Things To Know Before Moving Your Money To Smaller Banks

BOSTON (CBS) - Banking customers fed up with high fees and complicated rules have said they've had enough.

Many are leaving big national banks for small community institutions.

A social media movement called "Bank Transfer Day" prompted 650,000 customers to move their money to smaller banks and credit unions.

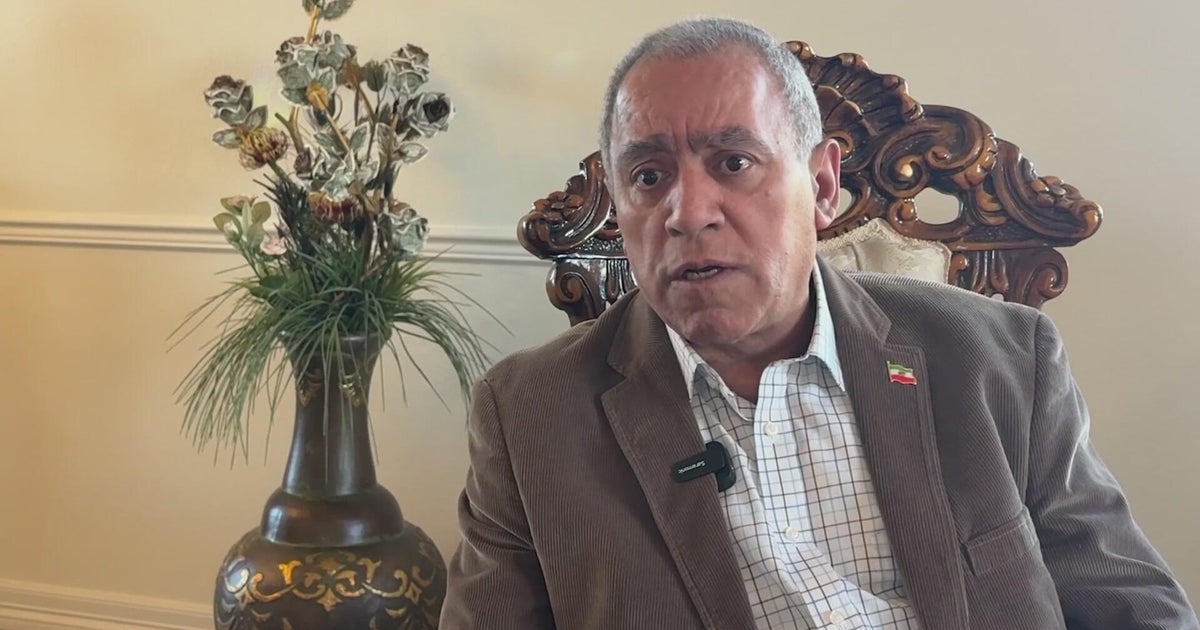

WBZ-TV's Paula Ebben reports

It was the $5 debit free proposal at Bank of America which really seemed to push a lot of people over the edge.

There are a number of things to take into consideration before making the jump, however.

First, ask the bank you are interested in for a Switch Kit. You can easily enter all the data for your automatic deposits and withdrawals so those transactions will continue.

Some kits include form letters, which can be sent to other companies with whom you do business. The kits can be obtained at a branch or downloaded.

Don't close your old account too soon. First, make sure your new one is up and running, and that all old outstanding checks have cleared.

Try to leave sufficient funds in your old account to cover automatic payments just in case the change-over takes more than one billing cycle.

Finally, think about what kind of banking institution will fit your needs. Credit unions and online banks often have better rates and fewer fees than larger institutions, but you could give up easy access to ATMs.

To compare fees and rates, go to www.bankrate.com and www.ncua.gov.