What's fueling the boomerang generation?

In a well-documented trend, the number of young Americans living with their parents has grown over the last 15 years. Some have returned home after striking out on their own, earning the nickname "the boomerang generation," while others never left at all. One consequence of this is that home ownership among the young has fallen considerably.

Though the trend is clear, the question remains: What's driving it? Are poor job prospects causing the young to live with parents until a decent employment opportunity comes along? Has increased tuition and high debt levels from student loans forced students to stay at home while attending college, or return home to live less expensively while they pay off those debts? Are housing and rent too costly for them to live on their own, more so than for previous generations?

A new Federal Reserve Bank of New York staff report suggests the most important factor is the rising student debt of college graduates. This "appears to be driving young people home and keeping them there." (The New York Fed examined data from what it calls the Consumer Credit Panel, or CCP, which is based on quarterly consumer credit information Equifax has collected since 1999.)

In addition, the "results demonstrate that local economic growth is a mixed blessing when it comes to building youth independence: Improvement in youth employment conditions enables young people to move away from their parents, but rising local house prices are estimated to have forced many young people to move back home. These two effects partially offset each other."

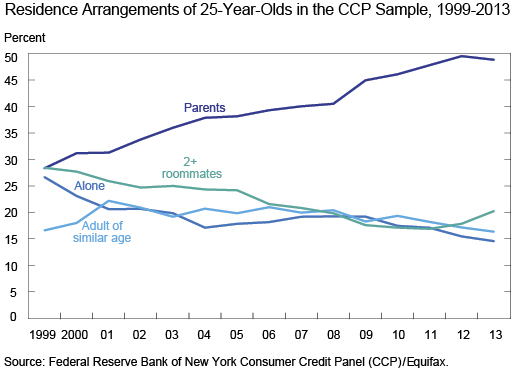

The researchers (Zachary Bleemer, Meta Brown, Donghoon Lee, and Wilbert van der Klaauw) begin by documenting the large change in living arrangements for the young in recent decades. For example, in 1999 approximately 30 percent of 25-year-olds lived with their parents, but by 2013 the percentage had risen to nearly 50 percent (chart above). In addition, home ownership for 25-year-olds has fallen from approximately 23 percent in 2003 to just over 10 percent in 2013 (for 30-year-olds, it fell from around 44 percent to 33 percent).

The next step is to compare the trends in living arrangements for the young with "trends in the local economic environment faced by twenty-five-year-olds in our sample from 2003 to 2013." If local economic conditions for jobs and housing are the driving force, then the trends ought to track the ups and downs of the local economy over the business cycle.

But that's not what the researchers find. The trend of living with parents rises steadily over the CCP sample despite considerable variation in the local economies due to the financial and housing crashes associated with the Great Recession.

However, the correlation between the number of young people living with their parents and growing student debt burdens is much larger. Further analysis estimates that a $10,000 increase in student debt per student leads to a 2.9 percentage point rise in the rate of students living with their parents.

The rising price of a college education in recent years has many costs, including the loss of opportunity for some students. This research highlights another cost that has not been widely recognized: the loss of independence for young Americans.

It has become more difficult for the young to get an education, strike out on their own, and not have to rely on their parents for support. And there's little reason to suspect this trend will end any time soon.