Aurora's Comedy Shrine theater shuts down, blames small business loan dispute

CHICAGO (CBS) – Live events are back in full force after a pandemic hiatus. Venues are no longer bleeding red.

One suburban theater owner had the money to make it, but says a dispute with the bank ruined his chance of COVID recovery. Morning Insider Lauren Victory explained why paying a loan on time doesn't mean everything is OK.

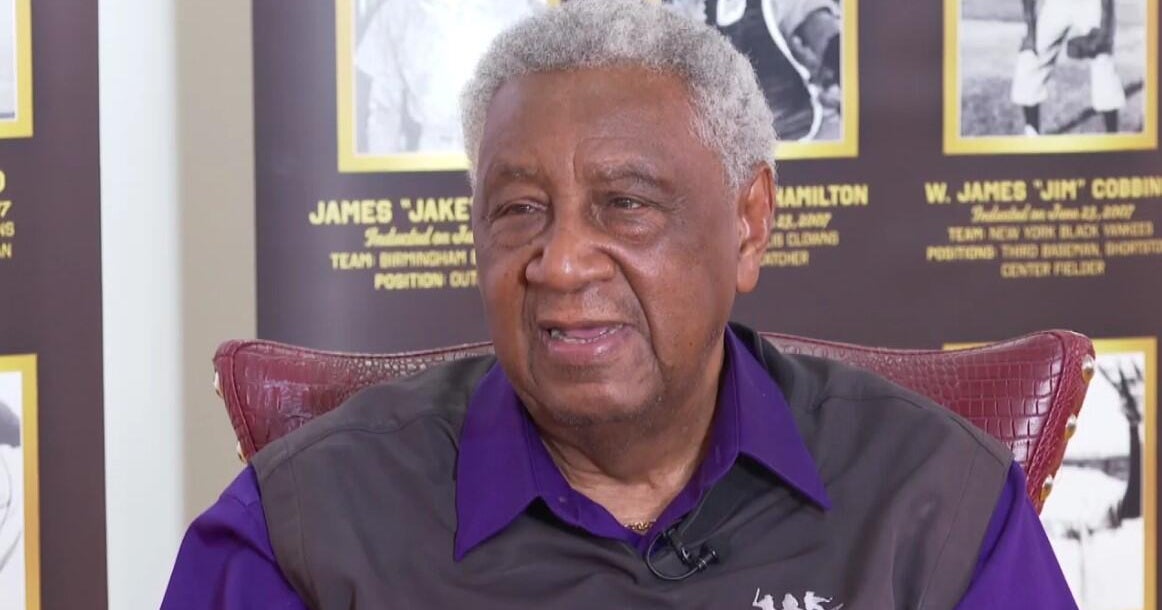

From a ringing phone to a chiming clock, David Sinker made light of interruptions to his interview with CBS 2 about his darkest times. The owner of the Comedy Shrine Theater in Aurora is on the verge of bankruptcy.

"I'll be at an offramp on I-88 with a sign that says 'Will write jokes for money,'" Sinker said.

Business was booming before the pandemic, enough for Sinker to move to a 14,000-square-foot venue with two theaters and a comedy museum in 2019.

"I got an SBA loan because I wanted the help," he said. "I wanted somebody to help a small business."

SBA as in the Small Business Administration, a federal agency meant to aid entrepreneurs. The more than $200,000 SBA loan came through Allied First Bank in Oswego.

His son Patrick helped dad navigate the expansion alongside COVID restrictions. The family business was hanging on.

"We had some good projections," said Patrick, the general manager of the Comedy Shrine.

Then, a bank letter arrived telling the Sinkers they defaulted on their SBA loan.

"Confused is the most common emotion right now," Patrick said.

They were confused because most people think "default" means the bills are piling up.

Victory: "Did you ever miss loan payments?"

David: "We never missed any loan payment."

A few weeks before the loan letter arrived, Sinker tried to save money by temporarily closing the business. Allied Frist seems to reference that "an adverse change" in "business operation" may "materially affect your ability to pay the loan."

"It was devastating for us," David said. "It was being pronounced dead when you still had a pulse."

The Comedy Shrine was permanently shutdown and gutted of its inventory.

A catalog has all the items they've auctioned off to try to repay the $198,000 left on the loan. They might not make it.

"I've got really good plasma I can sell," Daivd said, using comedy to battle the drama.

Neither Allied First Bank nor the SBA would answer our questions about Sinker's loan in particular.

CBS 2 was told that SBA loans generally can be considered to be "in default" if a payment is missed, if a company declares bankruptcy or if a business closes.

CBS 2 also specifically asked Allied First Bank what happened with Sinker's loan and if certain restrictions on his loan were not followed leading him to be "in default."

In a statement, the bank said, "From time to time, borrowers may experience difficulties running their business. If such a situation should arise, it is our Bank's policy to work closely with the borrower to assist where possible to help them succeed, which of course, is in everyone's best interest. In the unfortunate situation where a business fails under the SBA Loan Program and is unable to meet its obligations, the bank works closely with the SBA and legal counsel to remedy the terms of the contract."