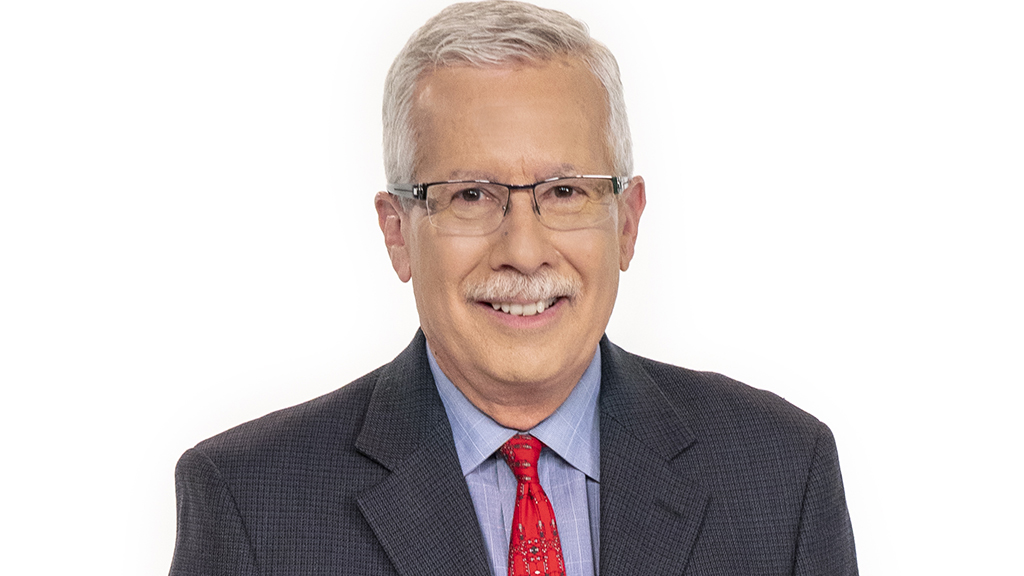

Keller @ Large: Sen. Elizabeth Warren says it's time to bring back tougher bank regulations

BOSTON - Massachusetts Senator Elizabeth Warren is calling for a return to tougher regulations after the abrupt collapse of Silicon Valley Bank (SVB) and several others.

In an interview with WBZ-TV, Warren slammed the Federal Reserve, Congress and bank executives for their roles in the banking meltdown, especially the 2018 rollback of regulations governing mid-size banks.

"They took the opportunity to weaken regulations, and wow, they ran with it," she said.

Warren, who's been warning this might happen since the Trump-era rollback - which drew bipartisan support - said immediate action is needed to keep it from happening again.

"It's time to put those regulations back in place," she told WBZ. "It's time to hold the Fed accountable, do a full investigation of what they've done. And it's time to spend, send a very strong message to bank CEOs - you're not going to be able to load up on risk in order to juice your profits."

Warren insists that investigation can't include the Federal Reserve chairman.

"To have any credibility in that investigation, Jerome Powell needs to recuse himself, let that investigation go forward without him because he was the leader of the pack in creating this problem."

And along with political and regulatory failures, Warren points the finger at a perennial target - reckless profiteers.

"There's what Congress did. Then there's what the regulators did. And then there's what the CEOs did," she said. "The CEO's who said, 'wow, we can juice our profits, we can get bigger bonuses, we can get fancier salaries, just by loading up a little bit on risk.' And of course, that's what they did. SVB's profits went up by 40% over the last three years, and it was all working great, right until they drove that bank over a cliff."

Warren's bill would put teeth back into the Dodd-Frank banking regulations that were passed after the 2008 economic crisis caused in part by risky investments.

But does it have a chance of passing? Probably not.

Congressman Seth Moulton reportedly tried to find Republican co-sponsors for a similar bill and couldn't come up with a single one. And 16 Democratic senators, including Jeanne Shaheen and Maggie Hassan of New Hampshire, voted for the rollback in 2018 and say they don't regret their vote now.

And keep in mind, the Frank in Dodd-Frank was former Massachusetts Congressman Barney Frank of Newton. After leaving office in 2013 Frank joined the board of Signature Bank, one of the institutions that failed last week, pocketing $2.4 million in stocks and cash over the years.