortgage with their lawyers or financial planners, who should be more familiar with their individual financial situations.

Bring your family into the conversation

"Even though some lenders will say it's between a couple and their (reverse mortgage) salesperson, this is a family decision because it will affect the entire family no matter what," Jolley said.

It's better for potential borrowers to discuss the decision and how it will affect their estates and their heirs' inheritance early, rather than "ambush" them with the information later, she said.

Watch out for -- and report -- scams

Lenders and reverse mortgage counselors try to keep an eye out for clients who are being told to get a reverse mortgage as part of a scam, but they may not catch all the fraudsters.

Bell said in the past he's seen clients fall victim to a number of scammers who used a reverse mortgage program to get money into victims' hands for them to steal. Crooked contractors have also persuaded homeowners to take out reverse mortgages to pay for large projects, according to Bell, for which the contractors overcharged.

Another scam involved people offering seniors in low-income communities a "free" house, moving them into a recently renovated fixer-upper, having them take out a reverse mortgage on the home and then taking all the funds from the loan, Bell said.

Jolley said she's seen numerous scams where potential borrowers whose homes were in foreclosure were approached by unscrupulous lawyers promising to fix the situation for a fee. After the fee was paid, the lawyers disappeared, Jolley said.

If you suspect you're being scammed or that someone involved in your transaction may not be following the law, let your reverse mortgage counselor, lender or loan servicer know -- and then file a complaint with the Federal Trade Commission, your state Attorney General's office or your state banking regulatory agency.

Explore your other options

Reverse mortgages aren't right for everyone, so you should look at all the other options before taking this step, Jolley said.

First, you could look at refinancing your mortgage while interest rates are low to trim your payments.

If you're having trouble making your mortgage payments, research the government programs available in your area.

"There are also a lot of different government programs out there to reduce your loan balance and make it more affordable to stay in your home," Jolley said. These programs go by different names in different states, like Keep Your Home California and the Florida Hardest-Hit Fund. Some local governments also offer mortgage assistance programs.

Jolley said she has also seen people do "family reverse mortgages," where family members lend the borrower the money they need and draw up a legal contract for repayment through the borrower's estate.

And there's always a regular home equity loan if you need immediate cash and can handle another monthly payment, Bell said.

"If you have enough income and cash flow, that might be better a better option," he said.