Littleton Man Indicted For Mail Fraud, Money Laundering

DENVER (CBS4)- A Littleton man has been indicted by a federal grand jury in Denver on wire fraud, mail fraud and money laundering.

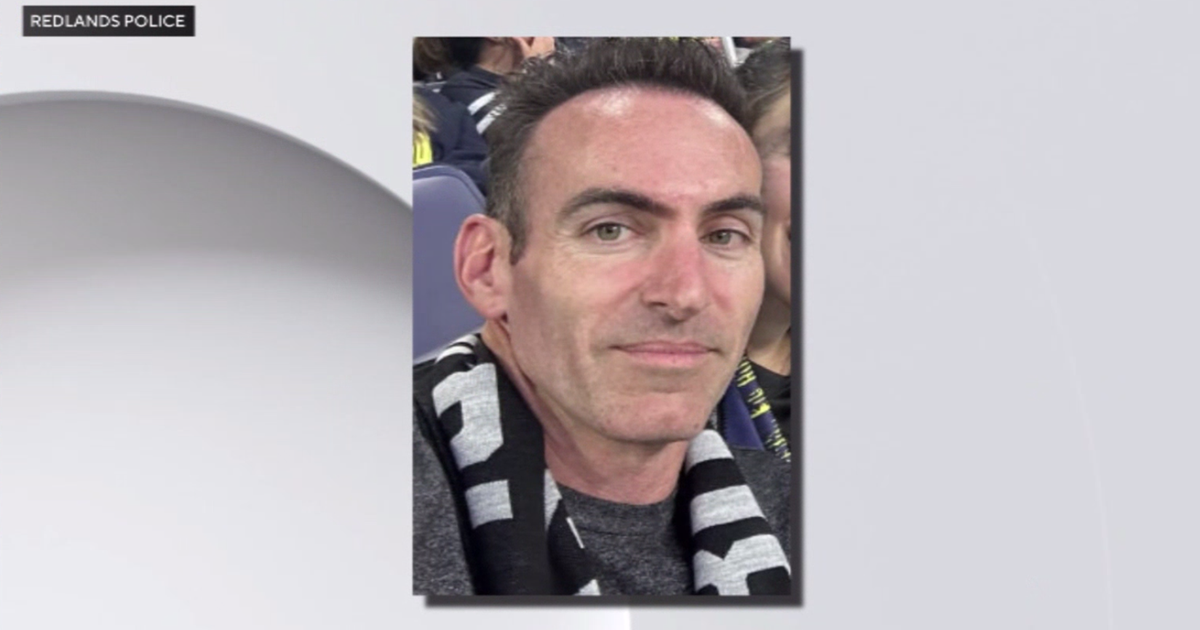

Peter Vincent Capra was indicted on Wednesday.

Capra, 55, is scheduled to appear in U.S. District Court on May 29. He was previously charged in a previous indictment with obstruction of justice.

According to the indictment, Capra was president of Golden Design Group, Inc. which built and sold houses in the Denver metro area.

Capra was also the registered agent for Distinctive Mortgages LLC which used GDG office space and provided mortgages for some of the purchases of GDG houses.

As part of the fraud, Capra caused the creation of Cambridge Real Estate Consulting, LLC, and Chateau Real Estate Investments, LLC. Although publicly filed paperwork suggested that these were independent entities, Capra or his associate, a person with the initials R.P., directed all activities of Cambridge and Chateau and controlled their bank accounts.

Between January 1, 2005 and July 31, 2008, Capra executed and attempted to execute a scheme to defraud mortgage lenders through the use of applications for residential mortgage loans and related documents associated with real estate purchases in the Denver Metro area. As part of the scheme, Capra would structure transactions involving homes built and sold by GDG to allow buyers to receive substantial amounts of the lenders' money at the time of closing without the lenders' knowledge.

Capra was able to facilitate his scheme by causing first and second mortgage applications related to the real estate purchases be submitted with false and fraudulent representations about the purchasers income, liabilities, and intent to occupy the properties as their primary residences. Many of the purchasers bought multiple properties at or near the same time in an attempt to prevent lenders from discovering the extent of the buyer's real estate liabilities.

At the closing or soon thereafter, Capra would cause funds to be distributed to the buyers in ways that prevented the lenders from knowing the funds were actually going to the buyers. The methods included the disbursement of funds to LLCs, causing buyers to sign false warranty waivers, making payments to the buyers through Cambridge, Chateau, or other sham entities, and having GDG issue checks directly to the buyers which were not reflected on the HUD-1 closing statements. The disbursements to buyers were usually in amounts between $85,000 and $130,000.