401k Advice From The Man Who Invented It

BOSTON (CBS) - As pensions in the private sector become extinct, more workers will depend on their 401k savings to see them through retirement.

The 401k is having a milestone birthday this year as it turns 30.

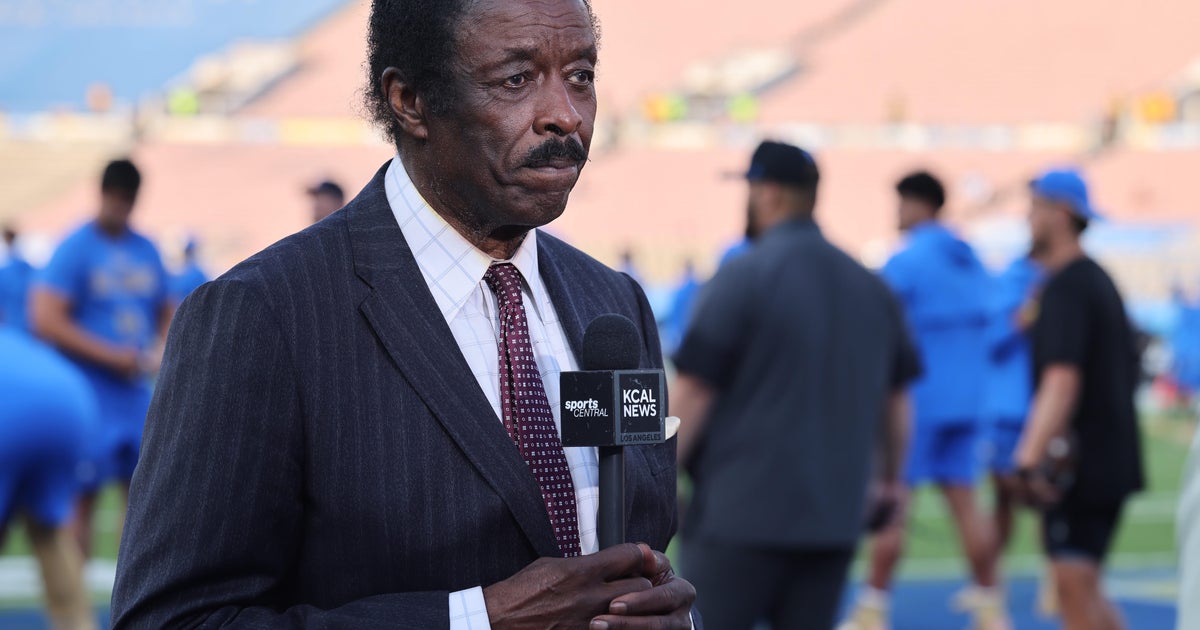

Back in 1981, the 401k as we know it was born when Ted Benna allowed his employees to make pre-tax contributions to their retirement accounts. His firm offered matching employer contributions.

Employees had greater control over how the money was invested which was a big departure from how pension programs were run.

"The reality is we would never take that money each paycheck and put it into an investment," said Benna.

Today, about 60-percent of households nearing retirement have 401k-type accounts.

The accounts for the earliest investors, who are now approaching retirement age, have an average balance of about $140,000.

WBZ-TV's Paula Ebben reports.

401k's were never intended to be an investor's sole source of retirement money, according to Benna.

The architect of these plans does have some ideas, however, on how workers can maximize their savings.

The first step is to start participating early.

"The biggest mistake that people make when they have a 401k available is to not get into the game at all," he said.

Secondly, make sure to take advantage of your employers matching contributions.

If you don't, you're basically turning down free money. Many large corporations match the first six-percent a worker contributes.

Next, increase your contributions.

A worker can save up to $16,500 a year.

Someone over 50 can take advantage of the "Catch Up Provision" which allows an additional $5,500 to be socked away.

Make sure your 401k is appropriately diversified for your age and retirement goals.

If the array of investment options is confusing, then consider target date funds.

"The target maturity funds usually have numbers like 2010, 2020, 2030 and the idea is you put your money solely into one of these funds, it's automatically allocated, you don't have to do any picking and choosing," explained Benna.

Before making significant changes in your retirement plans, it's a good idea to consult with a financial professional.