University of Chicago professor weighs in on the effects of student loan forgiveness

CHICAGO (CBS) – It's a plan that has borrowers jumping for joy, and critics calling for more fiscal responsibility.

So what will the impact of the student debt forgiveness plan be on the economy, and how will it be paid for? CBS 2's Tim McNicholas tried to find out.

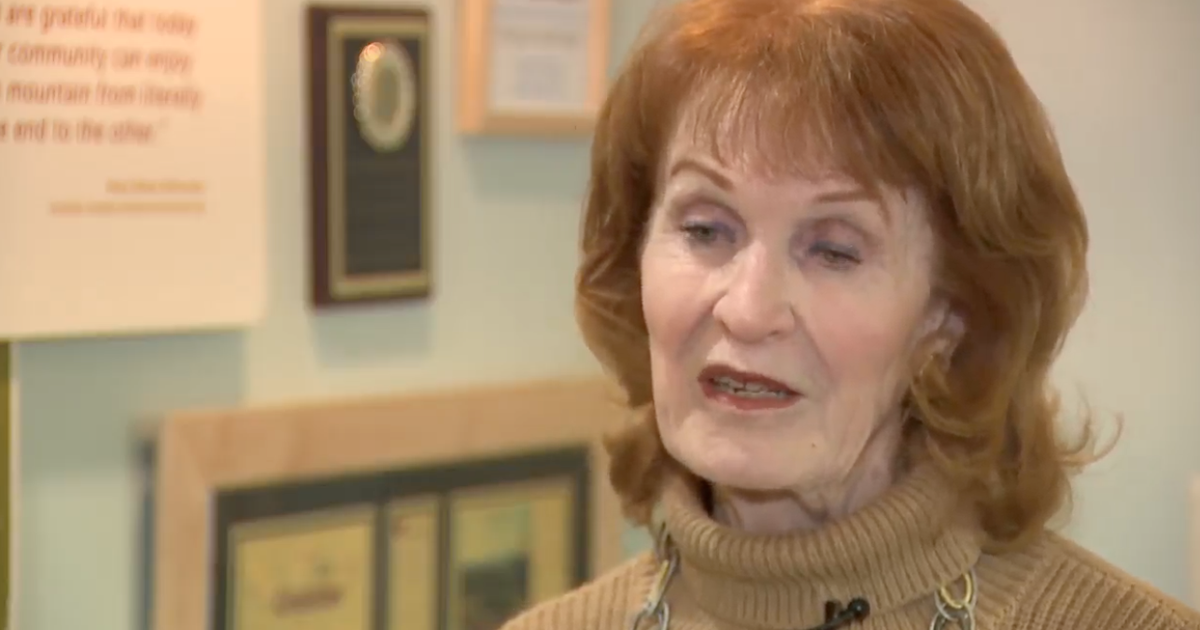

Each login to her student loan account serves as painful reminder for Kaitie Gaimari. She's over $47,000 in debt, despite the payments she started making after graduate school six years ago.

"I've done the math," she said. "If I have kids, I will be paying for their school as well as paying off my own debt."

Since yesterday's announcement by President Joe Biden, Gaimari has plenty of questions.

When might she see the $10,000 in forgiveness she qualifies for?

What will her new monthly payments be come January?

And, a broader question about the plan to forgive more than $300 billion nationwide: "Where is this money coming from?" she said.

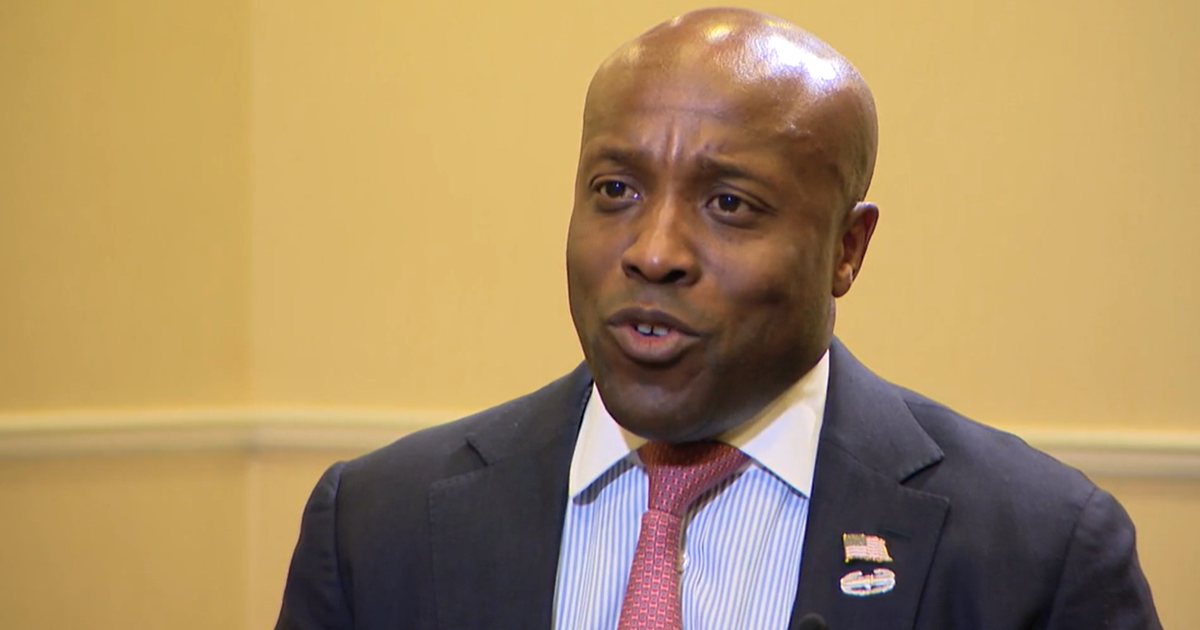

"At the end of the day, taxpayers," said Constantine Yannelis, a finance professor at the University of Chicago. He added, "It's going to be paid for in the future through one of two things, either tax increases or less government spending on things we care about like early childhood education or health care."

Could that spending pull the country closer to a recession?

"It could potentially, but it would be very far into the future," Yannelis said. "I think the aggregate effects of [$400 billion] are going to be washed away by other larger and longer-term policies."

In the short term, he said the larger effect will be in January, when payments resume and millions of borrowers have less money to spend.

Yannelis said that could dampen the economy.

"But we're not talking about something that's going cause another great recession," he said.

At least that's for now.

"Nothing is going be solved until we get to the root of why our educational system is so costly," Gaimari said.

Meanwhile, Gaimari will keep chipping away at her debt.

Some have said less debt will cause more consumer spending, and thus more inflation.

Yannelis said he disagrees with that, because borrowers already have had their payments paused for three years.