Zero-Percent Interest Deals Can Trap Consumers

BOSTON (CBS) - It sounds like a win-win. Buy a new TV, a couch or a mattress and pay no interest for an entire year. We see and hear advertisements for 0% deals all the time, but they are not always as simple as they sound.

Justin Miller found that out the hard way when he bought his new mattress set. "The bed is great. We love the bed," he said. But it was expensive. To make the $5,600 price tag a bit easier to swallow, he took the store up on an offer to finance it, interest free for a year through Citibank. "It sounded good," he said. Or so he thought. After making his final payment, he was shocked when Citibank sent him a bill for $1332, a years worth of interest at a whopping 25%. "I thought this is crazy," Miller said. "Either this is some kind of joke or some kind of scam," he said.

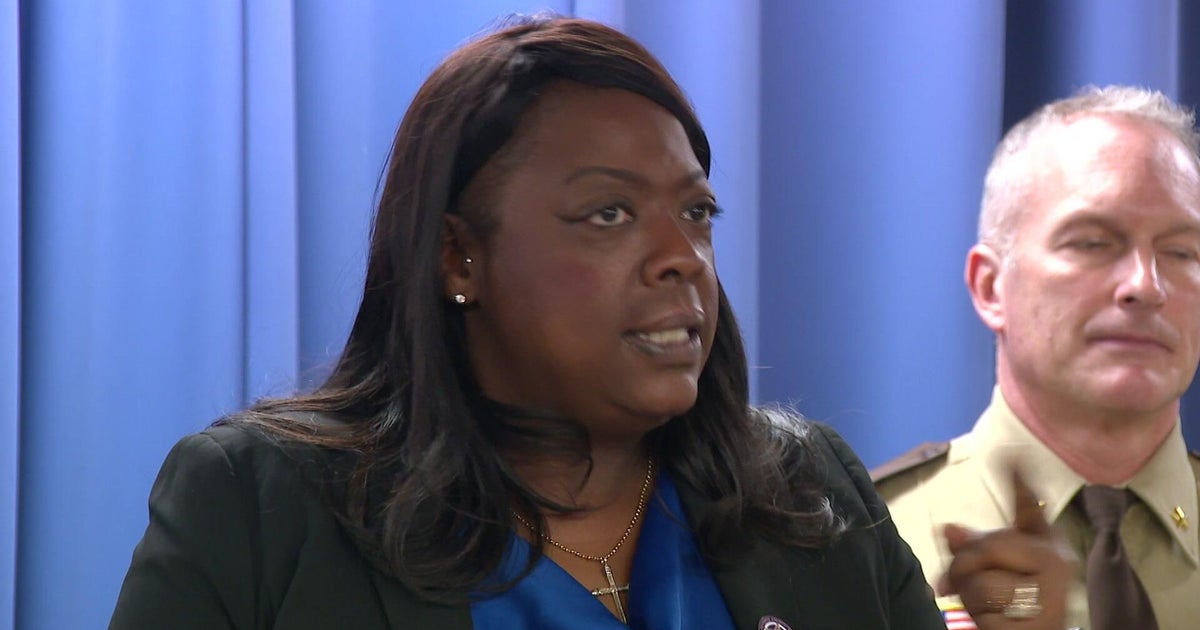

WBZ-TV's Paula Ebben reports.

They are called deferred interest offers and according to Chi Chi Wu of the National Consumer Law Center, they are not always a good deal for consumers. "0% isn't really 0%," she said. "It's 0% with a big catch."

Here's the catch. Miller's one year interest free deal expired on December 2nd; it says so in tiny print on his monthly statement. But his final payment due date was not until December 7th, five days after the interest-free period expired.

Miller is convinced it is an intention trap to force consumers to pay more money. Wu agrees that it's a questionable practice. "We think the entire structure of these deferred plans is deceptive," she said. "I think they are actually the single biggest trap left after the credit card act," she said.

According to Wu, federal regulators actually banned these deals but later reversed that decision. She speculates the move came because of objections from the retail industry. "These 0% financing plans are a way for retailers to sell those big ticket items and without them, the retailers were afraid they wouldn't sell as many TVs, carpeting and mattresses," she said.

Citibank refused to discuss the specifics of Miller's case and said the terms are clearly laid out in the contract. Miller doesn't think so. "I'm never going to do business with Citibank again," he said.

Miller took his story to Facebook and managed to convince Citibank to refund the interest, but there is no guarantee that would work for everyone.

According to Wu, your best bet is to make your last payment a full month before the end of the interest free period or pay with a conventional credit card with a competitive interest rate.