I-Team: Growing Scam Targets Home Buyers, Steals Huge Down Payments

SAGAMORE BEACH (CBS) - Five days after Cliff Gilliam and Traci Hanley closed on their new Sagamore Beach home, they got the shock of their lives. "It definitely took the wind out of our sails for sure," Traci recalled.

They closed on a Friday and according to Traci, the following Wednesday, the builder said, "We have a big problem. The wired money got sent to a fraudulent account."

Here's how it happened. An email with the builder's mortgage payoff information was sent to the lawyer for Cliff and Traci's bank. But hackers intercepted that email and changed the account numbers. The bank lawyer, without verifying the email, sent $325,000 directly to the hackers.

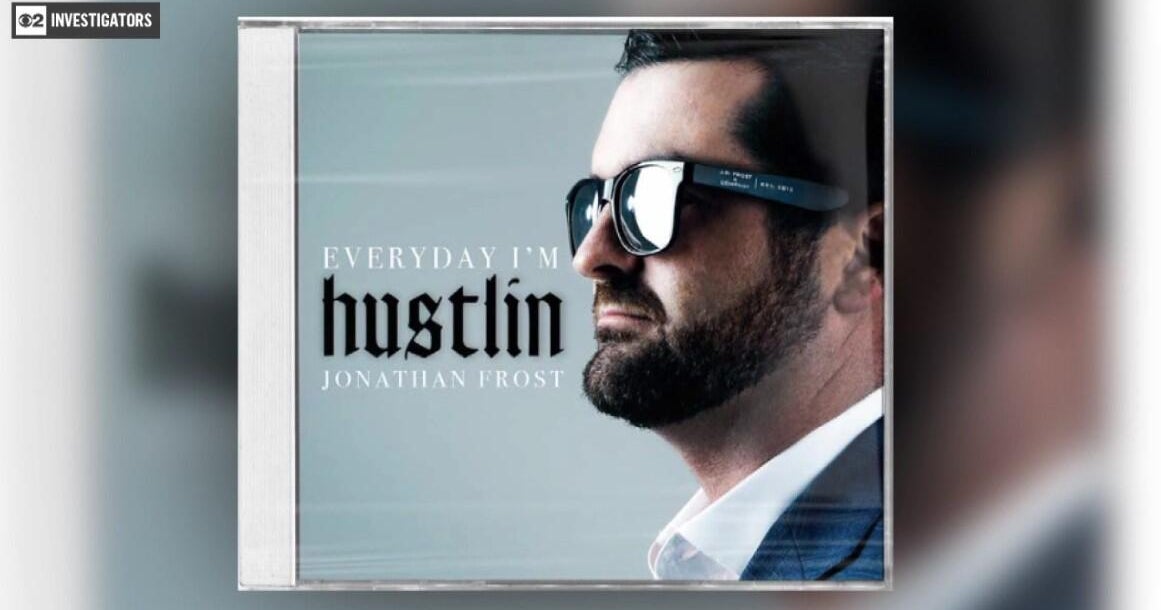

FBI special agent Michael Livingood with the Economic Crimes Squad said these are lucrative scams for the hackers. "When you consider how much money you make from robbing a bank and getting a couple of thousand dollars, to how much these scammers can make from what we call business email compromises which average about $130,000."

Just in the last year, the FBI in New England reported hackers stole more than $53 million using this scam.

Traci and Cliff say they are stuck between a rock and a hard place. "We feel kind of uneasy because the contractor said technically we don't own the house because he didn't get his money," Cliff said.

Traci and Cliff are living in the home and paying their mortgage on time, but the builder never got paid for the property.

As for getting the stolen money back, it generally depends on how quickly the fraud is reported to the bank and the FBI.

"It's not hopeless. If the fraud is reported within 48 to 72 hours, there's a 78 percent chance that the FBI can get the money back," Livingood said.

The FBI says this is one of the fastest growing crimes and it has been warning consumers about this scheme for years. Scammers are now getting more sophisticated and are targeting real estate lawyers and brokers, hacking their emails to intercept deals with large wire transfers.

Real estate attorney Alia Alavi is not involved in Traci and Cliff's case, but is well aware of this scheme and has a policy of always taking the extra step to confirm and verify wiring instructions with a trusted source before sending any money.

"We are extraordinarily fearful. We are on guard with scams becoming more complex," he said. "We are seeing a shift of going back to traditional way of doing business, going to a large bank and getting a certified check and bringing it to the closing," he added.

Traci and Cliff think that's good advice. "You wouldn't think it would happen to little old us trying to buy a pretty little house in Sagamore beach. If it can happen to us, it can happen to anyone doing a real estate transaction," Traci said.

The couple was just told that the builder's mortgage company plans to foreclose on their home and they are gearing up for what is likely to be a long legal battle.

At the closing, Traci and Cliff did buy title insurance and the company's lawyers are now representing them. The attorney representing the bank also has malpractice insurance, which may come into play.

But there is some good news, more than five weeks after the closing $179,040.67 was recovered.

For more information on the scheme and how to prevent becoming a victim, visit the FBI's website.

The FBI encourages anyone who believes they were a victim of wire fraud to report it at IC3.gov.