Northlake Mayor Got Tax Breaks He Didn't Deserve

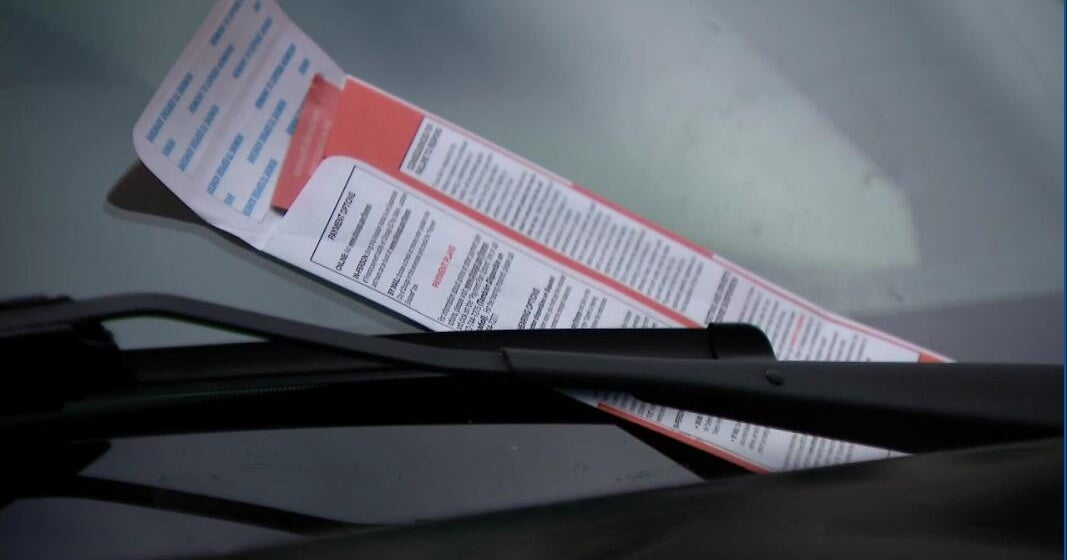

NORTHLAKE, Ill. (CBS) -- There are millions of dollars in homeowners exemptions given to Illinois property owners -- tax breaks that some don't deserve. That means everyone else is paying more than their fair share of taxes.

You are only eligible for one homeowner's exemption -- at your primary residence. But 2 Investigator Pam Zekman found county assessors lack the tools they need to enforce that rule.

Take the case of Northlake Mayor Jeffrey Sherwin. He is a lawyer who used his share of a $42 million dollar lottery jackpot years ago to purchase investment properties in Cook and DuPage counties. Sherwin also makes $68,000 a year as Northlake's mayor and liquor control commissioner.

"It's our dollars that's paying his paycheck," said one outraged viewer who asked not to be identified. She contacted CBS 2 Investigative Reporter Pam Zekman after learning from the Cook County Assessor's website that Sherwin gets a homeowners exemption where he lives in Northlake. But he also has another homeowners exemption at a second Northlake home he owns, but rents out.

"It's not fair to the taxpayer," she said. "The point is he's the mayor. He should be setting an example for homeowners."

Actually the mayor has also had exemptions on three Elmhurst homes he rents out, yielding tax breaks that have totaled $9,114 over several years.

So we went to the Northlake village hall to ask the mayor about it.

"Are you trying to cheat on your property taxes?" Zekman asked.

"No absolutely not," the mayor responded. "I'm very careful about this because I own a lot of rental property and I know that you're only entitled to one homeowners exemption."

He did not believe the records we showed him and said, "I'm going to get my tax bills and we'll take a look."

Days later, in preparation for a follow up interview, Sherwin showed me what he found on his tax bills. They stated he was getting a homeowners exemptions on the four properties. What did he think when he discovered it?

"I said, 'Oh man, I'm going to be skewered here,'" Sherwin said. "I guess I'm just guilty of carelessness or stupidity, not looking at the bill closer."

He contacted Cook and DuPage County officials to have the exemptions removed.

The mayor apparently inherited the exemptions that belonged to the previous homeowners and they were not removed by the Cook or DuPage county assessors after the properties were sold. Officials say they should have been.

"Going in and auditing these property tax exemptions is something that not only should be done now, it should have been done long ago," said William Kresse, an Associate Professor and Director of the Center for the Study of Fraud and Corruption at the Graham School of Management, Saint Xavier University.

Kresse says that, based on what other states have accomplished, "I would expect to find thousands and thousands of problems such as this and be able to collect millions of dollars in taxpayer revenue."

So is Mayor Sherwin going to pay back the $7,000 he got in tax breaks to DuPage County?

"Well, we'll see," Sherwin said. "Cook County, that there's a different situation, because I'm the head of one of the taxing bodies. I mean I'm absolutely going to pay this one back."

The reality is that county assessors have no legal authority to require repayment in cases like this. Cook County Assessor Joseph Berrios says he's working on legislation to change that. And he's now requiring new owners to apply for a homeowners exemption if in fact they are entitled to it.