Major car insurance companies getting out of California

Major auto insurers are pulling back in the California marketplace because they are saying our drivers are just too expensive to insure.

Californians are driving about as much as they were before the pandemic, but apparently not as well.

Auto accidents are up and some insurance companies say they are paying out more than they are taking in. But, the insurance commissioner says the facts don't support their claims.

From 2020 to 2021, auto insurance losses spiked 25% while premiums increased by only 4.5%, according to the American Property Casualty Insurance Association. The rate and severity of auto accidents are up as well as the costs to cover them.

"The cost to rent a car is up 33% and the cost for a new vehicle is up 11%," said Denni Ritter, American Property Casualty Insurance Association.

In California, some insurers haven't seen a rate increase approved by the insurance commissioner in over 3 years.

"What we've seen is that you have insurers who are paying out more in claims than they're taking in with premiums. That's not a sustainable business model," said Ritter.

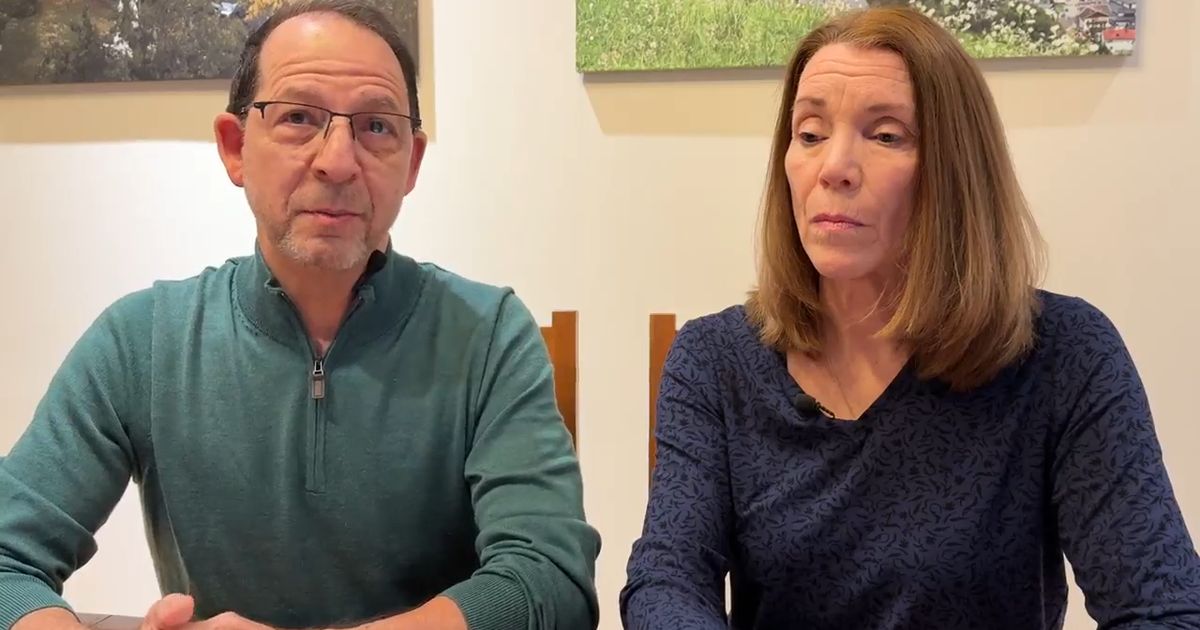

California is a very consumer friendly state and insurers must have any rate hike approved. State Farm, AllState and Farmer's are asking the California Department of Insurance for a nearly 7% premium increase. Progressive is asking for more than 19%. A local agent says insurers are now making it harder for him to get drivers new auto policies.

"They might ask you to pay in full instead of having a payment plan. Right now, all of the carriers that I can even think of have restrictions. They literally say, don't write please," said Karl Susman from Susman Insurance.

Geico has closed all of its California offices and Progressive stopped advertising in the state.

"State farm, you can no longer get quotes by calling them. You have to go to an agent's office," said Susman

A spokesperson for the Insurance Commisioner says "while insurance companies are focused on increasing rates, the department of insurance is focused on protecting drivers and helping them get the most value from the premiums they pay."

His office points out that the commissioner saved Californians $2.4 billion in reduced premiums during the height of the covid stay at home order- when the industry still raked in a collective of $42 billion in excess premiums.

Insurers cannot refuse to cover Californians as we are what's called a "take all market," but agents say they are having to go with smaller, lesser known carriers if clients need insurance quickly.