All About Long Term Care Insurance

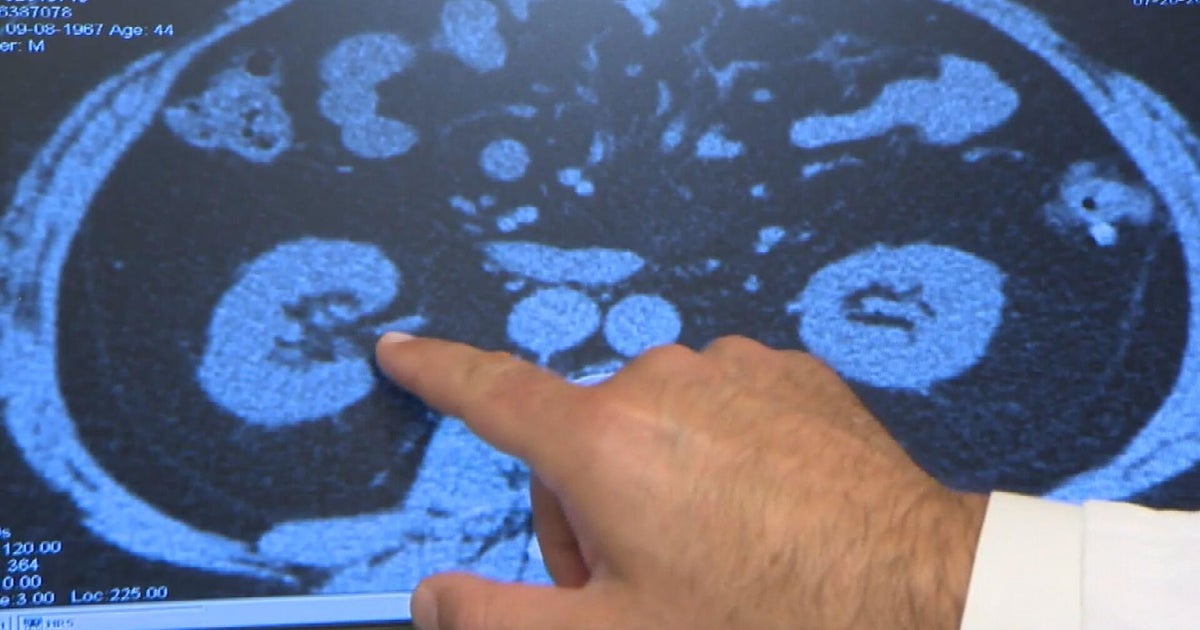

BOSTON (CBS) - Long-term care is a variety of services that includes medical and non-medical care to people who have a chronic illness or disability. Most long-term care is to assist people with support services for activities of daily living such as dressing, bathing, and using the bathroom. Long-term care can be provided at home, in assisted living facilities or in nursing homes.

All About Long Term Care Insurance

According to Genworth Financial's Long Term Care survey, the national average cost of a semi-private room in a nursing home is around $75,000 and it costs over $126,000 here in Massachusetts.

A recent study found that people who reach age 65 have a 45% chance of entering a nursing home. But many only stay a short while.

For example, a 70-year-old gets a knee replacement and can't take care of himself at home. He might spend several weeks in a nursing home to receive rehab after his surgery.

According to the Census Bureau, about 4% of the 65+ population occupy nursing homes at any given time. The rate of nursing home use increases with age and almost 50% of those 95 and older live in nursing homes.

So does Dad need long-term care insurance? If Dad has very few assets and it would be a financial hardship for him to pay the premiums for the insurance, then he probably doesn't need it. He will be eligible for Medicaid and community home-care services for a small fee because they charge on a sliding scale. LTC insurance premiums have increased in cost close to 30% over the last five years.

If Dad has assets over $100,000 and a home, buy the insurance. It's really cheap protection. If dad does not want the insurance and the kids want to protect the house they can buy the insurance for dad.

If his invested assets exceed $1 million, he may not need long-term care insurance because he can self-insure at that level.

One more thing: Resources: The National Clearinghouse for Long-Term Care Information and American Association for Long-Term Care Insurance