The Hidden Cost Of College

BOSTON (CBS) - From my experience, sending two kids to college and helping my niece and nephew, I have learned that tuition, room and board, the lab fees and medical insurance are not the only expenses you will need to plan for.

If you have a kid heading to college you need to know about all of those other expenses as well.

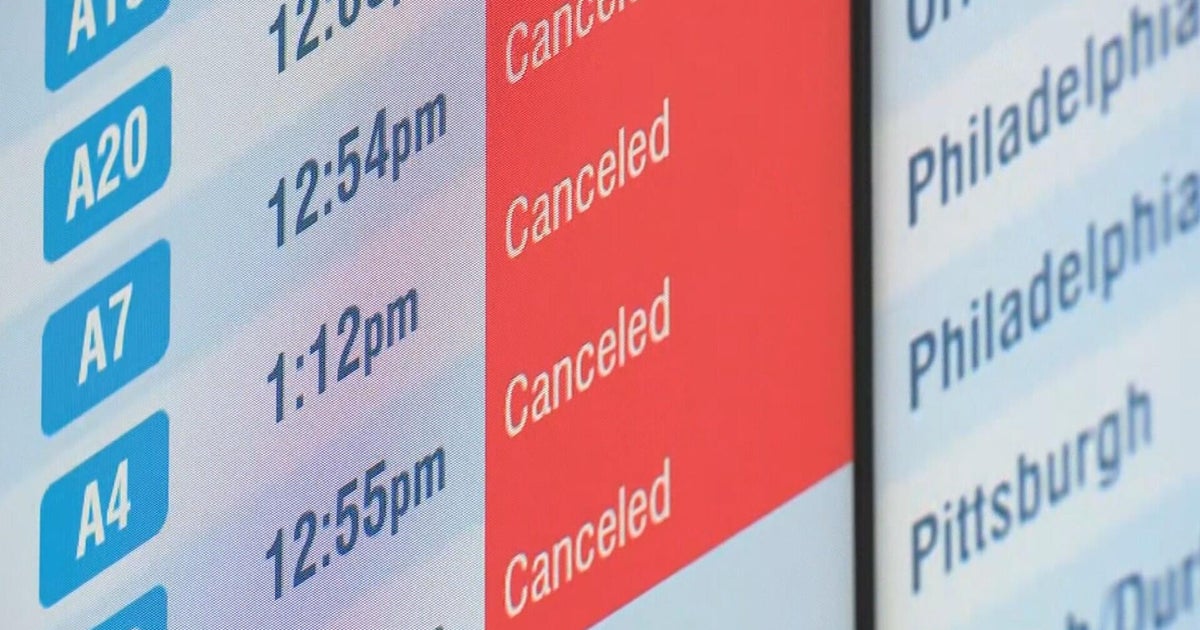

For example, your son just got into your alma mater, University of Colorado, in Boulder. And you are so proud. But how much is it going to cost to fly that kid home three or four times a year? What if he chooses your spouse's alma mater, UMASS Amherst and he wants a car to make it easier on you so you don't have to drive out to pick him up?

And the dorm room; it's going to need help to make it feel like home. First it will need the new computer and printer the school requires. It will need some additional furniture, maybe a rug, perhaps a refrigerator, and of course, music, lamps, maybe a TV. Also new linens that fit the extra-long mattresses.

Got yourself a jock? Or a wannabe jock? You may be looking at buying skates, padding, lacrosse sticks or soccer cleats if they make the team or if they play intramural sports.

And there's more. Who pays for the concerts that appear regularly on campus, the spring break trips and the nightly pizza run? And the laundry. Do they do their own or do they send it out?

The telephone bill can be a biggie. Your kiddo has a cell phone and if he is homesick, he will want to text all of his friends and you. About 10% of students away from home for the first time suffer from severe homesickness. Be sure your kiddo has a plan with unlimited minutes and texting. Consider using Skype so you can see your student as well as talk to them.

Sit your student down and have a money talk with them before they head off to college. Discuss who is going to be responsible for each expense? Have them earmark their summer earnings to pay for some of these extra costs.

This is the time to have the credit card talk also. In order for a student to get a credit card, they will need to have an adult co-sign for the card. If you do decide to co-sign for the card, this is would be a good time to tell them there is no credit card fairy to bail them out if they blow it.

They need to know there is such a thing as a limit on the card and you want them to understand that using the card is a form of borrowing and they must pay it back. And it they are late in paying there will be fees such as late charges and they will pay interest on the loan to the credit card company as well.