Colorado considers creating state insurance pool amid growing risks

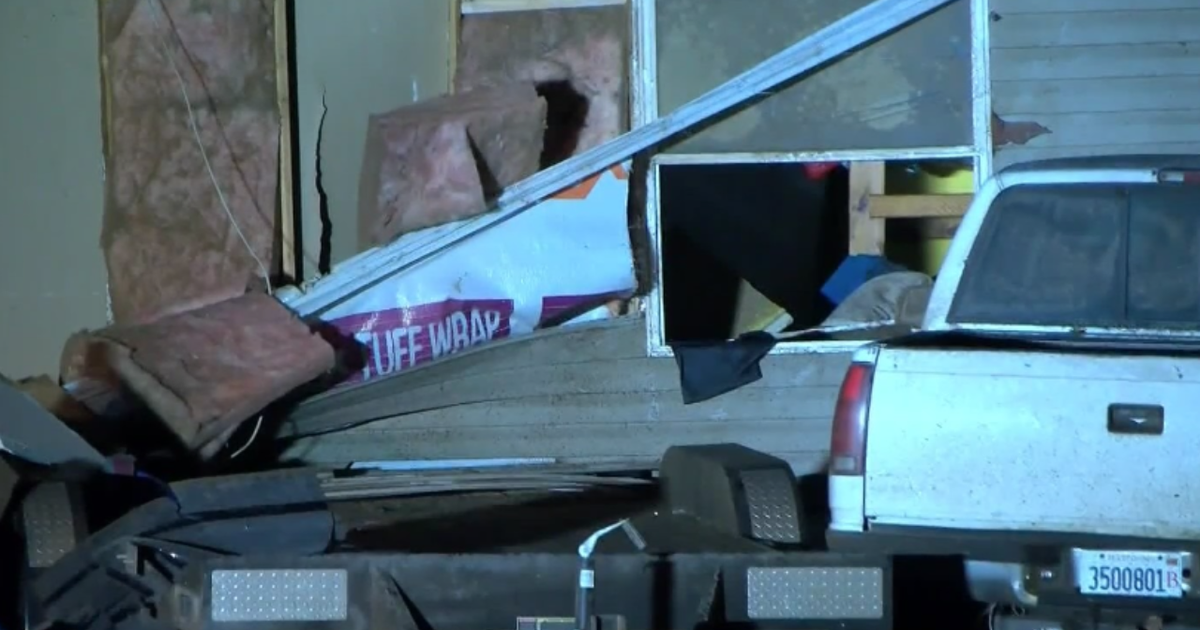

With the wide grasslands and Flatiron mountains behind, the view from The Ridge at Superior Townhomes is a big attraction. In one corner of the development where there are over 70 townhomes are the foundations that show where two homes were lost.

Nearby, a chainlink fence wraps damaged property, still being worked on more than 14 months after the Marshall Fire.

"It is a lovely spot and we love living here but we need to do it responsibly and safely," said Karen Kenny.

Kenny is a member of the board of the HOA for the development. They are caught in a hard place.

"Our insurance was non-renewed and as of April 1, 12:01 a.m. we will no longer have insurance," said Kenny about a recent move by the HOA's insurance provider.

The HOA has to insure common areas as well as parts of the buildings in which the homes are located. But their insurer wants to step away.

"We have been wronged, we are appealing," said Kenny.

There's a question about what the insurance provider can do. The law seems to indicate, says Kenny that an insurer cannot refuse to renew property within an area declared a federally designated disaster area for any reason related to wildfire. They have filed a complaint. Meantime, the homeowner's association has tried to obtain insurance, contacting over 40 providers.

"Nobody has quoted us yet. Some of the insurance companies we have reached out to will not quote because we have an active claim," said Kenny.

Colorado is faced with the reality of insurance companies pulling back.

"Really what we have right now is pressure on this marketplace," explained Carole Walker, executive director of the Rocky Mountain Insurance Association, an industry group. "We're seeing escalating catastrophe risk. We're really in a perfect storm in Colorado where we're number two in the nation for hail insurance claims. Number three for wildfire risk."

It could mean uninsured losses in areas where insurance is not available.

"We can see that in the near future, people aren't going to find anything. And especially if we're going to continue to have these big fire events," said Colorado representative Judy Amabile, a Democrat of Boulder County.

Amabile is planning to bring out a bill next week to establish what is known as a FAIR Act proposal. FAIR is an acronym for Fair Access to Insurance Requirements. There are 33 other states with similar insurance of last resort options. Some originated in the 1960s following riots in cities which were then left with areas of no insurance coverage. Others are states with high losses from hurricanes and fires like Florida and California.

Discussions about creating a FAIR Act in Colorado have been going on since last summer. Walker says it is important the state not compete with the private marketplace.

"In places like Florida where we've seen them make huge mistakes and make that insurer of last resort, the biggest insurer in the state, it's driven the private market out and that's put the state in jeopardy financially."

Amabile says they are hoping to learn from states that have insurance programs that operate better, "You'll be required to prove that you couldn't get insurance elsewhere because we don't want to compete with the commercial market. We don't want to erode the commercial market. We want it to bolster the commercial market."

The bill would still have to gain passage in the Colorado House and Senate and get the approval of Gov. Jared Polis. If passed, it could mean insurance offerings next year.