Maryland Council Aims For Financial Literacy Among Baltimore Students

In 2012, consumer fraud reported to the Federal Trade Commission cost more than $1.4 billion dollars and included such criminal activities as identity theft, health care and mortgage fraud, fraudulent securities and commodities offers and the selling of stolen cars.

One way to combat these types of economic crimes is through an educated consumer base. This is one of the goals of the Maryland Council on Economic Education. First started in 1953, MCEE seeks to provide financial education by providing resources for Maryland teachers' professional development. They provide both content knowledge and resources to kindergarten through 12th grade educators. For fiscal year 2014, the MCEE had 105 programs with 3127 teachers participating which impacted almost 300,000 students.

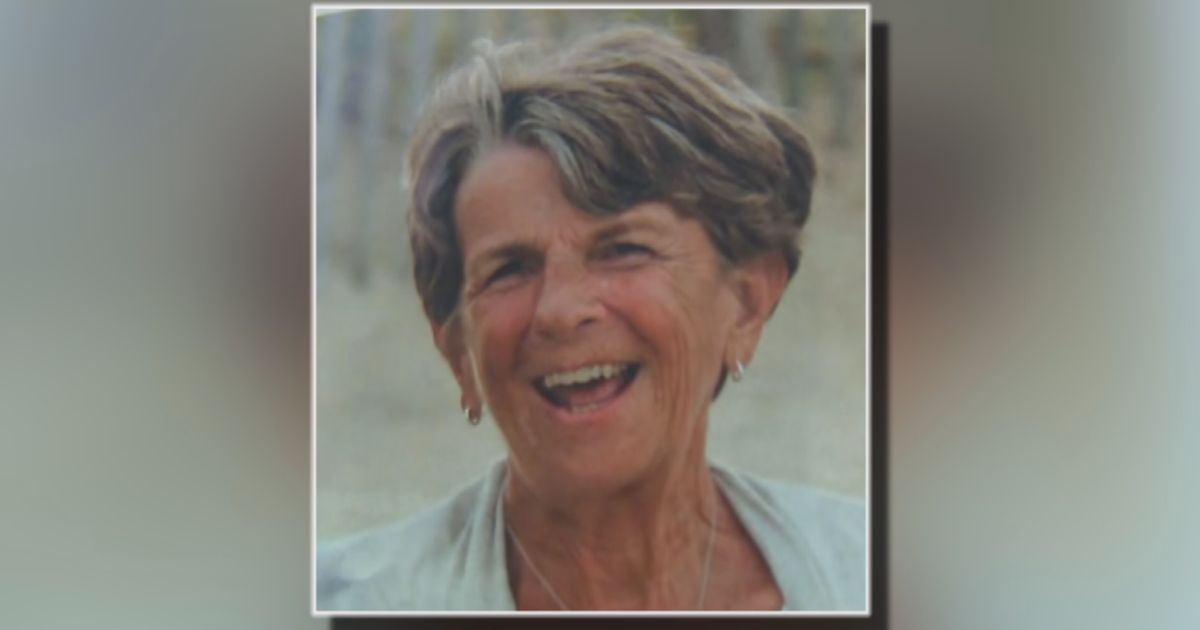

Mary Ann Hewitt, featured here, is the executive director of MCEE. She is a graduate of the University of Kentucky with a B.S. in home economics and an M.A. in counseling and personnel from Western Michigan University.

What led you to enter your current field?

"I began as a classroom teacher; and personal finance was the most popular topic. The students were interested and I also developed an interest. The Maryland Council on Economic Education provided an outlet for that interest. I rose to executive director of MCEE prior to the 2008 economic crisis and saw the havoc caused by the loan debacle. I realized that a lack of basic financial understanding and poor decision-making was at the root of the crisis. I became convinced that financial education must start at an early age so it was a natural fit that MCEE should start arming students with real-world financial knowledge to prevent them from repeating the mistakes of the past."

How does your educational background relate to your current role with MCEE?

"As a secondary education major with an emphasis in home economics, family resource management was a major theme. This included decision-making, technology, and money management, all components of financial education. Later, I worked at the Montgomery County Cooperative Extension Service managing their financial counseling program which gave me greater understanding of the concepts and skills that MCEE teaches to Maryland teachers."

How has your education helped to further your career and contributed to your success?

"At MCEE, we work with teachers to enable them to impart solid financial content and skills to their students. Having a degree in education and classroom experience provides credibility with teachers as well as a deep understanding of the content we teach."

What is some advice you can offer others looking to go into your field?

"My advice is four-fold: Be informed: learn the decision-making process, the political process, and the power-brokers in the field. Know how to motivate and lead your co-workers. Be flexible. Know how to prioritize."

Susan Brown originally spent many years in banking/finance before confronting her addictions. She has now been in recovery for 20 years. Her current interests, in which she has several certifications, are metaphysics and the healing arts. She has written for Examiner.com since 2009 and also writes for Om Times.