Stellantis' second-half profits hit by UAW strike

Automaker Stellantis on Thursday reported a 13% decrease in net profits in the second half of 2023 due to the impact of strikes in North America, its profit center, as it heads into a year it expects to be "turbulent."

The world's third-largest carmaker, formed three years ago through the Peugeot PSA-FCA FiatChrysler merger, reported a net profit of 7.7 billion euros ($8.3 billion) in the second half, down from 8.8 billion in the same period. Full-year profit rose 11% to 18.6 billion euros.

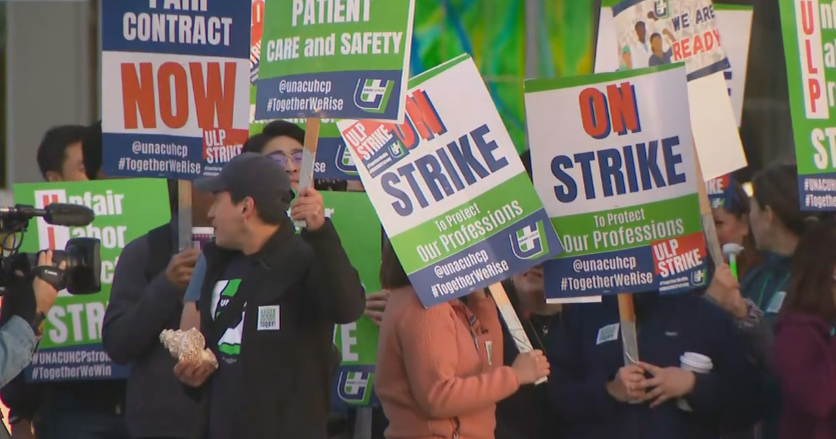

Strikes in North America idled plants at all three Detroit automakers for six weeks last fall, leading to a deal that increased pay across the industry and forced automakers to absorb higher vehicle costs as it shifts away from gasoline-fueled vehicles.

Stellantis' North American revenues, accounting for nearly half of the carmaker's total, dropped 5.6% in the second half of the year to 40.5 billion euros from 43 billion euros on lower shipments that eroded its market share.

Stellantis CFO Natalie Knight noted ongoing geopolitical uncertainty shaping up "what we think is going to be a pretty turbulent year." While Stellantis won't be shouldering strike costs, it will face higher labor costs in North America due to the union deal, she noted. Collective bargaining last year cost the company 428 million euros.

Knight expected tailwinds from lower raw materials and logistics costs. Impact from the attacks on global shipping by Houthi rebels in the Red Sea has been minimal, she said, as Stellantis has shifted shipments of high-voltage batteries and gear boxes to airfreight.

Stellantis' European revenues were flat in the second half of the year at 31.7 billion euros. South America was flat at 8.4 billion euros, while the Middle East surged 71% to 5.9 billion euros, and China, India, and the Pacific second-half revenues slid by a third to 1.5 billion.

Stellantis paid shareholders 6.6 billion euros last year through dividends and buybacks, up 53% from 2022. The carmaker said it plans to increase dividend payments by 16% this year, to 1.55 euros per share, and buy back another 3 billion euros in shares.